Easy Ways to Check Your DBS Bank Balance

Keeping track of your bank balance can be a hassle, but DBS Bank has made it incredibly simple for its customers. With multiple methods at your disposal, you can check your balance effortlessly. Whether you prefer calling, sending a missed call, or using SMS, DBS Bank has got you covered. Let’s dive into the different ways you can check your DBS Bank balance easily and conveniently.

Toll-Free Number: One Call Away from Your Balance

One of the most straightforward methods to check your DBS Bank balance is by using the toll-free number. Imagine you’re out shopping or at a café, and you suddenly need to know your balance. No need to worry! Just dial the toll-free number, and you’re all set.

Calling from India : 1860 267 1234 / 1800 209 4555

Singapore : 800 852 6186

Calling from overseas : +91 44 6685 4555

Here’s how you do it: Dial the DBS Bank toll-free number and follow the automated voice prompts. You will be asked to enter your customer ID or account number. Once verified, you will hear your current balance. It’s as easy as pie! You don’t have to wait in long queues or navigate through complicated menus. The toll-free number service is available 24/7, so you can check your balance anytime, anywhere.

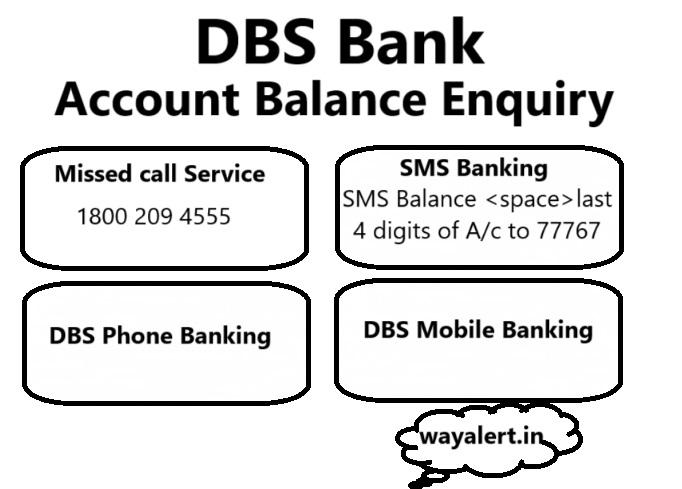

Missed Call Banking: Convenience at Its Best

Another super convenient way to check your DBS Bank balance is by using the missed call service. If you are someone who prefers quick and no-hassle methods, this one is for you. All you need to do is give a missed call to the designated number provided by DBS Bank.

To check DBS account balance by giving a missed call on-

1800 209 4555

Here’s a step-by-step guide: Save the DBS Bank balance enquiry number in your contacts. When you want to check your balance, just give a missed call to this number. Within a few seconds, you will receive an SMS with your account balance details. It’s fast, it’s simple, and it doesn’t cost you a thing! No need to speak to an operator or navigate through a menu – just a missed call, and your balance is delivered straight to your phone.

SMS Banking: Your Balance at Your Fingertips

For those who prefer texting, SMS banking is a fantastic option. With DBS Bank’s SMS banking service, you can get your balance information with just a simple text message. It’s perfect for when you’re on the go and need quick access to your account details.

BalanceLast 4 digits of Account to 77767

Here’s how it works: Compose a new SMS with a specific keyword (like BAL or BALANCE) and send it to the designated number provided by DBS Bank. In a matter of seconds, you will receive an SMS with your current account balance. It’s that straightforward! There’s no need for internet access or smartphone apps – just a regular text message will do the trick.

The Benefits of Using DBS Bank Balance Enquiry Services

There are several benefits to using these DBS Bank balance enquiry services:

- Convenience: Check your balance anytime, anywhere without the need for an internet connection.

- Speed: Get your balance information instantly, saving you time.

- Cost-Effective: These services are either free or incur minimal charges, making them cost-effective options.

- Ease of Use: No complex procedures – just simple steps to follow.

These methods are perfect for everyone, whether you’re tech-savvy or not. They offer peace of mind, knowing that your balance information is always accessible.

Guide to Checking Your DBS Bank Balance Using digibank Mobile/Online

In the digital age, managing your finances has never been easier, especially with DBS Bank’s digibank platform. Whether you prefer using your mobile device or your computer, checking your balance is a breeze. Let’s explore how you can effortlessly check your DBS Bank balance using digibank mobile and online.

Using digibank Mobile App: Your Balance on the Go

For those who are always on the move, the digibank mobile app is a fantastic tool. Here’s how to check your DBS Bank balance using the app:

- Download the App: If you haven’t already, download the digibank mobile app from the App Store or Google Play Store.

- Log In: Open the app and log in using your user ID and password. If you’re a new user, you might need to register first.

- Access Account Summary: Once logged in, navigate to the “Account Summary” section on the home screen.

- Select Your Account: Tap on the account for which you want to check the balance.

- View Your Balance: Your current balance, along with other account details, will be displayed on the screen.

This method allows you to check your balance anytime and anywhere, making it perfect for busy individuals.

Using digibank Online: Balance Check from Your Computer

If you prefer using a computer, digibank online offers a seamless way to manage your finances. Follow these steps to check your DBS Bank balance online:

- Visit the Website: Open your preferred web browser and go to the digibank online website.

- Log In: Enter your user ID and password to log in. If you’re logging in for the first time, you may need to complete a quick registration process.

- Navigate to Account Summary: On the dashboard, look for the “Account Summary” section.

- Select Your Account: Click on the account you wish to check.

- View Your Balance: Your current balance and recent transactions will be displayed.

This method is ideal for those who prefer a larger screen and detailed view of their finances.

Using Phone Banking : Your Balance can check

- Dial 1800 111 1111 (from Singapore) or (65) 6327 2265 (from Overseas).

- For a menu in English Press 1, for Mandarin Press 2.

- Enter your NRIC, Debit or Credit Card Number followed by # to proceed.

- Follow the steps for SMS OTP to proceed.

- Select Deposit Account Related Services.

- Press 1 for Account Balance(s).

- Press 2 for Last 5 Transactions.

- Enter your Account Number OR;

- Press # to list all the Accounts.

Why Choose digibank for Balance Enquiry

Using digibank mobile and online services for balance enquiries is incredibly convenient. Whether you’re at home or on the go, you can easily access your account details. The platform is designed to be user-friendly, ensuring a smooth experience for all users.

Benefits of Using digibank Mobile/Online

- 24/7 Access: Check your balance anytime, no matter where you are.

- Detailed Information: Get comprehensive details about your account, including recent transactions and available balance.

- User-Friendly Interface: The intuitive design makes navigation easy, even for those who aren’t tech-savvy.

Tips for a Smooth Experience

To ensure a hassle-free experience with digibank mobile and online, consider these tips:

- Keep Your Credentials Safe: Always keep your user ID and password confidential.

- Update Your App: Regularly update the digibank mobile app to enjoy the latest features and security enhancements.

- Log Out When Done: Always log out after checking your balance, especially on shared devices.

Guide to Checking Your DBS Bank Balance Using Digibot, POSB/ATM, and Video Teller Machine

Managing your finances is a breeze with the various balance enquiry methods offered by DBS Bank. Whether you prefer the digital assistance of Digibot, the convenience of POSB/ATM, or the interactive experience of a Video Teller Machine, DBS Bank has you covered. Let’s dive into how you can check your DBS Bank balance using these three methods.

Checking Balance with DBS Digibot

DBS Digibot is your virtual banking assistant, ready to help you check your balance anytime. Here’s how to use Digibot for your balance enquiry:

- Access Digibot: Visit the DBS Bank website or open the DBS banking app.

- Start a Chat: Click on the Digibot icon, usually located at the bottom right corner.

- Authenticate: Enter your credentials or authenticate using your registered mobile number.

- Ask for Balance: Type “Check balance” or a similar query.

- View Your Balance: Digibot will provide your current balance and recent transactions.

Using Digibot is quick, easy, and available 24/7, making it perfect for those who prefer digital solutions.

Checking Balance through POSB/ATM

For those who like using ATMs, checking your balance through POSB/ATM is straightforward. Here’s how:

- Visit a POSB/ATM: Find the nearest POSB or DBS ATM.

- Insert Your Card: Insert your DBS debit or credit card into the machine.

- Enter Your PIN: Follow the prompts and enter your Personal Identification Number (PIN).

- Select Balance Enquiry: From the menu, choose “Balance Enquiry.”

- View Your Balance: Your current balance will be displayed on the screen. You can also print a receipt.

This method is perfect for when you’re out and about and need quick access to your balance.

Checking Balance with Video Teller Machine

The Video Teller Machine (VTM) offers a unique, interactive way to check your balance. Here’s a step-by-step guide:

- Locate a VTM: Find a Video Teller Machine at a DBS Bank branch or location.

- Start a Session: Touch the screen to begin a session with a live teller.

- Authenticate Yourself: Verify your identity by showing your ID or using your debit/credit card.

- Request Balance Enquiry: Ask the live teller to check your balance.

- View Your Balance: The teller will provide your current balance and can help with other enquiries.

Using a VTM gives you the benefit of personal assistance while still being convenient and easy.

Why These Methods Are Great for Balance Enquiries

Each of these methods offers unique advantages tailored to your preferences. Whether you prefer digital interaction, traditional ATMs, or live teller assistance, DBS Bank ensures you have multiple options to check your balance easily.

Benefits of These Balance Enquiry Methods

- Digibot: Available 24/7, easy to use, and provides instant responses.

- POSB/ATM: Widely available, offers quick access to balance and cash withdrawals.

- VTM: Combines digital convenience with personalized service from a live teller.

Tips for a Smooth Experience

To make the most out of these balance enquiry methods, keep these tips in mind:

- Secure Your Information: Always protect your credentials and PIN to prevent unauthorized access.

- Know Your Locations: Familiarize yourself with the nearest ATMs and VTMs for quick access.

- Use Official Channels: Ensure you’re using official DBS Bank channels to avoid scams.

Frequently Asked Questions About DBS Bank Balance Enquiry

Managing your finances can sometimes be a bit confusing, but DBS Bank is here to help. Whether you’re new to banking with DBS or just need a quick refresher, we’ve compiled some of the most frequently asked questions about DBS Bank balance enquiries. Let’s dive in and make your banking experience smoother and more enjoyable!

How Can I Check My DBS Bank Balance?

There are several ways to check your DBS Bank balance. You can use the DBS Digibot for a quick chat-based enquiry, visit a POSB/ATM for a traditional check, or use the DBS mobile banking app for on-the-go access. Each method is designed to be user-friendly and convenient.

Is There a Fee for Checking My Balance?

Good news! Checking your DBS Bank balance is free of charge across all methods. Whether you’re using the mobile app, Digibot, ATM, or Video Teller Machine, you won’t incur any fees for a balance enquiry. This ensures you can always stay updated on your account without worrying about extra costs.

Can I Check My Balance Internationally?

Absolutely! If you’re traveling abroad, you can still check your DBS Bank balance using the mobile banking app or Digibot, provided you have an internet connection. This feature makes it easy to manage your finances no matter where you are in the world.

What Should I Do If I Forget My PIN?

Forgetting your PIN can be stressful, but DBS Bank makes it easy to reset. If you forget your ATM PIN, visit the nearest DBS branch or call customer service for assistance. For mobile banking or Digibank PINs, you can reset them directly through the app by following the on-screen instructions.

How Often Is My Balance Updated?

Your DBS Bank balance is updated in real-time across all platforms. Whether you’re checking via the mobile app, ATM, or any other method, the balance you see reflects the latest transactions. This real-time update helps you manage your finances more effectively and avoid any surprises.

Why Is My Available Balance Different from My Current Balance?

Your available balance may differ from your current balance due to pending transactions, such as recent purchases or holds on funds. The current balance includes all funds in your account, while the available balance reflects the amount you can immediately access. Understanding this difference can help you better manage your spending and avoid overdrafts.

How Secure Is My Balance Information?

DBS Bank employs top-notch security measures to ensure your account information remains safe. Whether you’re checking your balance online, via the mobile app, or at an ATM, your data is protected with advanced encryption and security protocols. Always remember to log out of your accounts and keep your login credentials confidential for added security.

Tips for a Smooth Balance Enquiry Experience

To make your balance enquiry experience as smooth as possible, consider these tips:

- Keep Your Information Handy: Have your account number and PIN readily available when using ATMs or the mobile app.

- Regularly Update Your App: Ensure you have the latest version of the DBS mobile app for optimal performance and security.

- Monitor Your Transactions: Regularly check your transactions to stay on top of your spending and spot any discrepancies early.

Conclusion

Understanding your DBS Bank balance enquiry options and frequently asked questions can make managing your finances much easier. With multiple ways to check your balance, free access, and top-notch security, DBS Bank ensures you have all the tools you need to stay informed about your account. So, the next time you have a balance-related question, refer to this FAQ guide and enjoy a hassle-free banking experience!