How to Apply CIBIL ONLINE CREDIT SCORE REQUEST FORM and Improve Credit Score

The CIBIL Score plays a critical role in the loan application process. After an applicant fills out the application form and hands it over to the lender, the lender first checks the credit score and credit report of the applicant.

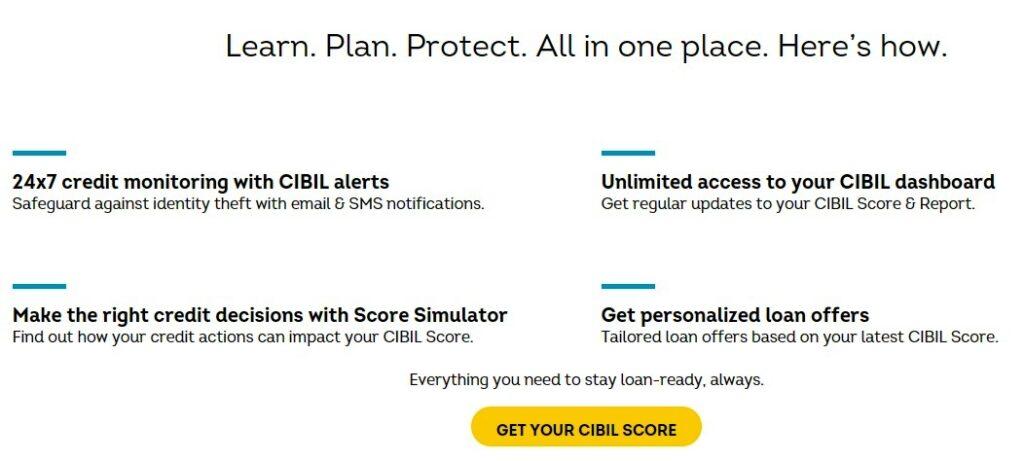

Cibil Score Online

If the credit score is low, the lender may not even consider the application further and reject it at that point. If the credit score is high, the lender will look into the application and consider other details to determine if the applicant is credit-worthy.

The credit score works as a first impression for the lender, the higher the score, the better are your chances of the loan being reviewed and approved. in paragraghy, CIbil score major word running here.

Apply CIBIL ONLINE CREDIT SCORE REQUEST FORM :

Visit Official link : https://www.cibil.com/

- Select CIBIL SCore and Report.

- Filling details of about Yourself :

- First and Last name

- Date Of birth, Gender, IDentity Proof and ID number.

- And filling YOur address like address,state,mobile number and email Address.

- And Click On “Proceed To payment”.

What is CIBIL?

TransUnion CIBIL Limited is India’s first Credit Information Company, also commonly referred as a Credit Bureau. We collect and maintain records of individuals’ and non-individuals’ (commercial entities) payments pertaining to loans and credit cards. These records are submitted to us by banks and other lenders on a monthly basis; using this information a Credit Information Report (CIR) and Credit Score is developed, enabling lenders to evaluate and approve loan applications. A Credit Bureau is licensed by the RBI and governed by the Credit Information Companies (Regulation) Act of 2005.

How to Improve Credit Score using CIbil :

You can improve your Credit Score by maintaining a good credit history. This will be viewed favorably by lenders and it can be done with 6 simple rules :

1. Always pay your dues on time

Late payments are viewed negatively by lenders

2. Keep your balances low

Always prudent to not use too much credit, control your utilization

3. Maintain a healthy mix of credit

It is better to have a healthy mix of secured (such as home loan, auto loan) and unsecured loans (such as personal loan, credit cards). Too many unsecured loans may be viewed negatively.

4. Apply for new credit in moderation

You don’t want to reflect that you are continuously seeking excessive credit; apply for new credit cautiously.

5. Monitor your co-signed, guaranteed and joint accounts monthly

In co-signed, guaranteed or jointly held accounts, you are held equally liable for missed payments. Your joint holder’s (or the guaranteed individual) negligence could affect your ability to access credit when you need it

6. Review you credit history frequently throughout the year

Purchase your CIR from time to time to avoid unpleasant surprises in the form of a rejected loan application.

How to Get 10% Cash-Back on CIBIL TransUnion Report through NetBanking :

10% Cashback on CIBIL TransUnion Report for Individuals.

The Cashback will be credited in your account within 7 working days.

Offer Valid for Requests placed from 26th Nov. to 15th Dec., through NetBanking only.

How to Request CIBIL Score ?

Login to NetBanking to Request for CIBIL Score, in 3 simple steps, and get 10% Cash Back :

- Select the transaction from Request section of Accounts tab, and consent to be redirected to CIBIL site.

- Verify your pre- filled details, and Confirm the Request.

- Make payment of Rs. 550

- The Report will be dispatched on your Email ID, within few minutes.

For More details, visit Official website : https://www.cibil.com.