Explore how to login to SBI Net Banking for personal and corporate accounts. Discover services, benefits, and a step-by-step guide.

SBI Net Banking Login

Welcome to the world of SBI Net Banking, where banking is as easy as a few clicks. With SBI Net Banking, you can manage your finances from the comfort of your home, office, or even on the go. In this blog, we’ll explore how to log in to SBI Net Banking for both personal and corporate accounts, the range of services available, and the numerous benefits it offers. Let’s dive in!

SBI Personal Net Banking Login:

Logging into your personal SBI Net Banking account is a breeze. Here’s a simple guide to get you started:

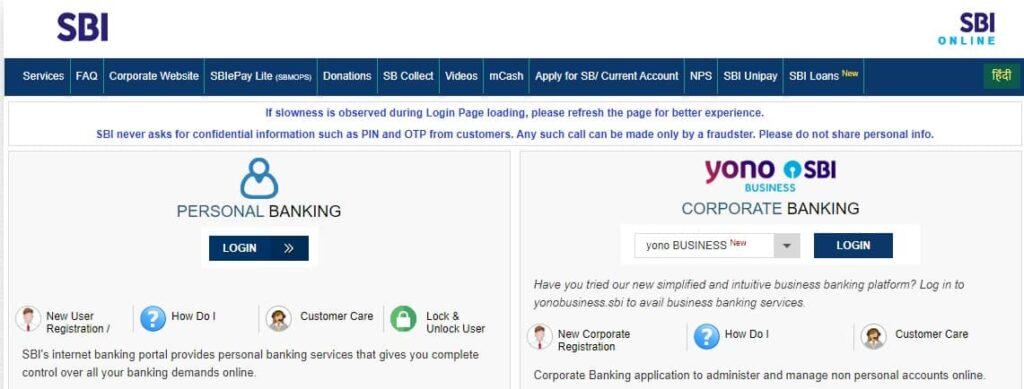

- Visit the SBI Net Banking Portal: Open your browser and go to the official SBI Net Banking website.

- Click on ‘Login’: You’ll find this option prominently displayed on the homepage. Select ‘Personal Banking’.

- Enter Your Credentials: Type in your User ID and password. Make sure to keep these details secure.

- Verify with OTP: You may be prompted to enter a One-Time Password (OTP) sent to your registered mobile number.

- Access Your Dashboard: Once logged in, you’ll be directed to your account dashboard, where you can view and manage your finances.

SBI Corporate Net Banking Login:

For corporate users, SBI Net Banking offers a seamless way to handle business transactions. Here’s how to log in:

- Access the SBI Net Banking Website: Navigate to the official site using your preferred web browser.

- Select ‘Corporate Banking’: Click on the ‘Corporate Banking’ login option.

- Enter Corporate ID and User ID: Provide your unique Corporate ID and User ID.

- Input Your Password: Enter the secure password associated with your account.

- Authenticate with OTP: As an added security measure, enter the OTP sent to your registered mobile number.

- Explore Your Corporate Dashboard: You’ll be taken to your corporate account dashboard, where you can manage all your business transactions.

SBI Net Banking Services

SBI Net Banking offers a wide array of services designed to make your banking experience smoother and more efficient. Here are some of the key services you can access:

- Account Information: View your account balance, transaction history, and statements at any time.

- Funds Transfer: Transfer money between your accounts, to other SBI accounts, or to accounts in other banks using NEFT, RTGS, or IMPS.

- Bill Payments: Pay your utility bills, credit card bills, and other payments easily online.

- Fixed Deposits: Open, renew, and manage fixed deposits without visiting the branch.

- Loan Services: Apply for loans, check your loan status, and make repayments directly from your account.

- E-Tax: Pay your taxes online with ease.

- Card Services: Manage your debit and credit cards, request for a new card, or block a lost card.

- Investment Services: Invest in mutual funds, IPOs, and more with just a few clicks.

Why Use SBI Net Banking? The Benefits Await You

The benefits of using SBI Net Banking are numerous and tailored to meet the needs of both personal and corporate users. Here’s why you should consider it:

- Convenience: Bank from anywhere at any time without the need to visit a branch.

- Security: Robust security measures, including OTPs and encrypted transactions, keep your information safe.

- Time-Saving: Perform multiple banking operations quickly, saving valuable time.

- Accessibility: Access a wide range of services from a single platform.

- 24/7 Availability: Enjoy round-the-clock access to your accounts and services.

- Cost-Effective: Reduce the need for physical visits, cutting down on travel and associated costs.

- User-Friendly Interface: Easy-to-navigate dashboard designed for hassle-free banking.

Guide to Make the Most of SBI Net Banking

Now that you know the basics, let’s go through a detailed step-by-step guide to help you maximize your SBI Net Banking experience:

- Register for SBI Net Banking: If you haven’t registered yet, visit your nearest SBI branch or do it online through the SBI website.

- Set Up Your Profile: Once registered, log in and set up your profile by providing necessary details and setting security questions.

- Add Beneficiaries: To transfer funds, add beneficiaries by providing their account details. This step usually requires OTP verification.

- Set Transaction Limits: Customize your transaction limits according to your needs to enhance security.

- Enable Alerts: Opt-in for SMS and email alerts to stay updated on your account activities.

- Explore Services: Familiarize yourself with the various services available such as bill payments, fixed deposits, and loan applications.

- Regularly Update Passwords: Change your passwords periodically to maintain account security.

- Use the Mobile App: Download the SBI YONO app for mobile banking on the go. It offers the same functionality as the web portal.

Ensuring Secure Banking Practices

Security is paramount when it comes to online banking. Here are some tips to keep your SBI Net Banking account safe:

- Use Strong Passwords: Create complex passwords that are difficult to guess.

- Avoid Public Wi-Fi: Access your account using a secure and private internet connection.

- Keep Software Updated: Ensure your browser and antivirus software are up to date.

- Log Out After Use: Always log out from your account after completing your transactions.

- Monitor Your Account: Regularly check your account for any unauthorized transactions.

Final Thoughts on SBI Net Banking Login

SBI Net Banking is a powerful tool that offers convenience, security, and a wide range of services to meet your personal and corporate banking needs. By following the steps outlined in this guide, you can easily navigate through the login process, explore the available services, and enjoy the numerous benefits it brings. Embrace the digital age of banking with SBI Net Banking and make managing your finances a hassle-free experience!

So, what are you waiting for? Log in to SBI Net Banking today and unlock a world of convenience right at your fingertips!

Guide to SBI Net Banking Login: Frequently Asked Questions

Welcome back to our blog series on SBI Net Banking! In this post, we’ll tackle some of the most frequently asked questions (FAQs) about SBI Net Banking Login. Whether you’re a first-time user or a seasoned pro, these FAQs will help you navigate the process smoothly. Let’s jump right in!

How Do I Register for SBI Net Banking?

Registering for SBI Net Banking is straightforward and can be done in a few simple steps. If you haven’t registered yet, here’s how to get started:

- Visit Your Nearest SBI Branch: To get your online banking credentials, visit your nearest SBI branch and fill out the registration form.

- Receive Your Kit: You’ll receive a Pre-Printed Kit (PPK) containing your first-time login credentials.

- Log In Online: Use the credentials from the PPK to log in to the SBI Net Banking portal for the first time.

- Create a New Password: Follow the prompts to create your unique username and password.

- Complete the Profile: Fill in additional details to complete your profile setup.

What Should I Do If I Forget My Password?

Forgetting your password is common, but don’t worry—it’s easy to reset it. Here’s what you need to do:

- Go to the SBI Net Banking Website: Visit the official SBI Net Banking portal.

- Click on ‘Forgot Password’: This option is usually available on the login page.

- Enter Your Details: Provide your username, account number, and registered mobile number.

- Verify with OTP: Enter the OTP sent to your registered mobile number.

- Reset Password: Follow the instructions to reset your password and log in with your new credentials.

How Can I Change My Username?

Unfortunately, once you’ve set your username, it cannot be changed. If you’re facing issues with your username, the best course of action is to contact SBI customer support for assistance. They can guide you on the necessary steps to resolve any issues.

Is SBI Net Banking Safe to Use?

Yes, SBI Net Banking is very safe, thanks to multiple layers of security measures. Here’s why you can trust it:

- OTP Verification: Transactions require One-Time Password (OTP) verification, adding an extra layer of security.

- Secure Login: Your login credentials are encrypted to protect against unauthorized access.

- Regular Updates: The system is regularly updated to safeguard against new threats.

- Transaction Limits: You can set transaction limits to minimize risk in case of unauthorized access.

What Should I Do If My Account Is Locked?

If your account gets locked due to multiple incorrect login attempts, don’t panic. Here’s how to unlock it:

- Use the ‘Unlock Account’ Option: This can be found on the login page.

- Enter Your Details: Provide your username, account number, and registered mobile number.

- Verify with OTP: Enter the OTP sent to your registered mobile number.

- Unlock Account: Follow the instructions to unlock your account and regain access.

Can I Access SBI Net Banking on My Mobile?

Absolutely! SBI Net Banking is accessible via mobile through the SBI YONO app. Here’s how to get start:

- Download the SBI YONO App: Available on both the App Store and Google Play Store.

- Log In with Your Credentials: Use your existing SBI Net Banking username and password.

- Explore Mobile Banking: Access all the features of SBI Net Banking right from your mobile device.

How Do I Add a Beneficiary?

Adding a beneficiary is necessary for transferring funds. Here’s how you can do it:

- Log In to Your Account: Enter your credentials on the SBI Net Banking portal.

- Navigate to ‘Profile’: Select ‘Manage Beneficiary’ under the profile section.

- Add Beneficiary Details: Enter the account details of the beneficiary.

- Confirm with OTP: Verify the addition with an OTP sent to your registered mobile number.

- Wait for Approval: Beneficiary addition might take a few hours for approval.

What Are the Charges for Using SBI Net Banking?

The good news is that SBI Net Banking is free of charge for most services. However, certain transactions like NEFT, RTGS, and IMPS may have nominal fees. Here’s a quick overview:

- NEFT Transactions: Nominal charges apply based on the transaction amount.

- RTGS Transactions: Charges are based on the amount being transferred.

- IMPS Transactions: Minimal charges for instant money transfers.

How Can I Contact Customer Support?

If you need help with SBI Net Banking, customer support is just a call away. Here’s how you can reach them:

- Call the Helpline: The SBI customer care number is available 24/7 for assistance.

- Email Support: You can also email your queries to the official SBI support email.

- Visit a Branch: For more complex issues, visiting your nearest SBI branch might be the best option.