CIL Salary Slip – Step-by-Step Guide to Download Coal India Payslip Online (2025)

Coal India Limited (CIL) is one of the largest public sector companies in India. With more than 250,000 employees spread across its subsidiaries, accurate salary records are essential. Every employee receives a CIL salary slip, which serves as an official proof of income. It not only lists the earnings and deductions for a particular month but is also required for loan approvals, tax filing, and other financial verifications.

In this article, we explain in detail how to download your CIL payslip online, what information it contains, troubleshooting steps, and frequently asked questions.

What is a CIL Salary Slip?

A CIL salary slip (Coal India payslip) is a digital statement generated monthly for each employee. It contains the following details:

- Personal details – Employee ID/EIS number, designation, department.

- Earnings – basic pay, allowances, incentives.

- Deductions – PF, NPS, professional tax, TDS, loan recoveries.

- Net Salary – the final credited amount after deductions.

Employees can download the document anytime using the salary.coalindia.in portal, the HRMS system, or their respective subsidiary portals.

Understanding Employee Codes: EIS / PIS / Man Number

Coal India uses different identifiers depending on the employee category and system in use:

- EIS (Employee Identification Sequence) – commonly used for executives.

- PIS (Personnel Information System number) – used in older records.

- Man Number – still required in some subsidiaries such as Eastern Coalfields Limited (ECL).

These numbers are printed on earlier payslips, ID cards, or available through the HR department.

Prerequisites for Downloading a CIL Payslip

Before attempting to download your Coal India salary slip, ensure that you have:

- Employee Code / EIS / Man Number

- Mobile number registered in the SAP system (for OTP verification)

- Date of Birth (sometimes used as login password)

- Internet access and a browser to visit the official portals

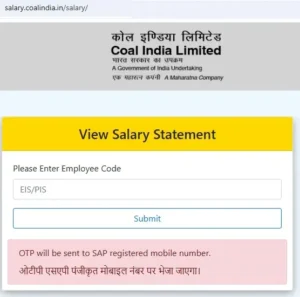

Method 1 – CIL Salary Slip from salary.coalindia.in

The primary portal for downloading payslips is salary.coalindia.in. Follow these steps:

- Visit salary.coalindia.in/salary.

- Enter your Employee Code.

- An OTP will be sent to your registered mobile number.

- Enter the OTP and click Login.

- Go to the Salary Statement section.

- Download or print the required payslip in PDF format.

🔑 Tip: If you are not receiving the OTP, confirm that your mobile number is correctly updated in the HR/SAP database.

Method 2 – Salary Slip via CIL HRMS / ESS (Executives)

Executives usually access their salary slips from the CIL HRMS portal.

Steps to log in:

- Visit the HRMS portal under Employee Corner on the official Coal India site.

- Enter your Login ID:

E + EIS Number. - Enter the Password:

y + Year of Birth(example: y1980). - After login, click on the Payslip/Salary Statement option.

- Choose the month and download the slip.

👉 Change the default password after first login for security.

Method 3 – Subsidiary Portals for Salary Slip

Coal India has multiple subsidiaries, and many provide their own employee portals:

- MCL (Mahanadi Coalfields Limited) – Employees can log in via the ESS/MSS portal for salary and HR services.

- ECL (Eastern Coalfields Limited) – Non-executive staff use the NEIS portal, logging in with Man Number and Date of Birth.

- Other Subsidiaries (BCCL, SECL, CCL, WCL, NCL) – Each has employee login options for payroll and related services.

Check with your HR section for the exact portal link and login details if your division uses a separate platform.

Key Components of a CIL Salary Slip

The Coal India payslip breaks down salary into two major parts – earnings and deductions.

Earnings

- Basic Pay – the fixed monthly wage based on grade and service.

- Dearness Allowance (DA) – cost-of-living adjustment revised quarterly.

- Housing Allowance (HRA) – varies depending on posting location; higher in metros, lower in small towns.

- Other Allowances – medical, risk, underground duty, shift allowance, etc.

Deductions

- Provident Fund (PF) or NPS contributions – compulsory retirement savings.

- Professional Tax – state-specific deduction.

- Income Tax (TDS) – deducted at source as per applicable slabs.

- Recoveries – loan installments or advances if applicable.

Net Salary

The final amount credited to the employee’s bank account, along with bank details and transaction references.

Compliance and Tax Reporting

The deductions mentioned in the salary slip directly impact income tax and retirement benefits.

- PF/NPS contributions qualify for tax deductions under Section 80C.

- TDS is visible monthly and summarized in Form 16 for annual tax returns.

- Employees are advised to download and preserve their monthly payslips for financial planning.

Troubleshooting Common Issues

Employees may face login or access problems when downloading the payslip. Some common issues and solutions are:

- OTP not received – Verify if your mobile number is correctly registered in the SAP system.

- Forgot login credentials – Contact HR to reset Employee Code/EIS details.

- Subsidiary login errors – Ensure correct DOB format (DD-MM-YYYY) when using portals like ECL NEIS.

- HRMS password issues – Use the default format (y+Year of Birth) or request a reset.

Downloading, Printing, and Sharing CIL Payslip Safely

- Always download payslips only from official CIL or subsidiary portals.

- Save a PDF copy for personal records.

- When submitting for bank loans or visa purposes, hide sensitive details like PAN or account number.

- Avoid logging in from public computers or cyber cafés.

Security Practices for Employees

- Update your password regularly.

- Do not share OTPs or login details with anyone.

- Check the portal URL carefully before entering credentials.

- Use updated browsers for smooth functioning.

FAQs on CIL Salary Slip

Q1. How do I download my CIL salary slip online?

You can download it from salary.coalindia.in by entering your Employee Code and OTP. Executives can also log in via HRMS.

Q2. Where can I find my Employee Code/EIS number?

It is printed on your ID card, earlier payslips, or can be obtained from the HR department.

Q3. What if I do not receive OTP while logging in?

Ensure your mobile number is updated in SAP. Contact the HR section if required.

Q4. Can non-executives access their payslips online?

Yes. Subsidiaries like ECL and MCL provide dedicated portals for non-executive staff.

Q5. What is the default login format for HRMS?

Login ID = E + EIS Number; Password = y + Year of Birth. Example: E234567, y1990.

Q6. Does the salary slip show PF and TDS details?

Yes. PF/NPS contributions and TDS are clearly shown in the deductions section.

Q7. Are there special bank packages for CIL employees?

Yes, some banks like SBI offer corporate salary account benefits to Coal India staff.

Conclusion

The CIL salary slip is a vital document for every employee of Coal India Limited. Whether you are an executive or non-executive, downloading your payslip has become simple with the salary.coalindia.in portal, HRMS login, and subsidiary employee portals.

Employees should ensure their mobile numbers and credentials are updated, download their slips every month, and maintain secure copies for future reference. This not only helps in loan approvals and financial planning but also ensures compliance with tax regulations.

By following the above steps, you can easily and safely manage your CIL salary slip online in 2025.