Income tax REFUND STATUS From Refund Banker :

The ‘Refund Banker Scheme,’ which commenced from 24th Jan 2007, is now operational for Non-corporate taxpayers assessed in Delhi, Mumbai, Kolkata, Chennai, Bangalore, Bhubaneswar, Ahmedabad, Hyderabad, Pune, Patna, Cochin, Trivandrum, Chandigarh, Allahabad, and Kanpur.

Income Tax Refund Status Online

In the ‘Refund Banker Scheme’ the refunds generated on processing of Income tax Returns by the Assessing officers/ CPC-Bangalore are transmitted to State Bank of India, CMP branch, Mumbai (Refund Banker) on the next day of processing for further distribution to taxpayers.

Refunds are being sent in following two modes:

1. RTGS / NECS: To enable credit of refund directly to the bank account, Taxpayer’s Bank A/c (at least 10 digits), MICR code of bank branch and correct communication address is mandatory.

2. Paper Cheque: Bank Account No, Correct address is mandatory.

Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker – by entering ‘PAN’ and ‘Assessment Year’ below.

Other Refunds :

Status of ‘paid’ refund, being paid other than through ‘Refund Banker,’ can also be viewed at www.tin-nsdl.com by entering the ‘PAN’ and ‘Assessment Year’ below.

‘Refund paid’ status is also being reflected in the ‘Tax Credit Statements’ in Form 26AS.

Check your Refunds status :

visit Official link : https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

1. Enter Your pan number and select Assessment Year.

2. Click on submit and check Your refund Status.

OR

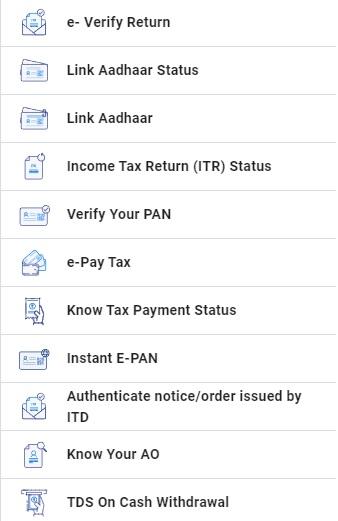

Income tax official website login :

https://www.incometax.gov.in/iec/foportal/

View Refund Status :

1. To view Refund/ Demand Status, please follow the below steps:

2. Login to e-Filing website with User ID, Password, Date of Birth / Date of Incorporation and Captcha. Go to My 3. Account and click on “Refund Status“.Below details would be displayed.

- Assessment Year Status Reason (For Refund Failure if any) Mode of Payment is displayed.

- Taxpayer can now view Refund/ Demand Status

Contact US For Refund status Details:

- For any refund related query the tax payer should contact Aayakar Sampark Kendra Toll Free No. 1800-180-1961 or email at refunds@incometaxindia.gov.in

- For refund related query or any modification in refund record relating to return processed at CPC Bangalore may be contacted on Toll free Number 1800-425-2229 or 080-43456700.

- For any payment related query the taxpayer should contact SBI Contact Centre Toll Free No. 1800-425-9760.

How to Refund be sent to me?

As per option for mode of payment exercised by the Assessee while filing his annual income tax return (ITR 1), refund will be made either through electronic mode i.e. direct credit to account or through Refund Cheque. Tax payers are therefore, required to enter correct Account number and IFSC code along with complete address details including PIN code at the time of filing of Return.

Refunds processed through Refund cheques mode are dispatched to record address through Speed Post.

Income tax Refund had Returned. What To DO?

Refund had been returned undelivered by Speed Post. All returned Refunds are cancelled and retained at CMP Centre. Tax payer may raise Refund re-issue request. In case the return was filed electronically- Refund reissue request may be raised online by login to e-filing portal i.e.https://incometaxindia.gov.in/Pages/default.aspx with user ID and password. In other cases the Taxpayer should contact Assessing Officer under whose jurisdiction the Return was filed for re-initiation of Refund.

income tax Refund Status had Expired. What to do?

Refund not presented for payment within the validity period of 90 days is marked as expired and cancelled. Tax payer may raise Refund re-issue request. In case the return was filed electronically- Refund reissue request may be raised online by login into e-filing portal i.e.https://www.incometax.gov.in/iec/foportal/ with user ID and password.

In other cases the Taxpayer should contact Assessing Officer under whose jurisdiction the Return was filed for re-initiation of Refund.