Learn how to easily e-file your income tax returns in India with this step-by-step guide. Save time and file your ITR online hassle-free today!

How to E-File Your Income Tax Returns (ITR) in India: Explained Step by Step

Filing your income tax returns may seem like a daunting task, but don’t worry! E-filing your ITR in India is easier than it sounds. With just a few simple steps, you can file your taxes online from the comfort of your home. Let’s break it down and make the process as smooth as possible for you.

1. Gather Your Documents

Before you start e-filing, it’s crucial to gather all your essential documents. Think of it as preparing for a road trip — you want everything in place before you hit the road! Here’s what you’ll need:

- PAN card: Your unique identification number for filing taxes.

- Aadhaar card: Linked to your PAN, making the process quicker.

- Bank statements: To track income, expenses, and investments.

- Form 16: Provided by your employer, this details your salary and tax deductions.

- Investment proofs: These help you claim deductions under various sections like 80C, 80D, etc.

Once you have everything, it’s time to move to the next step. Remember, gathering these in advance can save you a lot of last-minute panic!

2. Choose the Correct ITR Form

Selecting the right form is crucial for a smooth filing process. Depending on your income source, you’ll need to pick from ITR 1, ITR 2, ITR 3, and so on. If you’re a salaried employee, you’ll likely use ITR 1 (Sahaj). If you have other sources like rental income or capital gains, you’ll need a different form.

Don’t worry, the Income Tax Department’s website helps you figure out which form suits you best. It’s like choosing the right recipe for a meal — pick the one that matches your ingredients (income sources)!

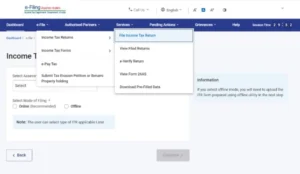

3. Log into the Income Tax e-Filing Portal

Now, head over to the official Income Tax e-Filing Portal. The website URL is incometaxindiaefiling.gov.in. If you’re new to the portal, you’ll need to register. Use your PAN as your user ID. Already registered? Just log in!

Once logged in, you’ll see an option to “File Income Tax Return.” Click on that, and you’re on your way to e-filing! It’s like entering your favorite online shopping site — but instead of buying things, you’re submitting your taxes!

4. Fill in the Details Carefully

This is where you need to pay close attention. The form will ask you for several details, including:

- Personal information like your name, PAN, and Aadhaar details.

- Income details like salary, interest earned from savings accounts, and other sources.

- Deductions under sections like 80C (investments), 80D (medical insurance), etc.

It’s vital to ensure all details match your Form 16 and bank statements. Errors here could lead to discrepancies in your filing, and nobody wants that!

5. Calculate Your Tax Liability

The following step involves figuring out your tax liability. Don’t worry, the portal does the heavy lifting here. Based on the income and deduction details you’ve entered, it will calculate how much tax you owe (if any) or if you’re due a refund.

This step is as simple as checking out your online shopping cart total. If the numbers match what you expect, you’re good to go!

6. Pay Your Tax Dues (if applicable)

If the calculation shows you still owe some taxes, don’t panic. You can make your payment online using the e-Pay Tax feature available on the portal. Once you’ve paid the due amount, make sure you download the challan receipt for future reference.

Think of it as paying for your groceries online — it’s quick, and you get an instant confirmation!

7. Submit and Verify Your Return

You’re almost at the finish line! Once all the details are filled in, hit submit. But wait — you still need to verify your return. Without verification, your e-filing isn’t complete.

You can verify your return using:

- Aadhaar OTP: A one-time password sent to your registered mobile number.

- Net banking: If your bank supports it, verification can be done directly through your online banking account.

- Physical verification: If digital options aren’t for you, you can send a signed physical copy of the ITR-V form to the CPC office in Bengaluru.

Once verified, pat yourself on the back — you’ve successfully e-filed your income tax returns!

8. Check the Status of Your Return

After filing, you can easily track the status of your return on the same portal. If a refund is due, it will be processed soon after your filing is verified. The portal keeps you updated on the progress, much like tracking an online order!

To check the status, log in, go to “My Account” and click on “View Returns/Forms.” It’s that simple! You’ll know whether your filing has been processed, if any refunds are on their way, or if there’s any follow-up needed.

9. Download and Save the Acknowledgment

Once your return is verified, download the ITR-V acknowledgment from the portal. It’s an important document that proves you’ve filed your returns. Keep it safe, just like any other important document — you never know when you might need it for future reference!

Why E-Filing is a Smart Choice

E-filing your income tax returns is not only hassle-free but also fast and secure. You can do it from your home, skip long queues, and get your refunds quicker. Plus, the government has made the process so user-friendly that even first-timers can file without breaking a sweat!

If you follow these steps, you’ll find that filing your income tax returns is less about stress and more about getting it done with ease. So, go ahead, file your income tax returns online this year — it’s simpler than you think!

By following this guide, you’ll be able to tackle e-filing with confidence and a smile on your face!

Frequently asked questions (FAQs) related to e-filing income tax returns in India:

1. What is e-filing of income tax returns?

E-filing is the process of submitting your income tax returns online through the Income Tax Department’s official portal.

2. Who needs to e-file their income tax returns?

All individuals, HUFs, and businesses earning above the specified income threshold are required to file their income tax returns. Salaried employees, freelancers, and self-employed individuals must also e-file.

3. What documents are required for e-filing?

Key documents include your PAN, Aadhaar, Form 16 (for salaried individuals), bank statements, and proofs of investments or deductions.

4. Which ITR form should I use?

The form you use depends on your income sources. For instance, ITR-1 is for salaried individuals, while ITR-3 is for those with business income.

5. What happens if I miss the deadline?

If you miss the deadline, you can still file a belated return, but late fees and interest may apply.

6. Can I revise my income tax return after submission?

Yes, you can revise your return if you find an error. The revised return must be filed before the end of the assessment year.

7. How do I verify my e-filed return?

You can verify your return using Aadhaar OTP, net banking, or by sending a physical signed copy of ITR-V to the CPC office.

8. How do I check the status of my income tax return?

Log in to the Income Tax e-filing portal and click on “View Returns/Forms” to check the status.

9. What if I am eligible for a refund?

If you’re owed a refund, it will be credited directly to your bank account after the return is processed. You can track this through the portal.