How to Pay Chennai Property Tax Online – Complete Guide by GCC Portal

Property tax in Chennai is a mandatory local tax collected by the Greater Chennai Corporation (GCC) for residential, commercial, and vacant land properties. It contributes to the development and maintenance of urban infrastructure, sanitation, road networks, and other essential civic services.

Thankfully, you can now pay it easily online, download receipts, check dues, and even calculate your tax — all through the GCC portal.

Documents & Details Required for Property Tax

Before proceeding to pay or check your property tax in Chennai, make sure you have the following details available:

- Assessment Number

- Zone & Division Number

- Owner’s Name

- Property Address

- Mobile number or email ID (for OTP verification)

Steps to Make Property Tax in Chennai Payment Online

You can pay your Chennai property tax online without visiting the local office. You can also use the Namma Chennai mobile app to conveniently pay your property tax, access payment receipts, and avail other civic services from your smartphone. Here’s how:

Step-by-Step Process

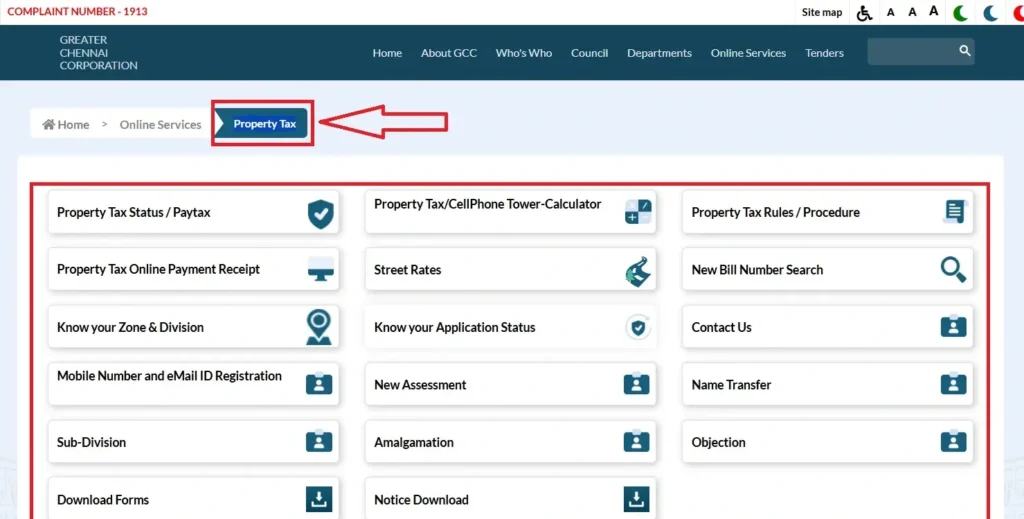

- Go to the GCC Official Portal

- Select Property Tax Online Payment from the Online Civic Services

- Enter your Assessment Number, Zone, and Division

- Review your outstanding tax dues and property details

- Click Pay Now and choose from available payment options:

- Credit/Debit Card

- Net Banking

- UPI (Google Pay, PhonePe, Paytm)

- After successful payment, your receipt will be generated automatically

How to Download Property Tax Receipt in Chennai

You can also download the property tax receipt later using these steps:

- Visit the GCC Property Tax page

- Go to “Receipt Download” section

- Enter your Assessment Number, Zone, and Division

- Click Submit

- Download your receipt in PDF format

Chennai Property Tax Calculator

To estimate your tax before paying:

- Visit the GCC Property Tax Calculator section

- Enter:

- Zone

- Plot area and built-up area

- Property usage (residential/commercial)

- Age of building

- Click Calculate

- The system will show the estimated half-yearly or annual tax

This helps avoid confusion and prepare exact payment.

Chennai Property Tax Due Dates, Rates & Penalty

In Chennai, propertytax is collected half-yearly:

- First Half-Year: Due by March 31

- Second Half-Year: Due by September 30

Property Tax Rates (2025):

- Residential (MRV up to ₹1,000): 6.62%

- Residential (MRV ₹1,001 – ₹5,000): 9.32%

- Commercial (MRV above ₹1,000): 12.40%

Note: Rates vary by zone and usage. For accurate calculation, refer to the official GCC Property Tax page.

Rebate for Early Payment:

- 5% rebate for payments made between April 1 and April 30, capped at ₹5,000.

Penalty for Late Payment:

- A 2% penalty per month applies after a 15-day grace period from the due date.

How to Check Property Tax Status Online

Want to confirm if your property tax is paid?

- Visit the GCC Property Tax Status page

- Enter your Assessment Number, Zone, and Division

- Click Submit

- View your current status:

- Paid (with date of payment)

- Unpaid (shows outstanding amount and due date)

How to Find Assessment Number (If You Don’t Have It)

Lost your Assessment Number? Here’s how to retrieve it:

- Go to the Search by Owner Name section on the GCC portal

- Enter the owner’s name and street name

- The system will display matching property records

- If you’re stll unable to find it, visit your nearest zonal revenue office with valid property documents(https://chennaicorporation.gov.in)

FAQs –

Q1. How can I pay property tax in Chennai online?

A. Visit chennaicorporation.gov.in, enter your assessment number, and pay using UPI, card, or net banking.

Q2. Where can I download the Chennai property tax receipt?

A. You can download it from the GCC Receipt Download section using your assessment number and zone details.

Q3. How much is the penalty for late payment of propertytax in Chennai?

A. GCC charges a 2% penalty per month on delayed payments after a 15-day grace period from the due date.

Q4. How do I calculate property tax ?

A. Use the official GCC Property Tax Calculator by entering built-up area, zone, and property type.

Conclusion

Paying Chennai property tax has become easier with the Greater ChennaiCorporation’s online portal. You can view dues, make payments, download receipts, and even estimate future taxes — all without visiting an office. To stay compliant and avoid penalties, ensure you pay on time and keep your records safe.

👉 Also explore:

- Birth Certificate Chennai – Apply, Download & Check Status

- Death Certificate Chennai – Online & Offline Application Guide

- Trade License Chennai: Online Application, Renewal & Status Check