GHMC Death Certificate Download – How to Access GHMC Death Records Online

Need to download a GHMC death certificate online? Whether for legal processes, bank claims, or pension formalities, the Greater Hyderabad Municipal Corporation (GHMC) provides a convenient way to search and access death records digitally through its official portal.

What is BND GHMC?

BND GHMC stands for Birth and Death (BND) Registration Portal of the Greater Hyderabad Municipal Corporation. It is an official online platform that allows residents to apply for, search, and download both birth and death certificates issued within the Hyderabad city limits. The portal offers:

- Online application for birth and death certificates

- Search facility by name and date

- Certificate download with OTP verification

- Correction request services

Visit the portal here: https://bnd.ghmc.gov.in/

What is a GHMC Death Certificate?

A GHMC death certificate is an official document issued by the Greater Hyderabad Municipal Corporation to certify an individual’s death within city limits. It includes:

- Name of the deceased

- Date & place of death

- Cause of death (in some cases)

- Address and parent/spouse information

It is essential for:

- Legal heirship certificates

- Property succession

- Bank accounts & insurance claims

- Cremation or burial formalities

How to Download GHMC Death Certificate Online – Step-by-Step

To get your GHMC death certificate, follow these simple steps:

- Visit the Official GHMC Portal

👉 https://bnd.ghmc.gov.in/ - Click on “Death Certificate Download”

Navigate to the relevant section on the homepage or use this link:

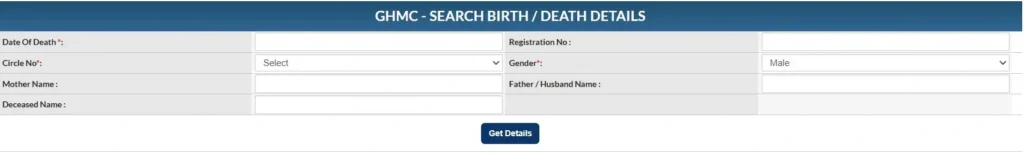

👉 Death Certificate Download - Enter Required Details

- Name of deceased

- Date of death

- Gender

- Parent/spouse name (optional but helpful)

- Mobile number for OTP

- Verify OTP

Enter the OTP sent to your mobile number. - Download the Certificate

The system will generate a digitally signed PDF version of the certificate.

How to Search GHMC Death Records by Name Online

If you don’t know the registration number, use the death record search by name option:

- Visit GHMC death cetifiacte search by name

- Enter:

- Name of the deceased

- Date/year of death

- Gender

- Parent/spouse name (if available)

- The system will show matching GHMC death records.

- Click on the correct record and proceed to download.

✅ Tip: Try partial name searches if the full name is not matching.

How to Fix Mistakes in GHMC Death Certificate

If there are mistakes in name, date, or address:

- Visit the nearest GHMC ward or circle office.

- Submit a correction application with supporting documents:

- Hospital death summary or certificate

- Aadhaar/ID of applicant

- Proof of relationship (if required)

- Once corrected, the updated death certificate can be downloaded online.

FAQs – GHMC Death Certificate Download

Q1: Is the online death certificate legally valid?

✅ Yes. It is digitally signed and valid for legal and official use.

Q2: What if OTP is not received?

📞 You can visit the GHMC office or contact the local ward officer to update the mobile number associated with the record.

Q3: Can I search GHMC death records without registration number?

✅ Yes. You can search using name, date of death, and parent/spouse name.

Q4: How can I get a death certificate older than 1990?

🕵️♂️ These may not be digitized. Visit the municipal office for manual search and verification.

Conclusion

The GHMC Death Certificate Download service and access to GHMC death records make the process easier for citizens managing sensitive post-death formalities. Whether you’re claiming insurance, transferring property, or applying for legal documents, you can now search and download the death certificate online securely.

🔗 Start here: https://bnd.ghmc.gov.in/

👉 Also read: GHMC Birth Certificate Download – Search & Verify Birth Records