PAN or TAN Application Status Check at tax information network of income tax department portal online..

Permanent Account Number (PAN) or Tax Deduction Account Number (TAN) application submitted to Income Tax Department, after all verification PAN OR TAN card generated. After generating card sends your address. usually what your card means track status of their application by selecting the application type, acknowledgement number, name and date of birth of the applicant.

Visit official website : https://tin.tin.nsdl.com/pantan/StatusTrack.html

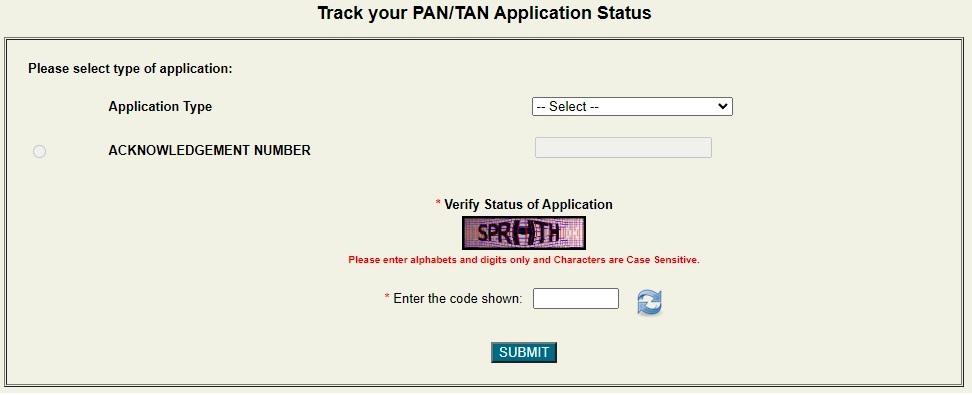

Know your PAN or TAN Application Status:

Enter Application Type.

Acknowledgement number

Name and

Date of birth

click on Submit and check your status details.

Reprint of PAN card :

This application should be used when PAN has already been allotted to the applicant but applicant requires a PAN card..

Changes or Correction in PAN details :

application should be used when PAN has already been allotted to the applicant, but when data associated with the PAN (e.g. name of applicant / father’s name / date of birth / address) is required to be updated in records of ITD. A new PAN card bearing the same PAN but updated information is issued to applicant.

Download e-PAN card:

Visit tax information network of income tax department portal :

https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html

where you seen 2 options

1. Acknowledgement Number

2. PAN

Suppose you Select “PAN”.

enter PAN and Aadhaar number .

select DAte of birth and birth year.

click on agree terms and enter captcha code.

and get your details and download PAN.

Note :

1. This facility is available for PAN holders whose latest application was processed through Protean.

2. For the PAN applications submitted to Protean where PAN is allotted or changes are confirmed by ITD within last 30 days, e-PAN card can be downloaded free of cost three times.

3.If the PAN is allotted / changes in PAN Data are confirmed by ITD prior to 30 days then charges applicable for download of e-PAN Card is Rs.8.26/- (inclusive of taxes).