Easily check your Bank of India account balance via toll-free number, WhatsApp, missed call, SMS, net banking, mobile app, and UPI.

What is Bank of India (BOI)?

The Bank of India (BOI) is one of the oldest and most reputable banks in India. Established in 1906, BOI has grown to become a significant player in the Indian banking industry, offering a wide range of financial services to individuals, businesses, and corporations. With a vast network of branches and ATMs across the country, BOI is committed to providing convenient and efficient banking solutions to its customers.

How Many Ways Can You Check Your Bank of India Account Balance?

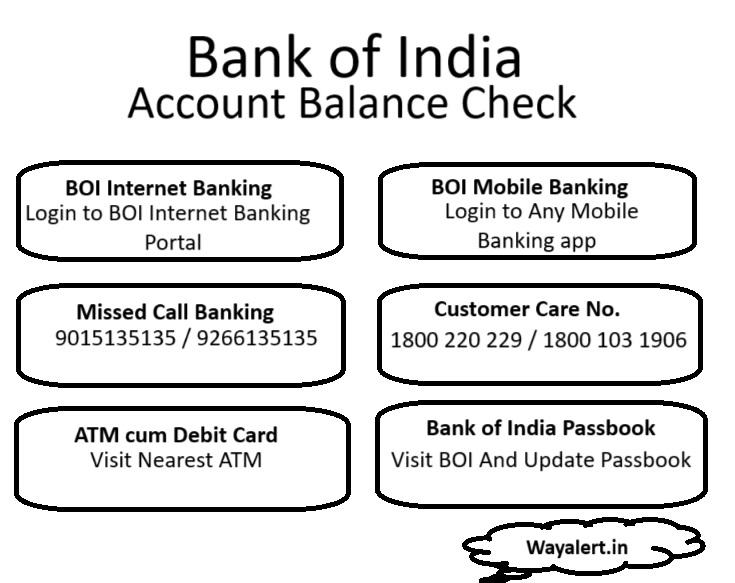

There are several convenient methods to check your Bank of India account balance. Here’s a comprehensive list:

Bank of India Account Balance via Toll-Free Number :

Are you tired of waiting in long queues to check your Bank of India account balance? Well, you’re in luck! The Bank of India offers a convenient and hassle-free way to check your account balance through a toll-free number. It’s quick, easy, and you can do it from the comfort of your home. Let’s dive into how you can make the most of this service.

The Convenience of a Toll-Free Number

Gone are the days when you had to visit the bank or ATM to check your balance. Now, with the Bank of India Account Balance toll-free number, you can get your balance information instantly. Just dial the toll-free number

1800 220 229 (Tollfree)

1800 103 1906 (Tollfree)

, follow the instructions, and your balance will be sent to you via SMS. It’s that simple!

Steps to Check Your Account Balance

First, make sure your mobile number is registered with the Bank of India. This is crucial because the balance information will be sent to this number. Once that’s sorted, dial the Bank of India Account Balance toll-free number. You’ll be prompted to enter your account number or follow a few simple voice instructions. Within moments, you’ll receive an SMS with your account balance. It’s a quick and efficient process designed to save you time and effort.

Why Use the Toll-Free Number?

Using the toll-free number to check your Bank of India account balance is not only convenient but also free of charge. You don’t have to worry about data charges or visiting the bank. This service is available 24/7, so you can check your balance anytime, anywhere. Whether you’re at home, at work, or even traveling, you can always stay updated on your account balance.

Check Your Bank of India Account Balance with Missed Call Banking

Did you know you can check your Bank of India account balance with a simple missed call? Yes, it’s that easy! Forget about standing in long queues or navigating complicated phone menus. With missed call banking, you can get your balance information in seconds. Here’s a step-by-step guide to make it even easier for you.

What is Missed Call Banking?

Missed call banking is a free service provided by the Bank of India. It allows you to check your account balance by giving a missed call from your registered mobile number. No need for internet or data charges. It’s quick, efficient, and can be done anytime, anywhere.

Step-by-Step Guide to Check Your Balance

1. Register Your Mobile Number: First, ensure your mobile number is registered with the Bank of India. This is essential for using missed call banking services.

2. Save the Missed Call Number: Save the Bank of India Account Balance missed call number in your contacts for easy access. The number is usually displayed on the bank’s website or your account documents.

9015135135

9266135135.

3. Give a Missed Call: From your registered mobile number, give a missed call to the provided number. You don’t need to wait for the call to connect; just dial and hang up after one ring.

4. Receive an SMS: Within a few seconds, you’ll receive an SMS with your account balance details. It’s that simple and convenient!

Checking Your Bank of India Account Balance via SMS:

Are you looking for an easy way to check your Bank of India account balance? Look no further! With the Bank of India’s SMS banking service, you can get your balance details in seconds. It’s simple, quick, and convenient. Let’s walk you through the step-by-step process to ensure you always stay on top of your finances.

What is SMS Banking?

SMS banking is a handy service provided by the Bank of India that allows you to access your account information through text messages. This service is perfect for those times when you don’t have internet access but need to check your account balance quickly. All you need is your registered mobile number and you’re good to go!

Step-by-Step Guide to Check Your Balance via SMS

1. Register Your Mobile Number: Make sure your mobile number is registered with the Bank of India. This step is crucial because the bank will send the balance details to this number.

2. Know the SMS Format: Familiarize yourself with the SMS format required to check your balance. Typically, you’ll need to send a specific keyword to a designated number. For example, type “BAL <space> <4-digit Password>” and send it to +919810558585.

3. Send the SMS: Using your registered mobile number, send the SMS with the correct format to the bank’s number. Double-check the details to avoid any errors.

4. Receive Your Balance Information: Within moments, you’ll receive an SMS from the Bank of India with your account balance. It’s that easy!

How to Check Your Bank of India Account Balance via Net Banking:

Are you looking to check your Bank of India account balance without leaving your home? Net banking is your answer! It’s a super convenient way to manage your finances, giving you access to your account balance and much more with just a few clicks. Here’s a simple, step-by-step guide to help you navigate through the Bank of India’s net banking system.

Getting Started with Net Banking

First things first, you need to be registered for the Bank of India’s net banking service. If you’re not registered yet, you can do so by visiting your nearest branch or using the online registration option on the Bank of India website. Once registered, you’ll receive your User ID and password. Keep these details secure and ready for the next steps.

Step-by-Step Guide to Check Your Balance

1. Visit the Bank of India Website: Open your preferred web browser and go to the official Bank of India website. Look for the ‘Net Banking’ option, usually found on the homepage.

2. Login to Your Account: Click on the ‘Retail Login’ button if you are an individual user. Enter your User ID and password in the login fields and hit ‘Submit’. For added security, you might be asked to enter a CAPTCHA code or an OTP sent to your registered mobile number.

3. Navigate to Account Information: Once you’re logged in, you’ll be taken to the dashboard. Here, you’ll see various options related to your account. Look for the ‘Account Summary’ or ‘Account Information’ tab.

4. Check Your Account Balance: Click on the ‘Account Summary’ tab, and voila! You’ll see your Bank of India account balance displayed on the screen. You can also view recent transactions and other account details from this page.

Download and Install the Mobile Banking App: Check BOI Bank Balance

First things first, you need to have the Bank of India’s mobile banking app installed on your smartphone. Head over to the Google Play Store or the Apple App Store, search for “Bank of India BOI Mobile Banking,” and download the app. It’s free and won’t take up much space on your device.

Register and Set Up Your Account

1. Open the App: Once the app is installed, open it and select the ‘New User Registration’ option if you haven’t registered yet.

2. Enter Your Details: You’ll be asked to enter your account number, registered mobile number, and other required details.

3. Set Your Credentials: After entering your details, set up a User ID and password. Make sure to choose a strong password for security.

4. Verification: You might receive an OTP (One-Time Password) on your registered mobile number for verification. Enter this OTP to complete the registration process.

Step-by-Step Guide to Check Your Balance

1. Login to the App: Open the app and log in using your User ID and password.

2. Navigate to Account Information: Once logged in, you’ll be greeted with the dashboard. Look for the ‘Account Information’ or ‘Balance Inquiry’ option.

3. View Your Account Balance: Tap on ‘Balance Inquiry‘ and your account balance will be displayed on the screen. You can also view detailed transaction history if needed.

Benefits of Using the Mobile Banking App

Using the Bank of India’s mobile banking app comes with a host of benefits. It’s incredibly convenient, allowing you to check your balance anytime, anywhere. You can also perform various banking tasks like transferring funds, paying bills, and recharging your mobile. The app is user-friendly and designed to make banking a seamless experience for you.

Stay Secure with Mobile Banking

Security is paramount when using mobile banking. Enable biometric authentication if your phone supports it for added security. Be cautious of phishing attempts and never share your login details with anyone. Regularly check your account for any unauthorized transactions.

How to Check Your Bank of India Account Balance: Passbook, ATM, and UPI

Keeping track of your Bank of India account balance is essential, and there are several convenient methods to do so. Whether you prefer traditional methods like using a passbook and ATM or modern solutions like UPI, we’ve got you covered. Here’s a step-by-step guide for each method to ensure you always know your balance.

Checking Your Account Balance Using a Passbook

The passbook is a traditional yet reliable way to check your Bank of India account balance. Here’s how you can use it:

1. Visit Your Bank Branch: Take your passbook to the nearest Bank of India branch.

2. Update Your Passbook: Hand your passbook to the bank teller or use the self-service passbook printing kiosk. The teller or machine will update it with all recent transactions.

3. Check the Balance: Once updated, your passbook will show the latest transactions and your current account balance.

Using a passbook is straightforward, and it also provides a physical record of your transactions, which is handy for keeping track of your finances.

Checking Your Account Balance at an ATM

ATMs are convenient for checking your Bank of India account balance anytime. Here’s how you can do it:

1. Visit an ATM: Go to any Bank of India ATM or an ATM that supports your Bank of India card.

2. Insert Your Card: Insert your Bank of India ATM card into the machine.

3. Enter Your PIN: Enter your Personal Identification Number (PIN) when prompted.

4. Select Balance Inquiry: Choose the ‘Balance Inquiry’ option from the menu.

5. View Your Balance: Your account balance will be displayed on the screen. You can also opt to print a receipt.

Using an ATM is quick and can be done at any time, making it a convenient option for checking your account balance.

Checking Your Account Balance Using UPI

Unified Payments Interface (UPI) is a modern and highly convenient way to check your Bank of India account balance. Here’s how to do it:

1. Download a UPI App: Ensure you have a UPI-enabled app like BHIM, Google Pay, or PhonePe installed on your smartphone.

2. Link Your Account: Link your Bank of India account to the UPI app using your registered mobile number.

3. Open the App: Log in to the UPI app.

4. Select Balance Inquiry: Look for the ‘Check Account Balance’ or similar option in the app.

5. Enter Your UPI PIN: Enter your UPI PIN to authenticate.

6. View Your Balance: Your account balance will be displayed on the screen.

UPI is incredibly convenient, allowing you to check your balance from anywhere with your smartphone. It’s quick and secure, making it a popular choice.

Check Your Bank of India Account Balance via WhatsApp Banking:

In today’s digital age, checking your Bank of India account balance has never been easier. With WhatsApp Banking, you can access your account details with just a few taps on your smartphone. Here’s a step-by-step guide to help you navigate this convenient service and stay on top of your finances.

What is WhatsApp Banking?

WhatsApp Banking is a user-friendly service provided by the Bank of India, allowing customers to perform banking tasks through WhatsApp. It’s as simple as chatting with a friend! This service is available 24/7, making it incredibly convenient for busy individuals.

Step-by-Step Guide to Check Your Balance via WhatsApp Banking:

1. Register Your Mobile Number: Ensure that your mobile number is registered with the Bank of India. This is essential for using WhatsApp Banking services.

2. Save the Bank’s WhatsApp Number: Save the Bank of India’s official WhatsApp Banking number in your contacts. You can find this number on the bank’s website or by inquiring at your local branch : +91-8376006006

3. Send a Message: Open WhatsApp and send a “Hi” message to the Bank of India’s WhatsApp number.

4. Follow the Instructions: You will receive a menu with various options. Reply with the number corresponding to the ‘Account Balance’ option.

5. Enter Your Details: You might be prompted to enter your account number or other verification details. Follow the instructions carefully.

6. Receive Your Balance: Within moments, you’ll receive a message with your Bank of India account balance. It’s that easy!

Benefits of Using WhatsApp Banking

WhatsApp Banking offers numerous benefits. It’s incredibly convenient since you’re likely already using WhatsApp for daily communication. There’s no need to download another app or remember additional passwords. The service is available 24/7, so you can check your balance anytime, anywhere. Plus, it’s secure, as all communications are encrypted end-to-end.

Staying Secure with WhatsApp Banking

Security is paramount when it comes to banking. Ensure you’re communicating with the verified Bank of India WhatsApp number to avoid phishing scams. Never share sensitive information like your PIN or passwords over WhatsApp. The bank will never ask for such details through this channel.

Your Go-To Guide for Bank of India Account Balance FAQs

If you’ve ever found yourself scratching your head while trying to figure out how to check your Bank of India account balance, you’re not alone. From traditional methods to modern technology, there are several ways to keep track of your account balance. Here, we answer some frequently asked questions (FAQs) to help you stay on top of your finances effortlessly.

Q. How Can I Check My Bank of India Account Balance?

There are multiple ways to check your Bank of India account balance. You can use the bank’s mobile banking app, net banking, WhatsApp banking, missed call banking, SMS banking, or visit an ATM. Each method is designed to be user-friendly and accessible, so you can choose the one that best suits your needs.

Q. What Do I Need to Register for Net Banking?

To register for net banking, you need to visit your nearest Bank of India branch or use the online registration option. You’ll need your account number, registered mobile number, and other personal details. After registration, you’ll receive a User ID and password to access your account online.

Q. How Do I Use WhatsApp Banking to Check My Balance?

First, save the Bank of India’s official WhatsApp Banking number in your contacts. Open WhatsApp and send a “Hi” message to the number. You will receive a menu of options; reply with the number for ‘Account Balance’. Follow the prompts, and you’ll receive your balance details in a message.

Q. Is There a Charge for Checking My Balance?

Most methods to check your balance are free of charge. Using the bank’s mobile app, net banking, missed call banking, SMS banking, and WhatsApp banking are all free services provided by the Bank of India. However, ensure you check with the bank for any potential charges related to SMS or mobile data usage.

Q. How Often Should I Check My Account Balance?

It’s a good idea to check your account balance regularly to stay updated on your finances. Checking your balance once a week is a good practice, or more frequently if you have multiple transactions. This helps you monitor your spending and quickly detect any unauthorized transactions.

Q. Can I Check My Balance Without Internet Access?

Yes, you can! Missed call banking and SMS banking are perfect for checking your balance without internet access. For missed call banking, dial the designated toll-free number from your registered mobile number and hang up after one ring. For SMS banking, send a specific keyword to the bank’s SMS number. You’ll receive your balance information via SMS.

Q. What Should I Do If I Forget My Net Banking Password?

If you forget your net banking password, you can reset it easily. On the login page, click on the ‘Forgot Password’ link. Follow the prompts to reset your password using your registered mobile number and email. If you encounter any issues, contact the Bank of India’s customer service for assistance.

Q. Is Mobile Banking Secure?

Yes, mobile banking is secure if you follow basic safety precautions. Always use the official Bank of India mobile app and avoid using public Wi-Fi to access your account. Enable biometric authentication if your phone supports it for added security. Regularly update your app to the latest version for improved security features.

Q. How Do I Use the Mobile Banking App?

First, download the Bank of India mobile banking app from the Google Play Store or Apple App Store. Register your account using your account number and registered mobile number. Once registered, log in with your User ID and password. Navigate to ‘Account Information’ or ‘Balance Inquiry’ to check your balance.

Q. What Are the Benefits of Using UPI?

Unified Payments Interface (UPI) is a modern and convenient way to manage your finances. With UPI, you can check your balance, transfer funds, and pay bills instantly. It’s available 24/7 and can be accessed from your smartphone. UPI is also secure, as it uses a two-factor authentication process.

Q. How Can I Keep My Account Secure?

To keep your Bank of India account secure, never share your PIN, password, or any sensitive information with anyone. Always log out of your net banking or mobile banking app after each session. Regularly update your passwords and use strong, unique passwords for different accounts. Be cautious of phishing emails or messages asking for your banking details.

Q. What Should I Do If I Notice Unauthorized Transactions?

If you notice any unauthorized transactions in your account, contact the Bank of India immediately. You can reach out to customer service via phone, email, or visit your nearest branch. Promptly reporting unauthorized transactions helps the bank take necessary actions to protect your account.

Conclusion

Staying informed about your Bank of India account balance is crucial for managing your finances effectively. With various methods available, including mobile banking, net banking, WhatsApp banking, and more, you can choose the one that fits your lifestyle. Regularly check your balance, follow security practices, and you’ll have peace of mind knowing your finances are in good shape. Happy banking!