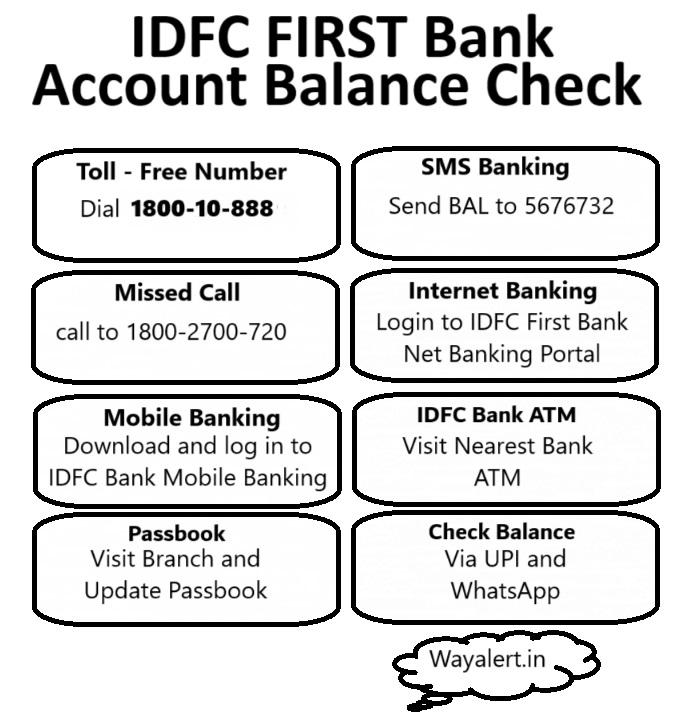

Check Your IDFC First Bank Balance with Ease: To Toll-Free, Missed Call, and SMS Banking

Do you ever find yourself wondering about your bank balance, but the thought of visiting a branch or logging into online banking feels too cumbersome? Well, IDFC First Bank has made balance enquiries incredibly simple for you. With options like toll-free numbers, missed calls, and SMS banking, checking your balance has never been easier. Let’s dive into how you can make the most of these convenient services.

Toll-Free Number Balance Enquiry

First up, let’s talk about the toll-free number. Imagine you’re on the go and need to check your bank balance urgently. With IDFC First Bank, you don’t have to worry about finding a computer or waiting in line at an ATM. All you need to do is dial their toll-free number, and you’ll get your balance details in no time.

Here’s how it works: Grab your phone and dial the toll-free number 1800-419-4332 or 1800-10-888. This service is available 24/7, so no matter when you need to check your balance, IDFC First Bank has got you covered. Once you dial the number, follow the simple voice prompts. In just a few moments, you’ll hear your account balance. It’s that easy!

The best part about using the toll-free number is that it doesn’t cost you a dime. Whether you’re in the middle of a busy workday or relaxing at home, checking your balance is just a phone call away. Plus, it’s a great option if you’re not tech-savvy or if your internet connection is acting up.

Missed Call Balance Enquiry

Now, if you thought the toll-free number was convenient, wait until you hear about the missed call service. This method is perfect for those times when you’re in a hurry and can’t spare a minute for a phone call.

To use this service, simply give a missed call to 1800-2700-720 from your registered mobile number. Within seconds, you’ll receive an SMS with your account balance details. It’s like magic!

This service is super handy because it’s quick and doesn’t require you to stay on the line. You can give the missed call, put your phone away, and get back to whatever you were doing. The SMS with your balance will be waiting for you when you’re ready to check it. It’s an effortless way to stay on top of your finances without interrupting your day.

SMS Banking for Balance Enquiry

Lastly, let’s talk about SMS banking. This is another fantastic option for checking your balance, especially if you prefer texting over calling. With SMS banking, you can get your balance details with just a few taps on your phone.

To check your balance via SMS, send a message with the text “BAL” to 5676732 or or 9289289960 from your registered mobile number. In a matter of seconds, you’ll receive an SMS with your account balance. It’s straightforward, quick, and reliable.

SMS banking is great for times when you might be in a noisy environment where making a call isn’t ideal, or if you’re in a meeting and need to be discreet. It’s also a fantastic option if you want a written record of your balance that you can refer back to later.

Why These Methods are a Game-Changer

All three methods—toll-free number, missed call, and SMS banking—offer unique benefits and cater to different preferences. Whether you’re someone who likes the reassurance of a voice prompt, the speed of a missed call, or the convenience of a quick text, IDFC First Bank has a solution for you.

To Checking Your IDFC First Bank Balance via Net Banking

In today’s digital age, online banking is a game-changer, and IDFC First Bank makes it incredibly easy for you to check your balance through net banking. Whether you’re at home, at work, or anywhere with internet access, you can quickly and securely check your account balance with just a few clicks. Let’s walk through the process step by step.

Step 1: Visit the IDFC First Bank Website

First things first, you need to visit the IDFC First Bank website. Open your favourite browser and type in the URL: www.idfcfirstbank.com. Once the page loads, you’ll see the homepage with various banking options.

Step 2: Login to Your Account

Next, look for the ‘Login’ button, usually found at the top right corner of the homepage. Click on it, and you’ll be directed to the login page. Here, you’ll need to enter your User ID and Password. If this is your first time logging in, you might need to set up your credentials. Follow the prompts, and you’ll be logged into your account in no time.

Step 3: Navigate to the Account Summary

Once you’re logged in, you’ll see your dashboard. This is where you can manage all your banking activities. To check your balance, look for the ‘Account Summary’ section. It’s typically located on the main menu or dashboard. Click on ‘Account Summary’ to proceed.

Step 4: View Your Account Balance

In the ‘Account Summary’ section, you’ll find a list of your accounts. Select the account for which you want to check the balance. Once selected, your current balance, along with recent transactions, will be displayed. It’s that simple! You can now view your balance and stay updated with your finances.

Why Net Banking is a Great Option

Net banking is an excellent option for balance enquiry because it’s fast, secure, and accessible 24/7. You don’t need to wait in lines or worry about banking hours. Plus, it’s incredibly convenient if you’re already online and want to manage your finances from the comfort of your home or office.

Tips for a Secure Net Banking Experience

While net banking is convenient, it’s essential to keep your account secure. Always use a strong, unique password and change it regularly. Make sure you’re logging in from a secure device and avoid public Wi-Fi networks. If you notice any suspicious activity, contact IDFC First Bank immediately.

Checking Your IDFC First Bank Balance via Mobile Banking App:

Managing your finances on the go has never been easier, thanks to the IDFC First Bank Mobile Banking App. Whether you’re at home, at work, or traveling, you can check your balance with just a few taps on your smartphone. Let’s dive into a simple, step-by-step guide to help you navigate the app effortlessly.

Step 1: Download the Mobile Banking App

First things first, you need to download the IDFC First Bank Mobile Banking App. If you’re using an Android device, head over to the Google Play Store. For iOS users, visit the Apple App Store. Search for “IDFC First Bank Mobile Banking App” and tap on the install button. Once the app is installed, you’re ready to get started.

Step 2: Register and Login

Open the app, and you’ll be greeted with the welcome screen. If this is your first time using the app, you’ll need to register. Tap on the ‘Register’ button and follow the prompts. You’ll need your Customer ID, mobile number, and a few other details. Once registered, log in using your User ID and password. If you’ve already registered, simply enter your login credentials.

Step 3: Navigate to the Account Summary

After logging in, you’ll land on the app’s dashboard. Here, you’ll see various options for managing your account. To check your balance, look for the ‘Account Summary’ option. It’s usually found on the main menu or as a prominent icon on the dashboard. Tap on ‘Account Summary’ to proceed.

Step 4: View Your Account Balance

In the ‘Account Summary’ section, you’ll find a list of your accounts. Select the account for which you want to check the balance. Your current balance, along with recent transactions, will be displayed. It’s quick, easy, and all the information you need is right at your fingertips.

Why Use the Mobile Banking App?

The IDFC First Bank Mobile Banking App is perfect for busy individuals who need to manage their finances on the go. It’s available 24/7, so you can check your balance anytime, anywhere. The app is user-friendly and designed to provide a seamless banking experience. Plus, it offers additional features like fund transfers, bill payments, and more.

Checking Your IDFC First Bank Balance: Passbook, ATM, and UPI :

Keeping track of your bank balance is essential, and IDFC First Bank offers multiple ways to do it. Whether you prefer traditional methods like using a passbook and ATM or the modern convenience of UPI, there’s an option for you. Here’s a step-by-step guide to checking your IDFC First Bank balance through these methods.

Step 1: Using Your Passbook

For those who appreciate the traditional approach, the passbook is a reliable option. It’s like having a mini account statement you can hold in your hand.

- Visit Your Branch: Head to your nearest IDFC First Bank branch.

- Update Your Passbook: Hand over your passbook to the bank teller and ask for an update.

- Check Your Balance: Once updated, your passbook will display your latest transactions and current balance.

Using your passbook is straightforward and gives you a physical record of your account activity. It’s perfect if you’re someone who likes to keep track of things manually.

Step 2: Checking Balance at an ATM

ATMs are another convenient way to check your balance. Here’s how you can do it:

- Find an ATM: Locate the nearest IDFC First Bank ATM or any ATM with your bank’s network.

- Insert Your Card: Insert your IDFC First Bank debit card into the machine.

- Enter Your PIN: Key in your PIN to access your account.

- Select Balance Enquiry: Choose the ‘Balance Enquiry’ option from the menu.

- View Your Balance: Your account balance will be displayed on the screen. You can also print a receipt if you prefer.

Using an ATM is quick and gives you access to your balance anytime, without needing to visit a bank branch.

Step 3: Checking Balance via UPI

UPI (Unified Payments Interface) is a modern and super convenient way to check your balance. Here’s how you can do it:

- Open Your UPI App: Open your preferred UPI app, like Google Pay, PhonePe, or the IDFC First Bank app.

- Select Your Bank Account: Go to the account section and choose your IDFC First Bank account.

- Check Balance: Look for the ‘Check Balance’ option. You might need to enter your UPI PIN.

- View Your Balance: Your balance will be displayed instantly on the app.

Using UPI is incredibly convenient, especially if you’re already using the app for other transactions. It’s fast, secure, and can be done anywhere, anytime.

Tips for Secure Banking

No matter which method you use, always keep your account information secure. Don’t share your PIN or passwords, and ensure you’re using trusted devices and networks.

Checking Your IDFC First Bank Balance via WhatsApp Banking

In today’s fast-paced world, staying updated with your bank balance needs to be as easy as chatting with friends. That’s where IDFC First Bank’s WhatsApp Banking comes in. With this service, you can check your balance and perform other banking tasks right from your WhatsApp. Let’s take a look at how you can use this super convenient feature.

Step 1: Register for WhatsApp Banking

First things first, you need to register your mobile number for IDFC First Bank’s WhatsApp Banking service. Here’s how:

- Save the Number: Save the IDFC First Bank WhatsApp Banking number (+91 95555 55555) to your contacts.

- Send a Message: Open WhatsApp and send “Hi” to the saved number.

- Verify Your Account: Follow the prompts to verify your account. You’ll need to use the mobile number registered with the bank.

Step 2: Checking Your Balance

Once you’re registered, checking your balance is a breeze. Here’s how you can do it:

- Open WhatsApp: Open your WhatsApp and go to the chat with IDFC First Bank.

- Send a Message: Type and send the message “BAL” or “Balance”.

- Receive Your Balance: Within seconds, you’ll receive a message with your current account balance.

It’s that simple! No need to log into an app or visit an ATM. Just a quick message, and you have your balance information.

Other Services via WhatsApp Banking

IDFC First Bank’s WhatsApp Banking isn’t just about checking your balance. There are several other services you can access:

- Mini Statement: Type “Mini Statement” to get a summary of your recent transactions.

- Cheque Status: Check the status of your cheques by typing “Cheque Status”.

- Request Services: Request a new cheque book, block your card, or update your contact information.

These services make banking even more accessible, allowing you to manage your finances effortlessly.

Security Tips for WhatsApp Banking

While using WhatsApp Banking, it’s important to keep your information secure. Make sure your phone is protected with a password or biometric lock. Don’t share your banking details with anyone, and ensure that you are communicating with the verified IDFC First Bank number.

IDFC First Bank Balance Enquiry: Frequently Asked Questions

When it comes to managing your finances, knowing your bank balance is essential. Whether you’re planning your budget or simply staying informed, having quick access to your balance is crucial. Here are some frequently asked questions about IDFC First Bank balance enquiries, along with clear and simple answers to help you navigate the process.

How Can I Check My IDFC First Bank Balance?

You have several options to check your balance:

- Net Banking: Log into your account on the IDFC First Bank website and check your balance in the ‘Account Summary’ section.

- Mobile Banking App: Download the IDFC First Bank Mobile Banking App and view your balance on the dashboard.

- WhatsApp Banking: Send “BAL” to +91 95555 55555 on WhatsApp for an instant balance update.

- Toll-Free Number: Dial 1800-419-4332 and follow the voice prompts to hear your balance.

- Missed Call: Give a missed call to 1800-2700-720 from your registered mobile number to receive an SMS with your balance.

- SMS Banking: Send “BAL” to 5676732 from your registered mobile number for your balance details via SMS.

- ATM: Use any IDFC First Bank ATM to check your balance.

- Passbook: Visit your branch and update your passbook for the latest balance.

What Should I Do If I Forget My Net Banking Password?

Forgetting your password is common, and resetting it is simple:

- Visit the Website: Go to the IDFC First Bank website and click on the ‘Forgot Password’ link on the login page.

- Enter Details: Provide your User ID and registered mobile number.

- Verify: Follow the prompts to verify your identity through an OTP sent to your mobile number.

- Reset Password: Create a new password and log in to check your balance.

Can I Check My Balance Without Internet?

Yes, you can check your balance without an internet connection using these methods:

- Missed Call: Give a missed call to 1800-2700-720.

- SMS Banking: Send “BAL” to 5676732 from your registered mobile number.

- Toll-Free Number: Dial 1800-419-4332 and follow the voice prompts.

- ATM: Visit any IDFC First Bank ATM.

Is There a Fee for Balance Enquiries?

Most balance enquiry methods are free of charge. However, it’s always good to check with the bank for any potential charges, especially when using ATMs other than IDFC First Bank’s.

How Often Should I Check My Balance?

It’s a good habit to check your balance regularly:

- Weekly: Keep track of your spending and ensure there are no unauthorized transactions.

- Before Large Purchases: Ensure you have sufficient funds before making significant purchases.

- Monthly: Review your balance and statements to manage your budget effectively.

What Should I Do If My Balance Seems Incorrect?

If you notice any discrepancies in your balance:

- Check Recent Transactions: Review your recent transactions via net banking or the mobile app.

- Contact Customer Support: Reach out to IDFC First Bank’s customer service for assistance.

- Visit Your Branch: For further clarification, visit your nearest branch and speak with a representative.

Conclusion

Understanding how to check your IDFC First Bank balance and addressing common queries can make managing your finances much smoother. With various convenient methods available, staying on top of your balance is easier than ever. Remember to check your balance regularly and contact the bank if you have any concerns. Happy banking!