Access your pension details easily with SBI Pensioners login. Learn how to download slips, check transactions, Form 16, and life certificate status.

SBI Pensioners Login and Portal: A Comprehensive Guide

As a pensioner, managing your pension details can sometimes feel overwhelming. But don’t worry! The State Bank of India (SBI) has made it easier with its user-friendly SBI Pensioners login portal. The SBI Pension Seva is a one-stop destination for all your pension-related needs. In this post, we’ll guide you step-by-step on how to use the portal to download your pension slip, check Form 16, view pension transactions, track investment details, and monitor life certificate status.

How to Access SBI Pensioners Login Portal

Getting started on the SBI Pensioners login portal is simple:

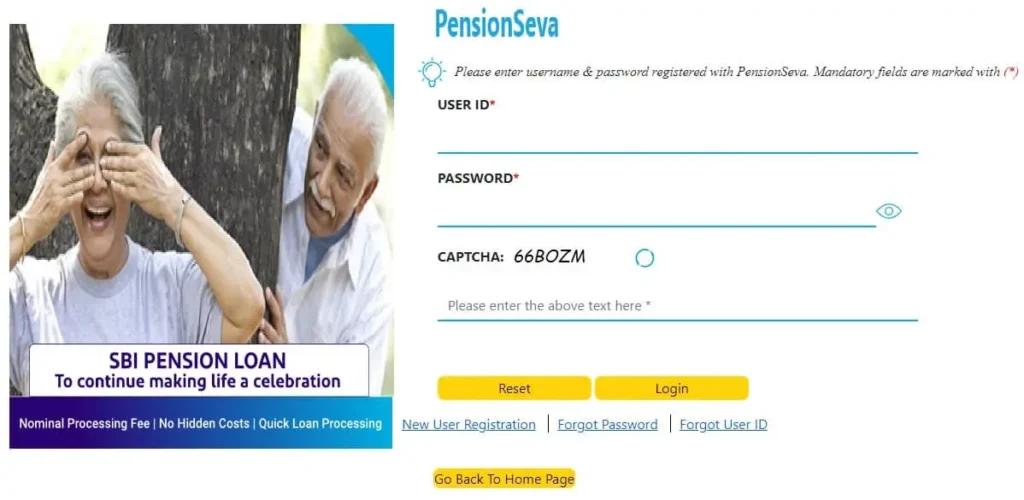

- Visit the Website: Head over to SBI Pension Seva and click on the “Login” button.

- Enter Your Credentials: Use your User ID and Password to log in. If you’re using the portal for the first time, just choose “New User Registration” to set up your account.

- Complete Authentication: You may be asked to enter a One-Time Password (OTP) sent to your registered mobile number.

- Access Dashboard: Once logged in, you’ll have access to various pension-related services.

With these simple steps, you can easily log in to the SBI Pensioners portal. Now, let’s explore the various features available on this platform.

How to Download Pension Slip and Form 16

Need a copy of your pension slip or Form 16? Here’s how you can download them effortlessly:

- Login to Your Account: Use your credentials to log in to the SBI Pensioners portal.

- Navigate to Pension Slip Section: Click on the “Pension Slip” tab from the menu.

- Select Date Range: Choose the month and year for which you need the slip.

- Download Slip: Select “Download” to obtain a PDF version of your pension slip.

For Form 16, the process is similar:

- Go to Form 16 Section: Click on the “Form 16” option in the menu.

- Select Financial Year: Choose the year for which you need the document.

- Download Form: Click “Download” to get your Form 16 in PDF format.

That’s it! You’ve successfully downloaded your pension slip and Form 16. Keep them handy for your records and future reference.

Pension Transactions Details: Track Your Payments Easily

Keeping track of your pension transactions is crucial. The SBI Pensioners login portal provides an easy way to view your payment history. Here’s how:

- Login and Access Transactions Section: Once logged in, go to the “Transaction Details” tab.

- Choose Date Range: Select the date range you want to review.

- View and Download: You can view the list of transactions, and even download a statement for your records.

This feature is particularly helpful for checking if your pension has been credited on time or for tracking any other payments.

Investment Related Details: Keep an Eye on Your Financials

The SBI Pensioners portal doesn’t just stop at pension details; it also helps you manage your investments. Here’s what you need to do:

- Go to Investment Section: Click on the “Investment Details” tab.

- View Information: Here, you can see a summary of your investments linked to your pension account.

- Download Statements: If you need a detailed report, click on “Download” to get a PDF.

Having all your financial information in one place makes it easier to manage your finances and plan your future better.

Life Certificate Status: Keep Your Account Active

Submitting a life certificate is essential to ensure your pension continues without interruptions. Here’s how to check its status:

- Log in to the Portal: Use your credentials to access the SBI Pensioners login portal.

- Click on Life Certificate Status: You’ll find this option under the “Certificate” tab.

- View Status: Check if your life certificate has been submitted and validated.

Remember to submit your life certificate on time each year to avoid any delays in your pension payments.

Benefits of Using SBI Pensioners Login Portal

Why should you use the SBI Pensioners portal? Here’s why this portal is an essential tool you shouldn’t miss out on :

- Easy Access: All your pension-related information is available in one place.

- Convenience: Download slips, Form 16, and transaction details with just a few clicks.

- Real-Time Updates: Get real-time updates on your pension transactions and life certificate status.

- Investment Tracking: Keep track of your investments without visiting the bank.

- User-Friendly: The portal is designed to be user-friendly, even for those who aren’t tech-savvy.

This portal saves you time and effort, allowing you to focus on enjoying your retirement!

Step-by-Step Guide to Register on the SBI Pension Seva Portal

If you haven’t registered on the SBI Pension Seva portal yet, don’t worry! Here’s a quick guide:

- Visit the Portal: Go to the SBI Pension Seva website.

- Select Registration: Locate and click the “New User Registration” option.

- Enter Details: Fill in your pension account number, date of birth, and other required details.

- Set Password: Create a strong password and complete the registration process.

- Verify Your Account: You may need to verify your account using an OTP sent to your registered mobile number.

After successful registration, you can log in anytime to access your pension details.

Tips for Using SBI Pensioners Login Portal Efficiently

To make the most out of the SBI Pensioners login portal, keep these tips in mind:

- Keep Login Details Secure: Don’t share your User ID and Password with anyone.

- Update Contact Information: Make sure your mobile number and email are updated for receiving alerts.

- Use Strong Passwords: Ensure your password is a mix of letters, numbers, and symbols.

- Check Regularly: Log in at least once a month to check for any updates or issues.

By following these tips, you can use the SBI Pensioners portal safely and efficiently.

Frequently Asked Questions (FAQs)

1. What is the SBI Pensioners login portal?

The SBI Pensioners login portal is an online platform where pensioners can access their pension-related information, including downloading pension slips, Form 16, and checking transaction details.

2. How do I register on the SBI Pensioners portal?

Visit the SBI Pension Seva website, click on “New User Registration,” and follow the steps to create your account.

3. How can I download my pension slip?

Log in to the portal, go to the “Pension Slip” section, select the desired month and year, and click “Download” to get a PDF copy.

4. Can I view my pension transactions on the portal?

Yes, you can view your pension transactions by logging in and selecting the “Transaction Details” tab. You can also download a statement for your records.

5. How do I check the status of my life certificate?

Log in to the SBI Pensioners portal, go to the “Certificate” tab, and click on “Life Certificate Status” to view its current status.

6. What should I do if I forget my SBI login credentials?

Click on the “Forgot Password” option on the login page and follow the instructions to reset your password using your registered email or mobile number.

7. Is it safe to use the SBI Pensioners portal?

Yes, the portal is secured with encryption and other safety measures to protect your personal and financial information.

8. Can I update my personal details on the portal?

Yes, after logging in, go to the “Profile” section to update your contact information or other personal details.

9. How often should I submit my life certificate?

Pensioners are required to submit their life certificate once a year, usually in the month of November, to ensure continuous pension payments.

10. Who can I contact for help with the SBI Pensioners login portal?

For assistance, you can contact the SBI Pension Seva customer support or visit your nearest SBI branch for guidance.

Conclusion

The SBI Pensioners login portal is a fantastic tool that simplifies managing your pension details. From downloading pension slips and Form 16 to tracking transactions and investment details, everything is just a few clicks away. Don’t forget to check your life certificate status to ensure uninterrupted pension payments. The SBI Pension Seva is designed to make your life easier, so take full advantage of its features. Happy retirement!