Atal Pension Yojana (APY) Scheme Full Details explained – benefits, Eligibility, where we have to apply this Scheme tells clearly Check it out.

What is ATAL PENSION YOJANA

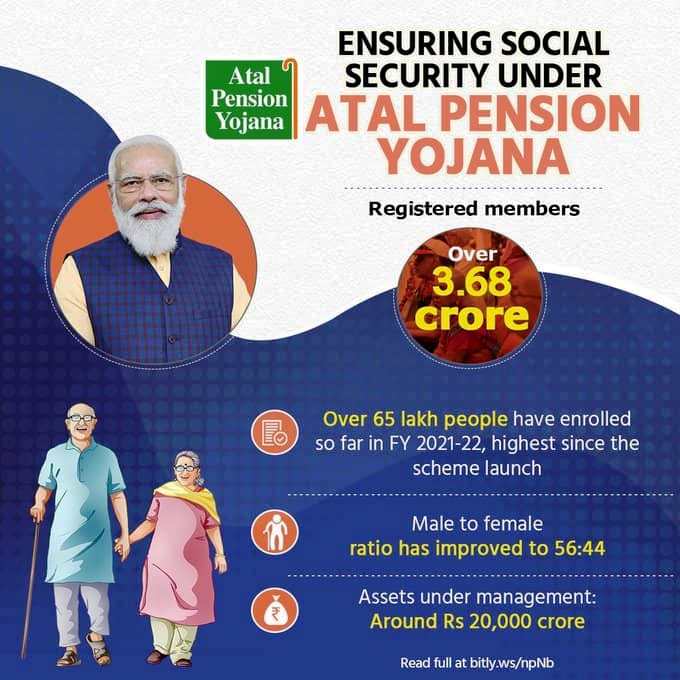

Atal Pension Yojana is a government Social Security Scheme designed to ensure a consistent income for Indian citizens aged 60 and above. It operates within the National Pension Scheme framework, providing subscribers the option of fixed monthly pensions ranging from Rs. 1000 to Rs. 5000 based on their chosen subscription amount.

The Central Government will match 50% of the annual contribution or Rs. 1000 per year, whichever is lower, for 5 years in the accounts of subscribers who enroll in the scheme by December 31, 2015, and are not part of any Statutory Social Scheme or income tax-paying category. The scheme issues a Permanent Retirement Account Number (PRAN) immediately upon enrollment.

Benefits of Atal Pension Yojana

If you Exit from the scheme at 60 Years:

Guaranteed Minimum Pension Amount: – Rs. 1000/-, Rs. 2000/-, Rs. 3000/-, Rs. 4000/-, or Rs. 5000/- per month after age 60 until death.

Spouse’s Guaranteed Minimum Pension:

- Spouse receives the same pension amount as the subscriber until the spouse’s death.

Return of Pension Wealth to Nominee:

- Nominee entitled to receive the accumulated pension wealth till the subscriber’s age of 60 after demise of both subscriber and spouse.

- If you die before 60 Years:

- Option 1:

- Spouse can continue contributions in the subscriber’s APY account, maintaining it in the spouse’s name.

- Spouse entitled to the same pension amount until the spouse’s death, even if the spouse has their own APY account.

- Option 2:

- Entire accumulated pension corpus.

- Option 1:

- Contributions and Tax Benefits:

- Contributions to APY eligible for tax benefits under section 80CCD(1), similar to NPS.

- Voluntary Exit (Before 60 Years):

- Refund of subscriber’s contributions along with net accrued income (after deducting account maintenance charges).

- Subscribers receiving Government Co-Contribution before March 31, 2016, won’t receive it upon exit.

What are the Eligibility conditions for Atal Pension Yojana?

Eligibility criteria for enrollment in the Atal Pension Yojana (APY) are as follows:

- Citizenship: The individual must be a citizen of India to be eligible for the benefits of Atal Pension Yojana.

- Age Range: The applicant should fall within the age bracket of 18 to 40 years at the time of registration. This age range ensures that individuals have a significant working period ahead to contribute to the scheme.

- Contribution Period: To qualify, individuals are required to make contributions to the Atal Pension Yojana for a minimum of 20 years. This extended contribution period allows for the accumulation of a pension corpus over the long term.

- Aadhar-Linked Bank Account: Prospective participants must possess a bank account linked with their Aadhar, the unique identification number issued by the Government of India. This linkage facilitates seamless transactions and ensures the efficient disbursement of pension benefits.

- Valid Mobile Number: It is mandatory for applicants to provide a valid mobile number during the registration process. This requirement enables effective communication and updates related to the Atal Pension Yojana.

- SwavalambanYojana Beneficiaries: Individuals who are already availing benefits under the SwavalambanYojana will be automatically migrated to the Atal Pension Yojana. This transition ensures a smooth continuation of social security benefits for those already enrolled in the previous scheme.

By fulfilling these eligibility criteria, individuals can access the benefits offered by the Atal Pension Yojana, thereby securing a stable financial future during their retirement years.

How to Apply for Atal Pension Yojana

To apply for Atal Pension Yojana (APY), follow these steps:

- Visit any nationalized bank to initiate your APY account. or Visit official website : https://npscra.nsdl.co.in/

- Download the Atal Pension Yojana form from the official website or obtain it from the bank; forms are available in multiple languages.

- Complete the application form and submit it to your bank.

- Provide a valid mobile number (if not already provided to the bank).

- Submit a photocopy of your Aadhaar card along with the application.

- Upon approval, you will receive a confirmation message.

Atal Pension Yojana Pension Withdrawal rules –

Withdrawal from the Atal Pension Yojana (APY) is generally not allowed before the age of 60, except in exceptional circumstances such as the death of the beneficiary or terminal illness. Exit scenarios include:

- Upon reaching 60 years of age: 100% annuitization of pension wealth for the subscriber.

- In the event of the subscriber’s death: The pension becomes available to the spouse, and upon the death of the spouse, the pension corpus is returned to the nominee.

Important Doubts:

The pension starts after the subscriber reaches the age of 60. The contribution period is from the age of enrollment (between 18 and 40) until the age of 60.

The contribution amount depends on the age of the subscriber and the chosen pension amount. The contributions range from Rs. 42 to Rs. 210 per month.

Yes, subscribers can choose a fixed pension amount of Rs. 1,000, Rs. 2,000, Rs. 3,000, Rs. 4,000, or Rs. 5,000 per month, depending on their contribution amount and age at entry.

Premature exit is allowed only in exceptional circumstances such as the death of the beneficiary or being diagnosed with a terminal illness. In such cases, the accumulated pension wealth is returned to the nominee or the subscriber.