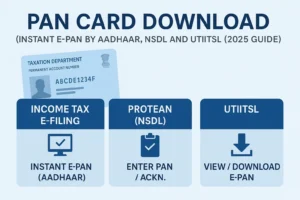

You can download your PAN card online via Instant e-PAN (Aadhaar) on the Income Tax portal or re-download e-PAN from Protean (NSDL) and UTIITSL using PAN/DOB with OTP.

PAN Card Download – Complete Guide 2025

A PAN card download is one of the most searched services in India today. Whether you have just applied for a new Permanent Account Number (PAN), lost your card, or want a soft copy for quick verification, the government provides multiple official portals for e-PAN download. This article explains every method—Income Tax e-Filing, Protean (formerly NSDL), and UTIITSL—along with instant PAN download options using Aadhaar, troubleshooting tips, password details, and FAQs.

PAN Card Download Options at a Glance

Here’s a quick comparison of the three official channels where you can download your PAN :

| Portal | Service Type | Eligibility | Cost | Requirements | Delivery |

|---|---|---|---|---|---|

| Income Tax e-Filing | Instant e-PAN, e-PAN view/download | Aadhaar-linked individuals | Free | Aadhaar + OTP | Immediate |

| Protean (NSDL) | e-PAN download for new/change requests | Applicants through NSDL | Free (first 3 times within 30 days) | PAN/Acknowledgement + DOB | PDF via email |

| UTIITSL | e-PAN download for UTIITSL-issued PAN | Applicants via UTI | Nominal fee if beyond free limits | PAN + DOB/incorporation | PDF download |

How to Download PAN Card (e-PAN) from Income Tax e-Filing Portal

The Income Tax e-Filing portal provides the most convenient way to download your e-PAN. Follow these steps:

- Visit Income Tax e-Filing Portal.

- Go to Quick Links → Instant e-PAN / Check Status.

- Enter your Aadhaar number and verify OTP sent to your registered mobile.

- If PAN is already allotted, you can View and Download e-PAN instantly.

- Save the PDF file for future use.

This service works best for individuals whose Aadhaar is already linked to PAN.

Instant e-PAN Download by Aadhaar (No PAN in Hand)

If you don’t know your PAN but have Aadhaar, the Instant e-PAN feature helps you:

- Use Aadhaar OTP to generate a new PAN instantly.

- Once allotted, you can download the e-PAN card PDF immediately.

- This service is free and available only to Indian residents (individuals, not companies).

Password to Open e-PAN PDF

Downloaded PAN cards are protected with a password. The format is:

- Date of Birth (DDMMYYYY) for individuals.

- Date of Incorporation/Formation for firms, companies, or trusts.

Example: If your DOB is 15th August 1995 → Password = 15081995.

PAN Card Download via Protean (NSDL)

If you applied through NSDL (now Protean), you can re-download your e-PAN:

- Visit the Protean e-PAN Download Page.

- Enter your PAN or Acknowledgement Number.

- Enter Date of Birth/Date of Incorporation.

- Authenticate via OTP (mobile/email registered with PAN).

- Download your e-PAN PDF.

Important Note: For PANs allotted/changed in the last 30 days, e-PAN can be sent free to the registered email up to three times.

PAN Card Download via UTIITSL

Applicants who submitted PAN applications through UTIITSL can download their e-PAN as follows:

- Visit UTIITSL e-PAN Download Page.

- Enter PAN, Date of Birth/Date of Incorporation, and Captcha.

- Authenticate via OTP sent to registered mobile/email.

- Download your PAN in PDF format.

UTIITSL also allows reprinting physical PAN cards (with a nominal fee).

When to Use Which PAN Card Download Method

- Need a brand new instant PAN → Use Instant e-PAN on Income Tax e-Filing.

- Applied through NSDL/Protean → Download from Protean portal.

- Applied through UTIITSL → Download from UTIITSL portal.

- Don’t know your PAN but Aadhaar is linked → Use Instant e-PAN with Aadhaar.

Troubleshooting PAN Card Download Issues

Sometimes, users face issues while downloading PAN cards. Common problems include:

- Aadhaar not linked → Link Aadhaar to PAN before using e-PAN services.

- OTP not received → Ensure your mobile/email is updated in PAN records. Retry after a few minutes.

- OTP expired → Valid only for 15 minutes; request a new one.

- PDF not opening → Check DOB format (DDMMYYYY). Remove separators.

- Portal downtime → Wait and try during non-peak hours.

⚠️ Warning: Be cautious of fake emails claiming to provide “PAN 2.0” or free downloads. Always use official portals.

Charges, Limits, and Validity of e-PAN Download

- Income Tax e-Filing e-PAN → Free.

- Protean (NSDL) → Free email delivery up to 3 times within 30 days. Beyond that, fees may apply.

- UTIITSL → Usually free within first few downloads; nominal fee if re-issued.

- Validity → e-PAN is legally equivalent to a physical PAN card and accepted everywhere.

Security & Privacy Tips for PAN Card Download

- Download only from official websites.

- Never share your OTP with anyone.

- Avoid using cybercafes or public Wi-Fi for PAN downloads.

- Do not respond to suspicious emails offering “free PAN downloads.”

- Always verify the site URL (ending with

.gov.inor official domains).

Quick How-Tos for PAN Card Download

- Download PAN card by Aadhaar only: Use Instant e-PAN service at e-Filing portal.

- Download PANcard without acknowledgement number: Enter PAN + DOB on Protean/UTIITSL portals.

- Find e-PAN PDF password: It is your DOB in DDMMYYYY.

- Re-download later: Use the same channel you originally applied with; respect free download limits.

FAQs on PAN Card Download

You can use the Instant e-PAN facility at the Income Tax e-Filing portal with Aadhaar OTP.

Yes. Enter your PAN + DOB on UTIITSL or Protean to authenticate and download.

It is your Date of Birth in DDMMYYYY format.

Yes. The e-PAN PDF is equally valid for KYC and tax purposes.

Free up to three times within 30 days of PAN allotment/changes.

It could be under scheduled maintenance. Try again later.

No. This is a phishing scam. Only use official portals.