Easily check your ICICI Bank Credit Card Statement with simple steps. Learn how to view it via net banking, mobile app, email, or SMS.

How to Check Your ICICI Bank Credit Card Statement:

If you’ve ever wondered how to check your ICICI Bank Credit Card Statement easily, you’re in the right place. Understanding your credit card statement can be key to managing your finances. But don’t worry, it’s super simple! Let’s break it down step-by-step in this light-hearted guide. So, grab a cup of coffee, sit back, and follow these steps to access your statement in a jiffy!

1. Log into ICICI Net Banking

The easiest way to check your ICICI Bank Credit Card Statement is through net banking. If you haven’t registered for ICICI’s net banking, don’t panic! The process is quick and straightforward. Here’s what you need to do:

- First, visit the official ICICI net banking portal.

- Use your user ID and password to sign in.

- Haven’t set up your net banking? You can register online by using your credit card details.

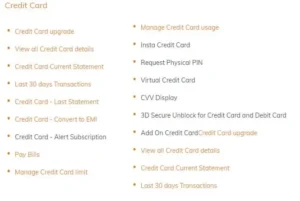

Once logged in, head straight to the ‘Credit Cards’ section. You’ll see an option that says ‘View Statement.’ This is your go-to spot to check your ICICI Bank Credit Card Statement any time you want!

2. Use the ICICI Mobile App

Who doesn’t love convenience? If you’re always on the go, the ICICI Mobile App is a lifesaver. Download the app from the Google Play Store or Apple App Store if you haven’t already. Here’s how to check your statement using the app:

- Open the app and log in using your credentials or biometrics.

- Tap on the ‘Credit Cards’ section.

- Now, select ‘Statements’ to view your recent ICICI Bank Credit Card Statement.

You can even download the PDF version directly from the app. Plus, it’s an eco-friendly way to manage your statements!

3. Receive Statements via Email

Are you someone who loves everything delivered to your inbox? If so, ICICI Bank has got your back! You can opt to receive your credit card statement directly in your email. All you have to do is register your email ID with the bank. The steps are simple:

- Log into your net banking or visit the nearest branch.

- Ensure your email ID is linked to your credit card account.

- Once linked, you’ll receive your monthly ICICI Bank Credit Card Statement directly to your inbox.

No need to rummage through papers. Just open your email and view your statement whenever you need it!

4. Check via ICICI Customer Care

Not a fan of online banking? ICICI Bank’s customer care is always available to help you out. You can simply call the ICICI Bank customer care number and ask them to provide details of your credit card statement. Here’s how:

- Dial the ICICI Bank customer care number and follow the IVR instructions.

- Select the option for credit card services.

- Request your credit card statement from the representative.

They’ll either send it to your registered email address or guide you on how to access it yourself.

5. View ICICI Bank Credit Card Statement via SMS

If you prefer a quick and hassle-free way to get your statement without logging into apps or websites, SMS is the way to go. ICICI offers an SMS banking service where you can simply send a text to receive your statement summary. Here’s how it works:

- Send an SMS with the text ‘STMTCC’ to the designated ICICI Bank SMS banking number.

- You’ll receive an instant SMS reply with a brief summary of your ICICI Bank Credit Card Statement.

It’s quick, easy, and saves you the effort of logging into any portals or apps!

6. Visit Your Nearest ICICI Branch

For those who prefer the traditional way, visiting your nearest ICICI Bank branch is also an option. You can walk into the branch and request your credit card statement at the counter. All you need is your credit card and valid identification. The staff will assist you in retrieving your ICICI Bank Credit Card Statement.

Though it might take a little more time than the digital methods, it’s a reliable option if you’re not comfortable with technology.

7. Understanding Your ICICI Bank Credit Card Statement

Now that you know how to check your ICICI Bank Credit Card Statement, let’s talk about understanding what’s in it. Here’s a breakdown of the key sections:

- Transaction Summary: This shows all your recent purchases, payments, and interest charges.

- Minimum Payment Due: The minimum amount you need to pay by the due date.

- Total Outstanding: The full amount you owe on your credit card.

- Due Date: Make sure to pay by this date to avoid late fees!

Understanding your statement ensures that you don’t miss payments, which can lead to interest charges. Plus, it helps you keep track of your spending!

8. Set Up Auto Debit for Easy Payments

One handy tip to never miss your ICICI Credit Card Statement payment is to set up auto debit. With auto debit, the bank will automatically deduct the required payment from your linked bank account on the due date. Here’s how you can enable it:

- Log into net banking and navigate to the ‘Credit Card’ section.

- Select ‘Auto Debit’ and follow the on-screen instructions to link your bank account.

This way, you’ll never miss a payment, and you’ll avoid those pesky late fees!

9. Common FAQs About ICICI Bank Credit Card Statements

Let’s address a few common questions you might have:

Q1: Can I access past ICICI Bank Credit Card Statements?

Yes, you can view your past 12 months’ statements via net banking or the mobile app.

Q2: Can I dispute a transaction on my statement?

Absolutely! If you notice any unauthorized or incorrect charges, you can raise a dispute through customer care or net banking.

Q3: Are there any charges for viewing my credit card statement?

No, viewing your ICICI Credit Card Statement online or through the app is completely free.

Final Thoughts: Stay on Top of Your ICICI Credit Card Statement!

There you have it—a comprehensive guide on how to check your ICICI Credit Card Statement, explained point-wise. Whether you prefer net banking, the mobile app, email, or even a visit to the branch, ICICI has multiple ways to make your life easier. Staying on top of your statement will help you manage your finances smartly, avoid late fees, and keep track of your spending like a pro. So, what are you waiting for? Go check that statement today!