Easy Ways to Check Your Karnataka Bank Balance: Toll-Free Number, Missed Call, and SMS Banking

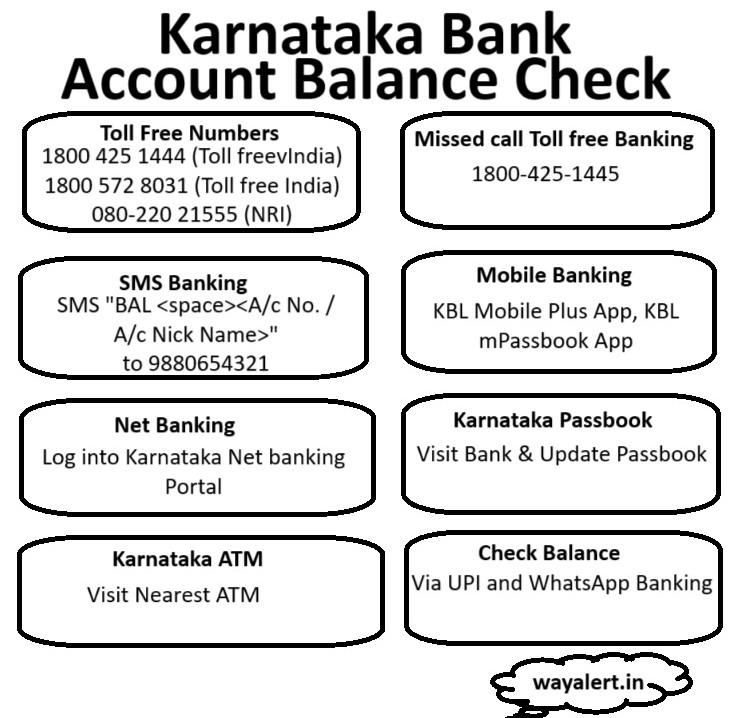

Are you a Karnataka Bank customer looking for quick and easy ways to check your account balance? You’re in the right place! In this blog post, we’ll explore three convenient methods: toll-free number, missed call service, and SMS banking. These methods save you time and effort, ensuring you always stay updated on your account status. Let’s dive into the details!

Karnataka Bank Balance Enquiry via Toll-Free Number

Did you know you can check your Karnataka Bank balance by calling a toll-free number? It’s a hassle-free way to stay updated. All you need to do is dial the toll-free number provided by Karnataka Bank from your registered mobile number. Once connected, follow the automated instructions, and within moments, you’ll have your balance details.

1800 425 1444 (Toll free within India)

1800 572 8031 (Toll free within India)

080-220 21555 (NRI)

This service is perfect if you’re on the go and need to check your balance quickly. There’s no need to visit a branch or find an ATM. Just dial, follow the prompts, and you’re good to go! This method is especially handy if you don’t have internet access but still want to stay on top of your finances.

Karnataka Bank Balance Enquiry through Missed Call Service

If you love simplicity, the missed call service is for you! Karnataka Bank offers a missed call service for balance enquiries that’s as easy as it sounds. From your registered mobile number, give a missed call to the designated number provided by the bank. Within seconds, you’ll receive an SMS with your account balance details.

For balance confirmation : 1800 425 1445

For mini statement : 1800 425 1446

This method is incredibly convenient because it’s free, quick, and requires no internet connection. Just one missed call, and your balance info is delivered straight to your phone. It’s perfect for busy days when you need your balance details in a flash.

Karnataka Bank Balance Enquiry via SMS Banking

For those who prefer texting, SMS banking is an excellent option. With Karnataka Bank’s SMS banking service, you can check your balance by sending a simple text message. From your registered mobile number, send an SMS with the specified keyword to the bank’s designated number. In no time, you’ll receive an SMS with your account balance.

By typing BAL. send SMS to 9880654321.

SMS banking is a fantastic option if you prefer a written record of your balance enquiries. You can refer back to the SMS anytime you need to check your balance history. Plus, it’s a great way to manage your finances if you’re not always connected to the internet..

How to Register for These Services

Before you can use these services, make sure your mobile number is registered with Karnataka Bank. If it’s not, visit your nearest branch or contact customer service to get it registered. Once your number is registered, you’re all set to use the toll-free number, missed call service, and SMS banking for balance enquiries.

Why These Methods Are Great for You

These three methods – toll-free number, missed call service, and SMS banking – are designed with you in mind. They’re easy to use, fast, and convenient, ensuring you always have access to your account balance. Whether you’re traveling, busy with work, or simply prefer not to visit the bank, these options make banking simpler and more accessible.

Easy Steps to Check Your Karnataka Bank Balance via Net Banking

Are you curious about how to check your Karnataka Bank balance using net banking? Don’t worry, it’s simpler than you think! In this blog post, we’ll walk you through the step-by-step process to access your account balance online. By the end, you’ll be a pro at Karnataka Bank balance enquiry using net banking. Let’s get started!

Step 1: Login to Karnataka Bank Net Banking

First things first, you’ll need to log in to your Karnataka Bank net banking account. Open your preferred web browser and go to the Karnataka Bank website. Look for the “Net Banking” option and click on it. Enter your User ID and password to access your account. If it’s your first time, make sure you have your credentials ready.

Step 2: Navigate to the Balance Enquiry Section

Once you’re logged in, you’ll be greeted by your dashboard. This is where you can see an overview of your account. To check your balance, find the “Accounts” tab or a similar option. Click on it, and a drop-down menu will appear. Select the “Balance Enquiry” option from the list.

Step 3: View Your Account Balance

After clicking on “Balance Enquiry,” you’ll be directed to a page showing your account details. Here, you’ll see your current balance, along with any recent transactions. It’s that simple! You can now check your balance anytime you want, right from the comfort of your home.

Step 4: Securely Logout

Once you’ve checked your balance, don’t forget to log out. This is an important step to ensure your account remains secure. Look for the “Logout” button, usually located at the top right corner of the page. Click on it to safely exit your account.

Why Use Net Banking for Balance Enquiry?

Net banking is a convenient and secure way to manage your finances. You can check your Karnataka Bank balance anytime, without needing to visit a branch or ATM. Plus, it provides a detailed view of your transactions, helping you keep track of your spending.

How to Check Your Karnataka Bank Balance Using the “KBL MOBILE Plus” App

Are you looking for a quick and easy way to check your Karnataka Bank balance? Look no further than the “KBL MOBILE Plus” mobile banking app! In this blog post, we’ll guide you step-by-step on how to use this app for your Karnataka Bank balance enquiry. You’ll see how simple it is to manage your finances on the go. Let’s get started!

Step 1: Download and Install the “KBL MOBILE Plus” App

First, you’ll need to download the “KBL MOBILE Plus” app on your smartphone. You can find it on the Google Play Store for Android devices or the Apple App Store for iOS devices. Simply search for “KBL MOBILE Plus,” click on the download button, and install the app. Once installed, open the app to begin the setup process.

Step 2: Register and Set Up Your Account

If you’re using the app for the first time, you’ll need to register. Open the app and select the “New User” option. Enter your Karnataka Bank account details, including your account number and registered mobile number. Follow the on-screen instructions to complete the registration process, which may include setting up a User ID and password. If you’re already registered, simply log in with your credentials.

Step 3: Navigate to the Balance Enquiry Section

After logging in, you’ll be greeted by the home screen of the app. To check your balance, look for the “Accounts” section. Tap on it to see a list of your accounts linked to the app. Select the account for which you want to check the balance.

Step 4: View Your Account Balance

Once you’ve selected your account, your current balance will be displayed on the screen. You can also view recent transactions and other account details. It’s that easy! With just a few taps, you have access to your account balance and more.

Step 5: Log Out Securely

After checking your balance, it’s important to log out of the app to keep your account secure. Tap on the menu icon, usually found in the top corner, and select the “Logout” option. This ensures that your financial information remains protected.

Why Use the “KBL MOBILE Plus” App for Balance Enquiry?

The “KBL MOBILE Plus” app offers a convenient and secure way to manage your Karnataka Bank account. With this app, you can check your balance anytime, anywhere, without the need to visit a branch or ATM. Plus, it provides additional features like fund transfers, bill payments, and more, making banking on the go a breeze.

Convenient Ways to Check Your Karnataka Bank Balance: Passbook, ATM, and UPI

Managing your Karnataka Bank account balance has never been easier! Whether you prefer traditional methods or modern technology, Karnataka Bank offers multiple ways to check your balance. In this blog post, we’ll explore how to check your balance using a passbook, ATM, and UPI. These step-by-step guides will make your Karnataka Bank balance enquiry a breeze. Let’s dive in!

Checking Your Balance with a Passbook

The passbook is a classic way to keep track of your bank transactions. Here’s how you can use it to check your Karnataka Bank balance:

- Visit the Bank Branch: Take your passbook to the nearest Karnataka Bank branch.

- Update Your Passbook: Hand over your passbook to the teller or use the passbook printing machine. This updates your passbook with the latest transactions.

- Check Your Balance: Your updated passbook will show all recent transactions, and you can easily find your current balance at the end of the list.

Using a passbook is straightforward and provides a physical record of all your transactions, making it perfect for those who prefer paper records.

Checking Your Balance at an ATM

Using an ATM is another convenient way to check your Karnataka Bank balance. Here’s how to do it:

- Locate an ATM: Find the nearest Karnataka Bank ATM or any ATM that supports your card.

- Insert Your Card: Insert your debit card into the ATM and enter your PIN.

- Select Balance Enquiry: From the menu options, select “Balance Enquiry” or “Check Balance.”

- View Your Balance: The ATM will display your account balance on the screen. You can also choose to print a receipt with your balance information.

This method is quick and can be done at any ATM, making it very accessible for those who are always on the go.

Checking Your Balance Using UPI

Unified Payments Interface (UPI) is a modern and convenient way to check your bank balance using your smartphone. Here’s a step-by-step guide:

- Download a UPI App: Download a UPI-enabled app like Google Pay, PhonePe, or BHIM from your app store.

- Register Your Account: Open the app and register your Karnataka Bank account by entering your account details and mobile number.

- Set UPI PIN: Follow the instructions to set up your UPI PIN. This step ensures secure transactions.

- Check Balance: In the app, select the “Check Balance” option. Enter your UPI PIN, and the app will display your current account balance.

Using UPI is highly convenient as it allows you to check your balance and perform transactions directly from your smartphone.

Why Use These Methods for Balance Enquiry?

Each method offers unique advantages depending on your preferences and situation:

- Passbook: Ideal for those who prefer a physical record of their transactions and enjoy visiting the bank.

- ATM: Great for quick, on-the-go balance checks, especially if you are near an ATM.

- UPI: Perfect for tech-savvy individuals who prefer managing their finances via smartphone apps.

Security Tips for Balance Enquiry

Regardless of the method you choose, it’s important to keep your financial information secure:

- Passbook: Store your passbook in a safe place and avoid sharing it with others.

- ATM: Always cover the keypad when entering your PIN and ensure no one is looking over your shoulder.

- UPI: Keep your UPI PIN confidential and never share it with anyone. Ensure your smartphone has security measures like a screen lock.

How to Check Your Karnataka Bank Balance via WhatsApp Banking

Are you looking for a quick and easy way to check your Karnataka Bank balance using WhatsApp? You’re in the right place! In this blog post, we’ll guide you through the steps to use WhatsApp Banking for your Karnataka Bank balance enquiry. This method is convenient, user-friendly, and perfect for managing your finances on the go. Let’s get started!

Step 1: Register for WhatsApp Banking

Before you can use WhatsApp Banking, you need to register your mobile number with Karnataka Bank. Here’s how:

- Save the Bank’s WhatsApp Number: Save Karnataka Bank’s official WhatsApp number in your contacts. You can find this number on their official website or by contacting customer service.

Chat with us on WhatsApp Send a “Hi” to +91 9632188999

- Send a Message: Open WhatsApp and send a message saying “Hi” or “Hello” to the saved number.

- Follow the Instructions: You’ll receive a welcome message along with instructions on how to proceed. Follow these instructions to complete the registration process.

Step 2: Check Your Balance

Once you’re registered, checking your balance is a breeze. Here’s what you need to do:

- Open WhatsApp: Open WhatsApp and go to the chat with Karnataka Bank’s WhatsApp number.

- Send a Command: Type “BAL” or “BALANCE” and send it as a message.

- Receive Your Balance: Within moments, you’ll receive a message with your account balance details.

It’s that simple! With just a few taps, you can get your balance information right on your WhatsApp chat.

Other Services via WhatsApp Banking

WhatsApp Banking isn’t just for balance enquiries. Karnataka Bank offers a range of services through this platform, making it a versatile tool for managing your account. Here are some additional services you can access:

- Mini Statement: Get a mini statement by sending “MINI” or “MINISTMT” to the WhatsApp number.

- Cheque Status: Check the status of your cheques by sending “CHQ” followed by the cheque number.

- Branch Locator: Find the nearest Karnataka Bank branch by sending “BRANCH” and your location details.

- Product Information: Learn about various bank products by sending “PRODUCT” or specific product-related keywords.

Why Use WhatsApp Banking?

WhatsApp Banking offers several advantages:

- Convenience: You can check your balance and access other services from anywhere, anytime.

- User-Friendly: The interface is simple and intuitive, making it easy for everyone to use.

- Quick Response: Receive instant replies to your queries, saving you time and effort.

Frequently Asked Questions about Karnataka Bank Balance Enquiry

Are you new to Karnataka Bank or looking for more information on balance enquiries? We’ve got you covered! In this blog post, we’ll address some of the most frequently asked questions about Karnataka Bank balance enquiries. These FAQs will help you navigate your banking needs with ease and confidence. Let’s get started!

How Can I Check My Karnataka Bank Balance?

Karnataka Bank offers multiple convenient ways to check your balance:

- Net Banking: Log in to your net banking account and navigate to the balance enquiry section.

- Mobile Banking: Use the “KBL MOBILE Plus” app to view your balance on your smartphone.

- WhatsApp Banking: Send “BAL” or “BALANCE” to Karnataka Bank’s WhatsApp number for a quick balance update.

- SMS Banking: Send a designated keyword from your registered mobile number to receive your balance via SMS.

- ATM: Visit any Karnataka Bank ATM or other ATMs to check your balance.

- Passbook: Update your passbook at any Karnataka Bank branch for a record of your balance.

Is There Any Charge for Balance Enquiries?

Most balance enquiry methods, like WhatsApp Banking, SMS Banking, and ATM checks, are free of charge. However, it’s always a good idea to confirm with the bank if there are any charges, especially for SMS services, as standard messaging rates may apply depending on your mobile carrier.

Can I Check My Balance Without Internet?

Absolutely! You can use the missed call service or SMS Banking to check your Karnataka Bank balance without an internet connection. Just give a missed call or send an SMS from your registered mobile number, and you’ll receive your balance details shortly.

What Should I Do if I Forget My Net Banking Password?

If you forget your net banking password, you can reset it online. Visit the Karnataka Bank net banking portal and click on the “Forgot Password” link. Follow the instructions to reset your password using your registered mobile number and email ID.

Is It Safe to Use Mobile Banking for Balance Enquiries?

Yes, mobile banking is safe when you follow basic security practices. Ensure your smartphone has a secure screen lock, never share your login credentials with anyone, and avoid using public Wi-Fi for banking transactions. Always download the official “KBL MOBILE Plus” app from trusted sources like the Google Play Store or Apple App Store.

How Often Should I Check My Bank Balance?

It’s a good practice to check your bank balance regularly to monitor your finances and detect any unauthorized transactions. Depending on your needs, you might check your balance daily, weekly, or after major transactions.

What Do I Do if My Balance Enquiry Shows an Incorrect Amount?

If you notice any discrepancies in your balance, immediately contact Karnataka Bank’s customer service. They will help you investigate and resolve the issue. Keeping a record of your recent transactions can also help in quickly identifying the problem.

Can I Check the Balance of Multiple Accounts?

Yes, if you have multiple accounts with Karnataka Bank, you can link them to your net banking or mobile banking profile. This allows you to check the balances of all your accounts in one place, making it easier to manage your finances.

Conclusion

Karnataka Bank provides several convenient methods for balance enquiries, ensuring you can always stay updated on your account status. Whether you prefer net banking, mobile apps, WhatsApp, or traditional methods like ATMs and passbooks, there’s an option that suits your needs. Regularly checking your balance helps you stay on top of your finances and quickly address any issues. If you have more questions, don’t hesitate to contact Karnataka Bank’s customer service for assistance. Happy banking!