GHMC Property Tax – Complete Guide 2025 at onlinepayments.ghmc.gov.in

Why GHMC Property Tax Matters

The Greater Hyderabad Municipal Corporation (GHMC) collects property tax from property owners across Hyderabad. This revenue is vital for maintaining roads, sanitation, streetlights, waste management, drainage, and other essential civic services. If you own a house, shop, apartment, or commercial space in Hyderabad, paying your GHMC property tax on time is mandatory.

Understanding GHMC Property Tax and PTIN

Every property within GHMC’s jurisdiction is assigned a Property Tax Identification Number (PTIN). This is a unique number that links your property with GHMC’s database. With the PTIN, you can:

- View property details

- Check pending tax dues

- Download receipts after payment

The city is divided into zones, circles, and wards, and your PTIN is tied to these divisions. Always keep your PTIN handy when paying tax online or offline.

How to Find Your PTIN Online

If you don’t know your PTIN, GHMC provides an online search option:

- Visit the official GHMC Know Your Property page.

- Choose the search method – by owner name, door number, or circle/ward.

- Enter the required details and submit.

- Your property record with PTIN will appear.

- You can also update your mobile number linked to PTIN to receive payment alerts and updates.

How GHMC Property Tax is Calculated

Unlike income tax or GST, property tax is not a fixed amount. GHMC uses the Monthly Rental Value (MRV) system for its calculations.

- Residential properties: The built-up area of your home is multiplied by the standard monthly rental value (per sq. ft.) applicable to your locality. Only 50% of this rental value is taken as the taxable amount, on which the notified tax percentage is applied.

- Commercial properties: For shops, offices, and business spaces, the full calculated rental value (100%) is considered before applying the tax rate.

Example

- A 1,000 sq. ft. residential apartment in a mid-level locality will have a modest MRV, and the tax is calculated at 50% of that value.

- A 1,000 sq. ft. shop in a commercial zone will attract higher tax because the entire MRV is taxable.

This ensures fairness: commercial properties, which generate income, pay more compared to residential homes.

GHMC Property Tax Calculator – How It Works

GHMC provides an online calculator where you can get an estimate of your tax. To use it, you need to enter:

- Property type (residential or commercial)

- Usage (self-occupied or rented)

- Built-up area (plinth area)

- Locality or zone

Once entered, the calculator will display the half-yearly tax amount you need to pay.

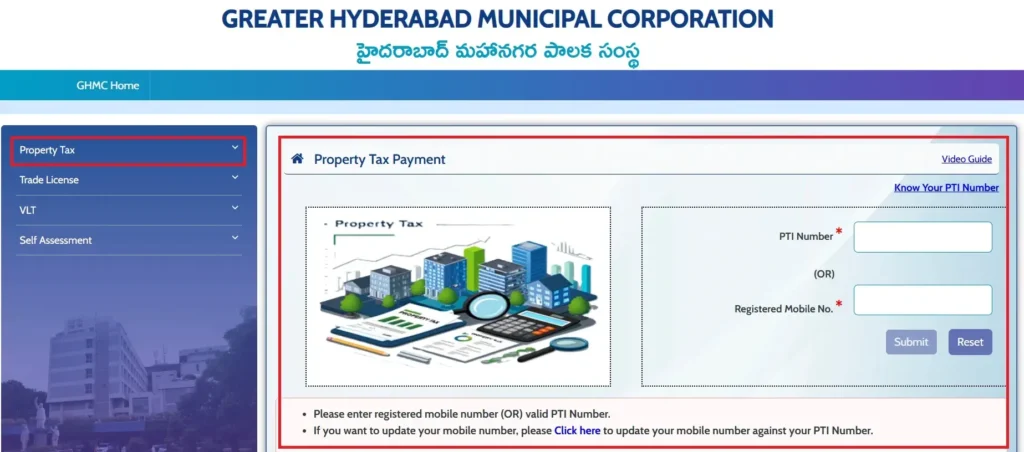

How to Pay GHMC Property Tax Online

You no longer need to visit municipal offices—GHMC has made payment seamless online.

Steps for Online Payment:

- Visit the GHMC official website → click on Property Tax Payment.

- Enter your PTIN.

- The system will show pending dues.

- Select your preferred payment method (net banking, UPI, credit/debit card).

- Complete the transaction.

- Download and print your receipt for records.

You can also use the MyGHMC mobile app to make payments instantly.

GHMC Property Tax Due Dates, Rebates & Waivers

Early-Bird Rebate

Each financial year, GHMC offers a 5% rebate for taxpayers who pay their current year’s property tax within the early-bird window (usually in April). This rebate is available only on the current year’s dues, not on arrears.

One-Time Settlement (OTS) Scheme

At times, GHMC announces a waiver of interest/penalties under a one-time settlement (OTS) scheme. This allows property owners with long-pending arrears to clear their dues without extra charges.

Staying updated on GHMC announcements helps you take advantage of these schemes.

New Online Services for GHMC Property Tax

As of 2025, GHMC has expanded its online services for property taxpayers. You can now request:

- Revision of assessment (if property structure changes)

- Vacancy remission (if property is vacant and unused)

- Correction of owner name or door number

- Update of registered mobile number

- Exemption applications for charitable, educational, or religious institutions

This saves time and avoids unnecessary office visits.

Self-Assessment / New Assessment Process

If you’ve built a new property or made significant modifications (like adding a floor), you need to file a self-assessment.

Steps:

- Login to GHMC portal using your mobile number and OTP.

- Provide details like plinth area, floors, and usage.

- The system automatically calculates your half-yearly tax.

- Pay the tax online and download your assessment order.

Common Corrections: Name, Door Number, Mobile Update

If your property details are incorrect in GHMC’s records, you can apply for corrections online.

- Name correction → Requires proof of ownership (like a sale deed).

- Door number correction → Needs municipal supporting documents.

- Mobile number update → Can be done instantly online without documents.

Penalties, Interest, and Compliance Tips

- Delayed payments attract monthly interest as prescribed by GHMC.

- Paying within deadlines avoids penalties and legal notices.

- Always retain payment receipts for income tax or legal purposes.

- Ensure your PTIN details are accurate before paying.

Offline Payment Options

For those who prefer offline payments, GHMC allows:

- Payment at Citizen Service Centers

- Authorized GHMC counters

- Payments via cash, cheque, or demand draft

Always cross-check the PTIN before making offline payments.

GHMC Property Tax FAQs

Q1. How can I check my GHMC property tax dues?

Use the GHMC website → Enter PTIN → View dues → Make payment → Download receipt.

Q2. How do I find my PTIN?

Use the Know Your Property service on GHMC’s portal by entering owner name, door number, or ward details.

Q3. What formula is used for GHMC property tax?

Tax is calculated based on Monthly Rental Value (MRV), with 50% considered for residential properties and 100% for commercial properties.

Q4. Does GHMC provide an early payment rebate?

Yes. A 5% rebate is available for those who pay current year’s tax within the early-bird deadline (generally April).

Q5. Can I file self-assessment online?

Yes. The GHMC portal allows online self-assessment for new properties or modified buildings.

Q6. How can I update my mobile number linked to PTIN?

You can update it instantly on the GHMC Mobile Number Update page.

Q7. What new services are available in 2025?

Online services for assessment revision, vacancy remission, corrections, and exemptions.

Conclusion

The GHMC property tax system has become more user-friendly with its online calculators, PTIN search, payment portals, and correction facilities. By paying dues on time, using the 5% early-bird rebate, and keeping your property details updated, you can avoid penalties and support Hyderabad’s urban development.