Calculate your HDFC Home Loan EMIs easily with the HDFC Home Loan EMI Calculator. Plan your budget & explore flexible loan options today!

Understanding HDFC Home Loan and the EMI Calculator

So, you’re thinking about buying a house, huh? That’s a big deal—and super exciting too! But let’s face it, unless you’ve got a magical money tree (please share if you do!), you’ll probably need a home loan.

This is where HDFC Home Loan steps in, acting like your financial buddy to help turn those homeownership dreams into reality.

And hey, don’t worry about the math—HDFC has this amazing EMI Calculator that can take the stress out of figuring out your loan details.

What is an HDFC Home Loan?

In simple words, an HDFC Home Loan is your ticket to owning a house without draining your bank account all at once.

HDFC Bank offers a range of home loan options tailored to your needs, whether you’re buying your first home, building your dream house, or even renovating your existing one.

The best part? They offer competitive interest rates, making it easier to repay the loan without losing sleep over the EMIs.

Plus, you can borrow a sizeable amount, depending on your eligibility, which HDFC determines based on factors like your income, age, and credit score.

But wait, what’s an EMI? Glad you asked! It’s short for Equated Monthly Installment, which is basically the fixed amount you’ll pay every month to repay your loan.

Sounds straightforward, right? Well, calculating it can get a little tricky, but HDFC’s EMI Calculator makes it ridiculously easy. Let’s dig into that next!

How to Use the HDFC Home Loan EMI Calculator

Okay, let’s be real—most of us would rather avoid complicated financial calculations. I mean, who wants to whip out a calculator and play around with interest rates and loan tenures? Not me, for sure! Luckily, the HDFC Home Loan EMI Calculator is here to save the day.

It’s simple, super user-friendly, and, most importantly, free to use.

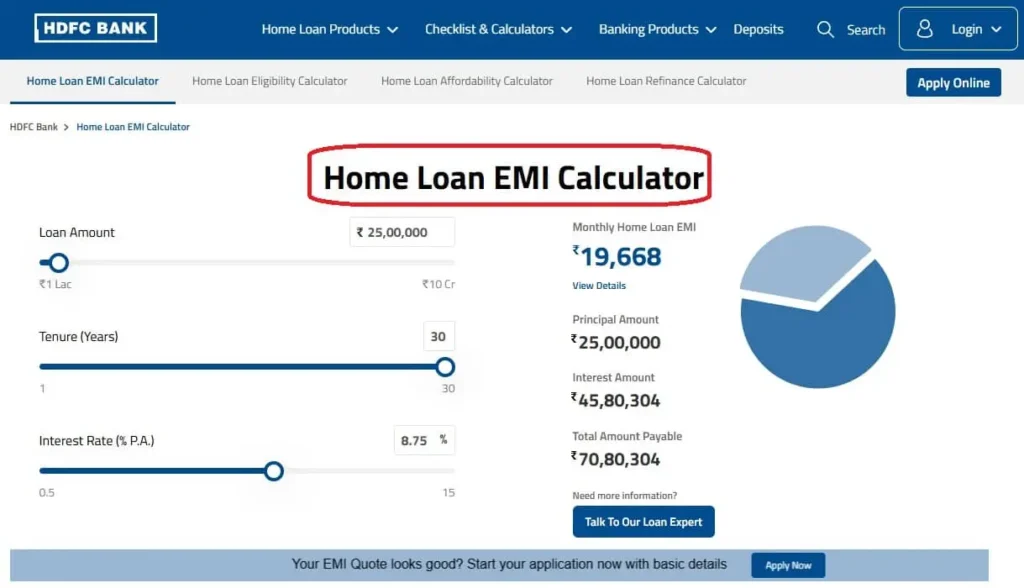

Here’s how you can calculate your EMIs with just a few clicks:

- Head to the EMI Calculator Page

Visit hdfc.com/home-loan-emi-calculator to get started. The page is clean, clutter-free, and ready to help. - Enter Your Loan Amount

This is the amount you’re planning to borrow from HDFC. Be realistic about what you can afford, okay? - Set the Interest Rate

Here, you’ll input the interest rate offered by HDFC for your loan. If you’re unsure, check their latest rates online. - Choose Your Loan Tenure

This is the period over which you’ll repay the loan, typically ranging from a few years to a couple of decades. - Hit Calculate!

And voilà, the EMI Calculator instantly gives you the monthly EMI amount. It even shows a detailed breakdown, so you know exactly where your money is going.

It’s honestly so simple that you might even enjoy using it (or is that just me?). Play around with different loan amounts and tenures to find an EMI that fits your budget like a glove.

Advantages of the HDFC Home Loan EMI Calculator Use

“Why should I use this calculator when I can just ask someone at the bank,” you may be asking yourself. Great question! Here’s why this nifty tool is worth your time:

- Quick Results

You get an instant estimate of your EMIs without waiting in line or scheduling a call. - Customizable Options

You can tweak the loan amount, tenure, and interest rate to see how they impact your EMI. It’s like testing out different scenarios without any commitment. - Transparency

The calculator gives you a clear picture of what you’re signing up for. No hidden surprises, just straightforward numbers. - Budget-Friendly Planning

You can easily figure out if your EMI fits within your monthly budget. If it doesn’t, adjust the inputs until you find a sweet spot. - Absolutely Free

Yep, you read that right. No charges, no strings attached. You are free to use it as often as you like.

Why HDFC Stands Out in the Home Loan Market

HDFC isn’t just any financial institution—it’s one of the most trusted names in India when it comes to home loans. Their flexible repayment options, competitive interest rates, and top-notch customer service make them a popular choice among aspiring homeowners. Plus, they’ve got some serious experience under their belt, so you know you’re in safe hands.

Here’s a quick breakdown of what makes HDFC home loans shine:

- Wide Eligibility Criteria: Whether you’re salaried, self-employed, or retired, there’s a good chance you’ll qualify.

- Low Processing Fees: You won’t feel like you’re being nickeled and dimed to death with unnecessary charges.

- Special Offers: They frequently have promotions, especially for women applicants and first-time homebuyers. So, keep an eye out!

- Online Tools: The EMI Calculator is just one of the many tools HDFC offers to simplify your loan process.

Wrapping It Up

Buying a home is a big financial decision, and getting your finances in order is the first step. With HDFC’s Home Loan options and the super-helpful EMI Calculator, the whole process becomes a lot less stressful and way more transparent. You get to understand your repayment obligations upfront and can plan your budget like a pro.

So, what are you waiting for? Go ahead, check out the HDFC Home Loan EMI Calculator, and start crunching those numbers. Trust me, once you see how manageable your EMIs can be, you’ll be one step closer to unlocking the doors to your dream home.