Learn how to open an SBI Demat & Trading account online in India with simple steps. Start investing today and secure your financial future effortlessly.

How to Open SBI Demat & Trading Account Online in India:

Opening a Demat and Trading account online with SBI has never been easier. Whether you’re a seasoned investor or just starting out, SBI provides a straightforward process to get your account up and running. In this guide, we’ll walk you through the steps clearly, so you’ll feel confident about opening your SBI Demat & Trading Account. Ready? Let’s get started!

Why Open an SBI Demat & Trading Account?

Before we dive into the steps, it’s good to know why an SBI Demat & Trading account might be a great choice. SBI stands as one of India’s leading and most reputable banks. By opening a Demat account with them, you get access to a wide range of investment options, seamless online trading, and strong customer support. Plus, SBI offers low brokerage rates and a user-friendly platform. Sounds good, right?

Step 1: Visit the SBI Website or App

The first step to open your SBI Demat & Trading account is to visit the official SBI website or download the SBI YONO app. You can find the option to apply for a Demat and Trading account under the “Investments” section. This is where the fun begins!

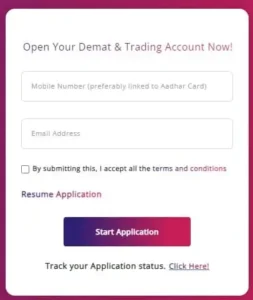

Once you’ve clicked on the “Open Demat & Trading Account” option, you’ll be directed to a form. Don’t worry—it’s short and simple!

Step 2: Fill in Basic Personal Details

After you’re on the right page, you’ll need to fill in your basic details. You’ll need to provide information such as your name, date of birth, and mobile number. Make sure all your information is accurate because it will be verified later on. You don’t want any hiccups during verification!

Also, remember to use a valid email ID because SBI will send you important updates and account information. Double-check all your details before moving forward.

Step 3: Complete Your KYC (Know Your Customer)

Now comes an important step: completing your KYC. KYC verification is a mandatory process to open a Demat & Trading account. You’ll need to upload a few essential documents to prove your identity and address.

Here’s a list of documents you’ll need:

- PAN Card

- Aadhaar Card

- Bank Statement or Utility Bill (for address proof)

- Passport-sized photograph

Make sure your scanned copies are clear and legible. You wouldn’t want any delays, would you?

Step 4: E-sign the Application Form

After submitting your documents, you’ll be required to e-sign the application form. This step is super easy! SBI will send you an OTP (One-Time Password) to your registered mobile number. Enter the OTP and your e-signature will be complete. This ensures the entire process is secure and paperless!

Step 5: Link Your Bank Account

The next step involves linking your bank account to your Demat & Trading account. This is important because your investments and trading transactions will be processed through this account. Since you’re already with SBI, linking your existing SBI savings account will be a breeze. However, if you have an account with another bank, don’t worry—you can link that too.

Step 6: Select Your Brokerage Plan

SBI offers several brokerage plans to suit different types of investors. Whether you’re a frequent trader or a long-term investor, you can pick a plan that works best for you. Do take a moment to compare the plans, as selecting the right brokerage structure can make a big difference to your trading experience.

Step 7: Submit the Application and Wait for Approval

You’ve done all the heavy lifting! Now, you just need to submit the application and wait for approval. SBI will review your form and documents, and if everything is in order, you’ll receive confirmation that your account has been opened. This usually takes a few working days, but sometimes it’s quicker!

Once approved, you’ll get your Demat Account Number and Trading ID via email. Exciting times ahead—you’re almost ready to start investing!

Step 8: Access Your Account and Start Trading

Once your account is active, you can log in using your Demat Account Number and Trading ID. Whether you use the SBI YONO app or log in through the website, the platform is intuitive and easy to navigate. You’ll be able to view your portfolio, make trades, and track your investments with just a few clicks.

Advantages of Opening an SBI Demat & Trading Account Online

If you’re wondering why opening an SBI Demat & Trading account online is the way to go, here are some of the top benefits:

- Convenience: You can complete the process from the comfort of your home—no branch visits required.

- Time-Saving: The whole process is paperless and can be done in just a few minutes.

- Low Brokerage Fees: SBI offers competitive brokerage fees, especially for long-term investors.

- Integrated Banking and Trading: Easily manage both your banking and trading through the SBI platform.

- User-Friendly Platform: Whether you’re a beginner or an expert, the interface is designed to be simple and intuitive.

Key Points to Remember Before You Begin

- Have Your Documents Ready: Make sure all your KYC documents are up-to-date and ready to upload. This will save time.

- Choose the Right Brokerage Plan: Take some time to explore the different brokerage plans. Your investment style will guide your choice.

- Check Your Internet Connection: Since the process is online, a stable internet connection is important to avoid any interruptions.

Conclusion: You’re Ready to Open Your SBI Demat & Trading Account!

Opening an SBI Demat & Trading account online is a smart move for anyone looking to dive into the world of investments. With SBI’s trusted services, low fees, and seamless online platform, you’ll be all set to explore the stock market at your own pace. So what are you waiting for? Start today and take charge of your financial future!

If you follow these easy steps, you’ll have your account up and running in no time. Happy investing!