Learn how to easily manage Telangana Commercial taxes online with step-by-step guidance on eRegistration, eReturns, and secure payments at tgct.gov.in.

Telangana Commercial Taxes Payment: Everything You Need to Know

Dealing with taxes may sound complex, but the Telangana Commercial Taxes department has made it easier than ever. With eRegistration and eReturns available online, you can complete your commercial tax obligations from the comfort of your home. Let’s break it down step by step so you can confidently manage your Telangana Commercial taxes!

Step 1: eRegistration – Get Your Business Registered Online

The first step for any business is to register for Telangana Commercial taxes. You can do this easily through the official website tgct.gov.in.

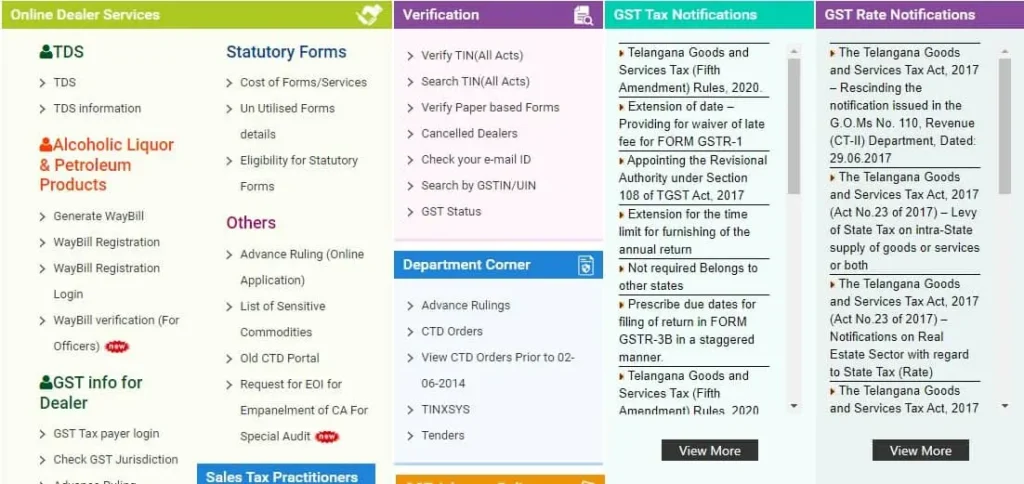

- Visit the official website: Head over to the Telangana Commercial Taxes website, and you’ll see an easy-to-navigate interface.

- Select the eRegistration option: Look for the ‘eRegistration’ tab on the homepage. It’s your gateway to getting started.

- Fill in your details: You’ll need to enter your business information, including GST number, business address, and contact details. Ensure the details are correct to avoid delays.

- Submit required documents: Upload the necessary documents, such as proof of identity and business registration. These documents ensure your business is legitimate.

- Verification: Once your details are submitted, they will be verified by the department. You’ll receive updates via SMS or email.

- Confirmation: After verification, you’ll receive your unique registration number. Congratulations! Your business is now officially registered.

Step 2: eReturns – Filing Your Commercial Tax Returns Online

After getting your business registered, the next step is to file your commercial tax returns. The good news is, the process is fully online and hassle-free. Here’s how you can do it:

- Login to your account: Once registered, log in to your account using your credentials on the Telangana Commercial Taxes portal.

- Select ‘eReturns’: After logging in, navigate to the ‘eReturns’ section. This is where you’ll file your monthly, quarterly, or annual returns.

- Enter transaction details: You’ll need to input the details of your sales, purchases, and other transactions. Don’t worry, the portal is designed to make it as simple as possible.

- Upload invoices: If required, upload relevant invoices for the transactions you’re reporting. This step is crucial for accurate tax calculations.

- Calculate your tax liability: The system will help calculate your tax liability based on the information you provide. If you’re unsure, the portal has guides to assist you.

- Submit and pay: Once everything looks good, submit your return. You can pay your taxes online through a secure payment gateway. That’s it—you’ve filed your taxes without breaking a sweat!

Why Opt for Online Telangana Commercial Taxes?

You might be wondering why you should bother with eRegistration and eReturns. Here are some solid reasons to embrace the digital way:

- Convenience: You can manage everything from registration to returns without visiting a physical office. Save time and effort.

- Accuracy: The online portal helps you avoid errors by guiding you through the process. This way, you can file accurate returns every time.

- Speed: The entire process is fast. Forget about long queues or paperwork—it’s all online and instant.

- Transparency: All your transactions and submissions are available online, making it easy to track your history and stay compliant.

- 24/7 Access: The online portal is available 24/7, allowing you to work on your taxes at your convenience.

Step 3: Online Payments – Making Tax Payments Securely

Paying your Telangana Commercial taxes is easy and secure. Here’s how you can make your payments directly through the portal:

- Navigate to the payment section: After filing your return, you’ll be prompted to make your tax payment.

- Choose your payment method: The portal supports multiple payment options including credit cards, debit cards, net banking, and UPI. Choose what works best for you.

- Confirm payment: Double-check the amount before confirming your payment. Once done, you’ll receive a confirmation receipt.

- Download the receipt: Don’t forget to download the receipt for your records. This serves as proof of payment and is useful for future reference.

How to Track Your Application and Payment Status

If you want to track the status of your registration or return, the Telangana Commercial Taxes website has you covered. Here’s how:

- Login to your account: Head to tgct.gov.in and log in with your credentials.

- Check ‘Application Status’: You’ll find an option to track the status of your registration or return under ‘Application Status.’

- Enter your reference number: Input the reference number you received after submitting your registration or return.

- View the status: The status will display instantly, keeping you inform every step of the way.

Benefits of Using the Telangana Commercial Taxes Portal

Opting for the online portal isn’t just about convenience; it comes with a host of benefits for both small and large businesses:

- Faster Processing: With everything online, your applications and returns are process much quicker.

- Less Paperwork: No need to shuffle through documents—everything is digitize, reducing clutter and saving trees!

- Cost Savings: You’ll save money on travel, courier services, and printing by going paperless.

- Immediate Updates: Receive real-time updates on your application and payment statuses.

- User-Friendly Interface: The portal is design to easy for users of all technical skill levels.

Wrapping It Up

Managing Telangana Commercial taxes doesn’t have to be a daunting task. With the user-friendly online portal at tgct.gov.in, you can handle everything from eRegistration to eReturns with ease. The digital process not only saves time but also ensures accuracy and transparency, making your tax journey stress-free. So why wait? Start using the Telangana Commercial Taxes online portal today and stay ahead of your tax game!