All State wise Tin Search(Tin number search),How to CST search in commercial taxes at www.tinxsys.com

TIN Search :

The Tax Payer’s Identification Number (TIN) is new unique registration number that is used for identification of dealers registered under VAT. It consists of 11 digit numerals and will be unique throughout the country. First two characters will represent the State Code as used by the Union Ministry of Home Affairs. The set-up of the next nine characters may, however, be different in different States.

TIN is being used for identification of dealers in the same way like PAN is used for identification of assesses under Income Tax Act. All the dealers seeking for new registration under VAT or Central Sales Tax will be allotted new TIN as registration number, however every State Commercial Tax Department have made provisions to issue new TIN to their existing dealers replacing old registration/ CST number.

TIN Search Online :

Visit official website : https://www.tinxsys.com/TinxsysInternetWeb/searchByTin_Inter.jsp

Enter your tin number and get your details.

CST Search :

The Central Sales Tax (CST) is a levy of tax on sales, which are effected in the course of inter-State trade or commerce. According to the Constitution of India, no State can levy sales tax on any sales or purchase of goods that takes place in the course of interstate trade or commerce. Only parliament can levy tax on such transaction. The Central Sales Tax Act was enacted in 1956 to formulate principles for determining when a sale or purchase of goods takes place in the course of interstate trade or commerce. The Act also provides for the levy and collection of taxes on sale of goods in the course of interstate trade and commerce and to declare certain goods to be of special importance in the interstate commerce or trade.

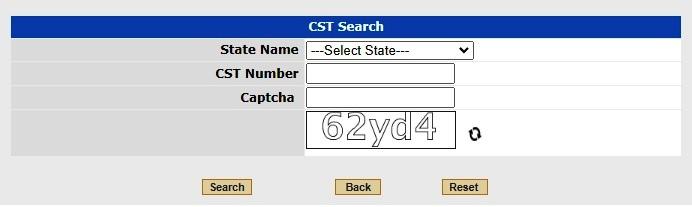

CST Search online :

Visit official website : https://www.tinxsys.com/TinxsysInternetWeb/searchByCst_Inter.jsp

Select your “state name”, enter your CST Number.

click on “search”, and gets your details.