Easily check Aadhaar PAN card link status online with simple steps. Learn multiple methods including Income Tax e-Filing, SMS, Aadhaar, UIDAI, and NSDL.

How to Check Aadhaar PAN Card Link Status Online: Multiple Easy Ways

In today’s digital world, checking your Aadhaar PAN card link status is a breeze. You don’t need to stress over it. We’ll walk you through the steps to make sure your cards are linked properly. There are several simple methods you can use, and we’ll cover them all in detail.

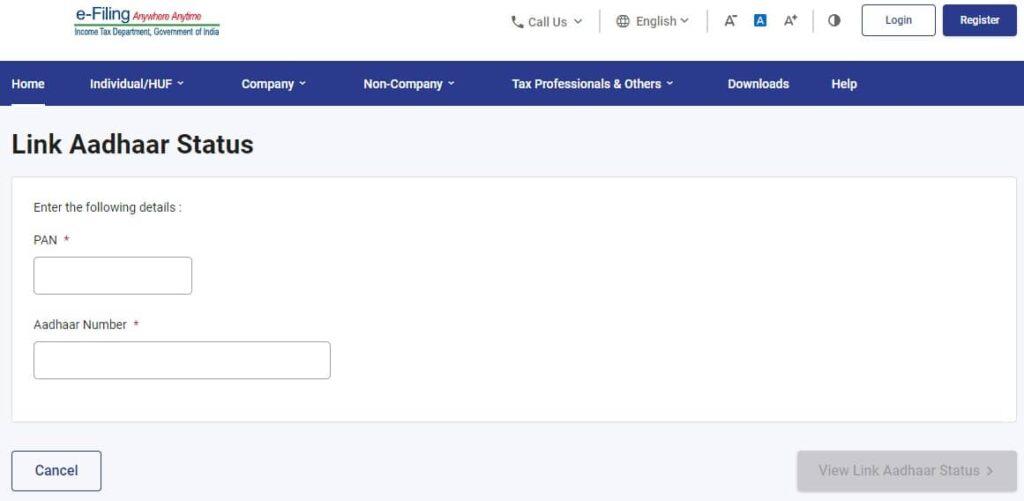

How-to Check Aadhaar PAN Card Link Status via the Income Tax e-Filing Website

- Visit the Income Tax e-Filing website.

- Click on the “Link Aadhaar” option.

- Log in with your credentials. If you don’t have an account, register first.

- Go to “Profile Settings” and select “Link Aadhaar.”

- Enter your PAN and Aadhaar numbers in the respective fields.

- Click on the “View Link Aadhaar Status” button.

- The status of your Aadhaar PAN linkage will be displayed.

Check Aadhaar PAN Card Link Status via SMS

- Open the messaging app on your mobile phone.

- Type a new message in the format: UIDPAN <12-digit Aadhaar> <10-digit PAN>.

- Example: UIDPAN 123456789012 ABCDE1234F

- Send this message to 567678 or 56161.

- You will receive a message confirming whether your Aadhaar is linked to your PAN.

Check Aadhaar PAN Card Link Status via the Aadhaar Website

- Visit the official Aadhaar website.

- Look for the “Check Aadhaar & PAN Status” option and click on it.

- Enter your Aadhaar and PAN details in the provided fields.

- Click on the “Check Status” button.

- The status of your Aadhaar PAN linkage will be display.

Use the UIDAI Website to Check Aadhaar PAN Card Link Status

- Go to the UIDAI website.

- Select “Aadhaar Services” and then choose “Aadhaar PAN Linking Status.”

- Enter your Aadhaar and PAN numbers in the specified fields.

- Click on the “Submit” button.

- The website will show the status of your Aadhaar PAN linkage.

Check Aadhaar PAN Card Link Status via the NSDL Website

- Visit the NSDL website.

- Navigate to the “PAN Services” section.

- Click on the “Link Aadhaar Status” option.

- Enter your PAN and Aadhaar numbers in the respective fields.

- Click on the “View Link Aadhaar Status” button.

- The status of your Aadhaar PAN linkage will be display.

Why It’s Important to Link Aadhaar with PAN

- Streamline Financial Transactions: Linking helps verify your identity across various platforms.

- Prevent Tax Evasion: Ensures accurate tax filings and compliance with government regulations.

- Avoid Penalties: Stay compliant to avoid penalties or future complications.

What to Do If Your Aadhaar PAN Link Status Is Not Updated

If you find that your Aadhaar PAN link status is not updated, don’t panic. There are steps you can take to resolve the issue. Here’s what you can do:

First, ensure that the details you entered are correct. Double-check your Aadhaar and PAN numbers to make sure there are no typos. If your details are correct and the status is still not updated, re-link your Aadhaar with your PAN.

To do this, follow the same steps mentioned earlier for linking your Aadhaar with your PAN. Once re-linked, check the status again using any of the methods we discussed. If the issue persists, consider contacting the Income Tax Department for further assistance.

Conclusion: Stay Informed and Up-to-Date

Keeping your Aadhaar PAN card link status updated is essential for smooth financial transactions and compliance with regulations. Use the methods mentioned above to easily check your status and ensure that your Aadhaar is linked with your PAN.

Whether you prefer using the Income Tax e-Filing website, sending an SMS, or checking through the Aadhaar or UIDAI websites, there’s a method that suits your needs. Stay informed and stay up-to-date to avoid any complications in the future.

Remember, you can complete the process in just a few minutes. So, take a moment to check your Aadhaar PAN card link status today and enjoy peace of mind knowing that your information is accurate and up-to-date.

Frequently Asked Questions (FAQs)

1. Why do I need to link my Aadhaar with my PAN card?

Linking your Aadhaar with your PAN card helps streamline your financial transactions, ensures accurate tax filings, and helps prevent tax evasion. It also ensures compliance with government regulations, avoiding any penalties or future complications.

2. How do I check if my Aadhaar is link with my PAN card?

You can check your Aadhaar PAN card link status using several methods:

- Income Tax e-Filing website

- SMS

- Aadhaar website

- UIDAI website

- NSDL website

3. What details do I need to check my Aadhaar PAN card link status?

You need your 12-digit Aadhaar number and your 10-digit PAN number to check the link status.

4. Can I check the Aadhaar PAN card link status without logging in to the e-Filing website?

No, you need to log in to the Income Tax e-Filing website to check the Aadhaar PAN card link status. If you don’t have an account, you’ll need to register first.

5. Is there any fee for checking the Aadhaar PAN card link status?

No, there is no fee for checking your Aadhaar PAN card link status. All the methods provided are free of cost.

6. What should I do if my Aadhaar is not linked with my PAN card?

If your Aadhaar is not linked with your PAN card, you should follow the linking process again using any of the methods provided. Ensure that the details entered are correct. If the issue persists, contact the Income Tax Department for further assistance.

7. How long does it take for the Aadhaar PAN linking status to update?

The update process can vary. Generally, it should update within a few days. However, in some cases, it might take longer. It’s advisable to check the status periodically until it is update.

8. Can I link my Aadhaar with my PAN card if the names on both cards are different?

Yes, you can still link your Aadhaar with your PAN card if there are minor mismatches in the name. The Income Tax e-Filing portal has a provision to correct these discrepancies during the linking process.

9. What happens if I don’t link my Aadhaar with my PAN card?

If you do not link your Aadhaar with your PAN card, your PAN might become invalid. This can lead to difficulties in financial transactions and tax filings, and you may also face penalties.

10. Is it mandatory to link Aadhaar with PAN for all individuals?

Yes, it is mandatory for all individuals to link their Aadhaar with their PAN card as per the government regulations to ensure smooth financial operations and compliance with tax laws.

11. How often should I check my Aadhaar PAN card link status?

Periodically check your Aadhar PAN card link status, especially after linking them, to ensure the linkage is updated and accurate.

12. Can I unlink my Aadhaar from my PAN card?

What is the Full Form of PAN?

PAN stands for Permanent Account Number. It is a unique, ten-character alphanumeric identifier issued by the Income Tax Department of India to individuals, companies, and other entities. The PAN primarily tracks financial transactions and ensures accurate tax payments..