GHMC property tax

GHMC property tax is a local tax collected by the Greater Hyderabad Municipal Corporation (GHMC) from property owners within its jurisdiction. This tax is levied on residential and commercial properties based on the annual rental value, size, location, and other factors pertaining to the property. The funds collected through this tax are used to provide and maintain public services such as roads, sewage systems, street lighting, parks, and other municipal services that benefit the community.

Paying this tax is mandatory for property owners in Hyderabad, and it plays a crucial role in the city’s development by funding infrastructure and civic amenities. Property owners can pay their GHMC property tax online through the GHMC’s official portal or at designated municipal offices. The process includes locating your Property Tax Identification Number (PTIN) to ensure payments are accurately credited to the right property.

How to Register or Update Your Mobile Number for GHMC Property Tax

Hey there, property owners! Need to update or register your mobile number for your GHMC property tax account? It’s a smart move—keeping your contact details up-to-date ensures you receive all important notifications directly on your phone. Let’s walk through the process step by step, so you can get back to enjoying your day without any tax worries.

Step 1: Visit the GHMC Official Website

First things first, hop onto the GHMC official website. This is your starting point for all things related to property tax in Hyderabad.

Step 2: Navigate to the Property Tax Section

Once you’re on the GHMC website, look for the ‘Property Tax’ section. This is usually found in the main menu or under the services tab. Click on it to proceed.

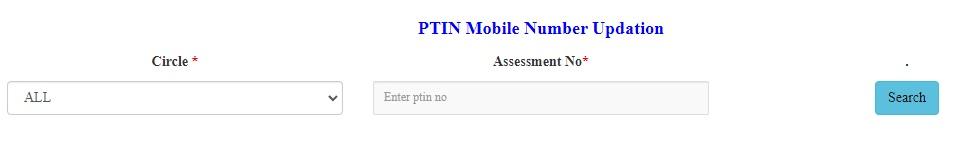

Step 3: Access the PTIN Dashboard

Within the Property Tax section, you should see an option for ‘PTIN Dashboard’ or something similarly named. This dashboard is where you can view and manage all your property tax details.

Step 4: Log In to Your Account

To access your specific property details, you’ll need to log in. Use your PTIN or Aadhaar number linked to the property to do so. If you haven’t set up an account or logged in before, you might need to create an account or follow the prompts to register.

Step 5: Select the Update Mobile Number Option

Once you’re logged in, look for an option like ‘Update Contact Details’ or ‘Manage Profile’. Click on this to start the process of updating your mobile number.

Step 6: Enter Your New Mobile Number

You will be prompted to enter your new mobile number. Make sure you enter it correctly to avoid any future issues with communication.

Step 7: Verify Your Mobile Number

After you enter your new number, you’ll likely need to verify it. Typically, this involves receiving an OTP (One-Time Password) via SMS. Enter the OTP you receive on the website to confirm that your number is correct.

Step 8: Confirm and Save Changes

Once your mobile number is verified, you should see an option to save or confirm the changes. Make sure you click on this to ensure your new number is register in the system.

Step 9: Keep Confirmation for Your Records

It’s always a good idea to keep a record of any changes you make. Once your mobile number update is confirmed, you might receive a confirmation message or email. Save this for your records.

And there you have it! Updating or registering your mobile number for your GHMC property tax account is that simple. By keeping your contact details current, you ensure that you never miss out on important updates or deadlines, keeping your property tax responsibilities as hassle-free as possible. Now, wasn’t that easier than finding a parking spot in downtown Hyderabad on a busy afternoon? Happy updating, and stay connected!