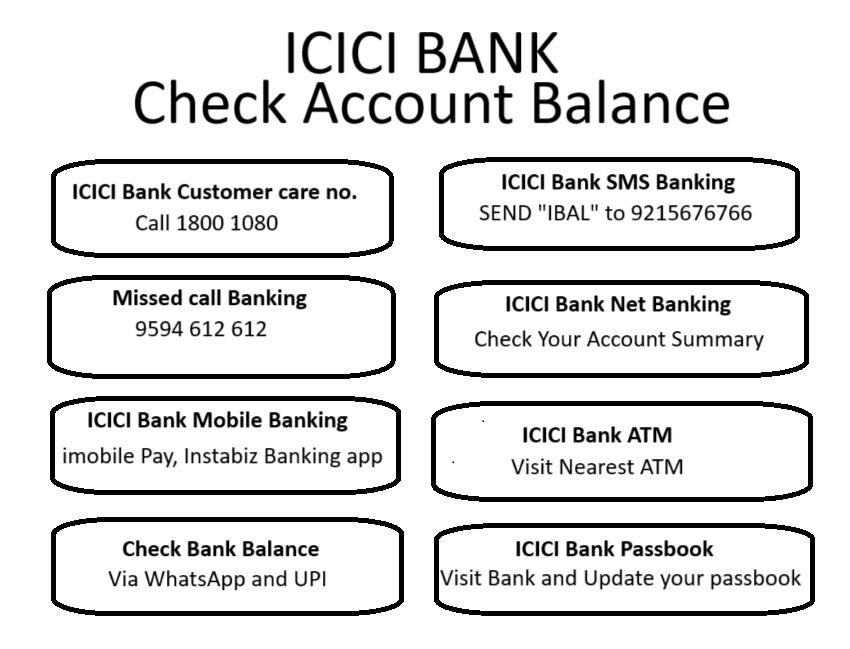

Managing your ICICI Bank account balance is simple with the variety of methods available. Whether you prefer mobile banking, WhatsApp, ATMs, customer care, or UPI apps, there’s an option for everyone. Regularly checking your balance helps you stay on top of your finances and ensures your account is secure.

ICICI Bank Account Balance via Customer Care Number

Need to check your ICICI Bank account balance but don’t have internet access? No worries! You can easily check your balance by calling the ICICI Bank customer care number. Here’s a simple, step-by-step guide to help you through the process.

Step 1: Dial the ICICI Bank Customer Care Number

First things first, grab your phone and dial the ICICI Bank customer care number. For balance inquiries, call 1800 1080 or 1800-103-8181, which is toll-free.

Step 2: Choose Your Preferred Language

Once connected, you’ll be prompted to select your preferred language. Press the corresponding number to proceed in the language you’re comfortable with.

Step 3: Authenticate Your Account

Next, you’ll need to authenticate your account. Enter your 12-digit ICICI Bank account number followed by the # key. This ensures that the system pulls up the correct account information.

Step 4: Navigate to Balance Inquiry

After authentication, you’ll be guided through a menu of options. Select the option for balance inquiry by pressing the corresponding number. This might vary slightly, so listen carefully to the instructions.

Step 5: Hear Your Account Balance

The automated system will retrieve your account details and announce your current balance. You can note it down for your records.

Additional Services via Customer Care

While you’re on the call, you can also explore other services. These include recent transaction details, credit card information, and loan inquiries. Just follow the menu prompts to access these options.

Tips for Smooth Customer Care Experience

To make your call smoother, ensure you have your account number and other relevant details handy. Also, be in a quiet place to avoid any disruptions during the call.

Missed call : Check your ICICI Bank Balance

Ready to unlock another simple trick to check your ICICI Bank account balance? This time, we’re exploring the wonders of the missed call and SMS services. Sit back, relax, and let’s zip through this guide to staying informed with just your phone. No internet needed—just your mobile in hand!

Get Set Up for Missed Call Magic

First things first, ensure your mobile number is registered with your ICICI Bank account. This is a must! Not set up yet? A quick call to customer service or a visit to your nearest branch will fix that. Once registered, you’re all set to use the magic of missed calls to keep tabs on your balance!

9594 612 612

Here’s How to Do It:

1. Save the Number: Add the ICICI Bank balance enquiry missed call number to your contacts. Let’s call it “ICICI Balance Buddy.”

2. Give a Ring: Dial “ICICI Balance Buddy.” Let it ring once or twice and then hang up. Yep, it’s that simple!

3. Wait for Magic: In a jiffy, you’ll receive an SMS with your ICICI Bank account balance. Quick and easy!

Account holders can obtain the ICICI Mini Statement (previous three transactions) by missing a call to –

9594 613 613

SMS Banking Service: ICICI Bank

Not in the mood to make a call? No problem! ICICI Bank’s SMS service is here to save the day. This is perfect for those times when you’re in a meeting or somewhere you can’t make calls.

Just follow these steps:

1. Open Your Messaging App: Grab your phone and find your messaging app.

2. Send a Simple SMS: Type the keyword “IBAL” and send it to the designated ICICI Bank SMS number 9215676766.

You have two many accounts. Send like this “IBAL <space> Last 6 digits of Account Number” to 9215676766.

3. Receive Your Balance: Like magic, a message pops up with your up-to-date ICICI Bank account balance.

Why You’ll Love These Services

Convenience at Its Best: Whether you’re in a noisy street market or quietly getting ready for bed, these services work seamlessly. They fit perfectly into your busy life, giving you financial updates in seconds.

Always Informed: Keep a close eye on your finances. Regular checks can help you manage your budget better and catch any unexpected charges early.

Absolutely Free: Yes, you heard that right! These services don’t cost a dime. ICICI Bank provides them free of charge, making it even easier to stay connected with your finances.

ICICI Bank Net Banking : Check your Bank Balance

Ready to harness the power of the internet to check your ICICI Bank account balance? It’s easier than you think, and I’m here to guide you through every click. Let’s break down the steps to access your financial snapshot in a flash, without leaving your cozy couch. Let’s get started with the world of ICICI Net Banking!

Step 1: Setting Up Your Online Fort

If you haven’t ventured into the realm of online banking yet, no worries—I’ve got you covered. Setting up is as easy as pie:

1. Visit the Official ICICI Website: Head over to ICICI Bank’s homepage.

2. Register for Internet Banking: Click on the ‘Login’ button and then find the option for new registration.

3. Fill in the Details: You’ll need your account number and registered phone number handy. Follow the prompts and set your login password.

Voilà! You’re now equipped to enter the digital banking battlefield!

Step 2: Log In to Your Account

With your net banking credentials set, logging in is your next move:

1. Return to the ICICI Homepage: Click on the ‘Login’ button again.

2. Enter Your User ID and Password: Type in the credentials you set during registration.

3. Secure Code: For added security, you might receive an OTP (One-Time Password) on your registered mobile. Enter it to proceed.

Congratulations, you’re in! Feels like unlocking a treasure chest, doesn’t it?

Step 3: Discover Your Balance

Now, for the moment of truth—checking your balance:

1. Navigate the Dashboard: The user interface is super friendly. Look for the ‘Accounts’ section.

2. Select Your Account: Click on it, and a detailed list of your accounts will appear.

3. View Balance: Click on the specific account you want to check. Your balance will be displayed prominently, along with recent transactions.

Why You’ll Love ICICI Net Banking

Efficiency at Its Finest: Say goodbye to waiting in long queues. Your account information is just a few clicks away, anytime and anywhere.

Complete Control: Not only can you check balances, but you can also manage transactions, pay bills, and transfer funds. It’s like having a bank branch in your pocket!

Security You Can Trust: ICICI ensures that your online banking experience is secure with top-notch encryption and security protocols. Sleep easy knowing your financial data is well protected.

How to Check Your ICICI Bank Account Balance Using Mobile Banking:

In today’s fast-paced world, managing your finances on the go is essential. Thanks to ICICI Bank’s mobile banking app, you can check your account balance with just a few taps on your smartphone. Whether you’re a tech-savvy individual or someone who’s new to mobile banking, this step-by-step guide will walk you through the process in a simple, easy-to-follow manner. Let’s dive in!

Getting Started: Download and Install the ICICI Bank Mobile Banking App

The first step to checking your ICICI Bank account balance on your phone is to download the ICICI Bank mobile banking app. If you haven’t done this already, here’s how:

1. Open the App Store or Google Play Store: Depending on your smartphone, open the app store relevant to your device.

2. Search for “ICICI Bank Mobile Banking”: In the search bar, type “ICICI Bank iMobile pay” And “instaBiz: Business Banking app” and hit enter.

3. Download and Install the App: Locate the official ICICI Bank app and tap the “Install” button to download it to your phone.

4. Open the App: Once the installation is complete, open the app by tapping its icon on your home screen.

Registering and Logging In: Secure Access to Your ICICI Bank Account

Now that you have the app installed, it’s time to register and log in to your ICICI Bank account. Follow these steps to get started:

1. Enter Your Mobile Number: Open the app and enter your registered mobile number.

2. Verify Your Mobile Number: ICICI Bank will send an OTP (One-Time Password) to your registered mobile number. Enter this OTP to verify your number.

3. Set Up a Login PIN: Create a secure login PIN that you will use to access the app in the future. Make sure it’s something you can remember but hard for others to guess.

4. Log In Using Your PIN: After setting up your PIN, log in to the app using this PIN.

Navigating the App: Finding the Balance Check Option

Once you’re logged in, you need to navigate the app to find the balance check option. Here’s how:

1. Home Screen Overview: When you log in, you will see the home screen with various banking options.

2. Locate the ‘Accounts’ Section: Look for the ‘Accounts’ section, which displays your bank accounts linked to the app.

3. Select Your Account: Tap on the account for which you want to check the balance.

Checking Your ICICI Bank Account Balance: The Moment of Truth

After selecting your account, you can easily check your balance. Follow these steps:

1. View Account Details: Once you select your account, you will see a detailed view of your account, including your balance.

2. Refresh for Latest Balance: To ensure you have the latest balance, swipe down on the screen to refresh the data.

Additional Features: Making the Most of Your Mobile Banking Experience

The ICICI Bank mobile banking app is not just for checking your balance. It offers a range of features that make banking convenient:

1. Fund Transfers: Easily transfer funds to other ICICI Bank accounts or accounts with other banks.

2. Bill Payments: Pay your bills directly from the app without any hassle.

3. Recharge Services: Recharge your mobile, DTH, or data card quickly.

Tips for Safe Mobile Banking: Keeping Your Information Secure

While mobile banking is convenient, it’s important to keep your information secure. Here are some tips:

1. Use a Strong PIN: Ensure your login PIN is strong and unique.

2. Avoid Public Wi-Fi: Use mobile banking over secure networks, not public Wi-Fi.

3. Regularly Update the App: Keep the app updated to benefit from the latest security features.

How to Check Your ICICI Bank Account Balance via ATM, Passbook, and UPI:

Keeping track of your ICICI Bank account balance is crucial for managing your finances. While mobile banking is a popular choice, there are other reliable methods to check your balance. This guide will walk you through checking your balance via ATM, passbook, and UPI. Let’s get started!

Checking Your ICICI Bank Account Balance via ATM

ATMs are convenient and available 24/7, making them a great option for checking your balance. Here’s how you can do it:

1. Locate an ICICI Bank ATM: Use the ICICI Bank ATM locator on their website or app to find the nearest ATM.

2. Insert Your Debit Card: Insert your ICICI Bank debit card into the ATM slot.

3. Enter Your PIN: Type in your four-digit PIN to access your account.

4. Select ‘Balance Inquiry’: On the ATM screen, choose the ‘Balance Inquiry’ option.

5. View Your Balance: Your account balance will be displayed on the screen. You can also opt for a printed receipt.

Using an ATM is straightforward and provides instant access to your balance information.

Checking Your ICICI Bank Account Balance via Passbook

For those who prefer traditional methods, the passbook is an excellent way to keep track of your account balance. Follow these steps to update your passbook:

1. Visit Your Branch: Head to the nearest ICICI Bank branch with your passbook.

2. Locate the Passbook Update Machine: Look for the passbook update machine in the branch.

3. Insert Your Passbook: Place your passbook in the designated slot of the machine.

4. Update Your Transactions: The machine will automatically print your recent transactions and update your balance.

5. Review Your Balance: Once updated, you can see your current balance in the passbook.

Updating your passbook regularly ensures you have a physical record of your transactions and balance.

Checking Your ICICI Bank Account Balance via UPI

Unified Payments Interface (UPI) is a modern, convenient way to check your account balance directly from your smartphone. Here’s how to do it:

1. Download a UPI App: Ensure you have a UPI-enabled app like BHIM, Google Pay, or PhonePe installed on your phone.

2. Register Your Bank Account: Open the app and register your ICICI Bank account using your mobile number and debit card details.

3. Set Up a UPI PIN: Create a secure UPI PIN that you will use for transactions and balance inquiries.

4. Select ‘Check Balance’: In the UPI app, look for the ‘Check Balance’ option.

5. Enter Your UPI PIN: Type in your UPI PIN to authenticate the request.

6. View Your Balance: The app will display your current ICICI Bank account balance.

Using UPI apps makes it easy to check your balance anytime, anywhere, with just a few taps.

Tips for Safe Banking: Protecting Your Information

While using these methods to check your balance, it’s essential to keep your information secure. Here are some tips:

1. Memorize Your PINs: Avoid writing down your ATM or UPI PINs. Memorize them to keep your account secure.

2. Update Passbook Regularly: Regular updates ensure your passbook is always up-to-date with the latest transactions.

3. Use Secure Networks: When using UPI apps, ensure you are connected to a secure Wi-Fi network or use mobile data.

How to Check Your ICICI Bank Account Balance with WhatsApp Banking :

Managing your ICICI Bank account balance has never been easier with WhatsApp Banking and UPI. These modern, user-friendly services let you check your balance anytime, anywhere. Let’s explore how you can use these methods efficiently.

ICICI WhatsApp Banking: Your Banking Buddy

ICICI WhatsApp Banking is a convenient way to access your bank services through a platform you use daily. Here’s how to get started:

1. Save ICICI Bank’s WhatsApp Number: Save ICICI Bank’s official WhatsApp number (+91 86400 86400) to your contacts.

2. Send a Message: Open WhatsApp, find ICICI Bank in your contacts, and send a “Hi” message.

3. Authenticate Your Account: Follow the prompts to authenticate your account using your registered mobile number.

4. Select ‘Account Balance’: Once authenticated, type “Account Balance” or select it from the menu options.

5. View Your Balance: Your ICICI Bank account balance will be displayed instantly in the chat.

With WhatsApp Banking, you can access your account information without leaving the app you already love.

Services Available on ICICI WhatsApp Banking

Beyond checking your account balance, ICICI WhatsApp Banking offers a range of services to make your life easier:

1. Mini Statement: Get a quick view of your recent transactions.

2. Fund Transfers: Transfer money to other ICICI Bank accounts or to accounts in other banks.

3. Credit Card Details: Check your credit card outstanding balance and payment due date.

4. Loan Information: Inquire about your loan account and check your loan balance.

These services make WhatsApp Banking a versatile tool for managing your finances on the go.

Tips for Safe Banking: Protect Your Information

While using WhatsApp Banking and UPI, ensure your banking information is secure. Here are some tips:

1. Use Strong PINs: Choose strong, unique PINs for your UPI and WhatsApp Banking services.

2. Verify Contacts: Ensure you’re communicating with the official ICICI Bank WhatsApp number.

3. Update Apps Regularly: Keep your WhatsApp and UPI apps updated to the latest versions for enhanced security.

ICICI Bank Account Balance Check: Frequently Asked Questions (FAQ)

Keeping track of your ICICI Bank account balance is essential for managing your finances effectively. Whether you’re a seasoned user or a newbie, you might have some questions about the various ways to check your account balance. In this blog post, we’ll answer some frequently asked questions to help you stay informed and confident in managing your ICICI Bank account balance.

Q. What Are the Different Ways to Check My ICICI Bank Account Balance?

ICICI Bank offers several convenient methods to check your account balance. You can choose the one that suits you best:

1. Mobile Banking App: Use the ICICI Bank mobile app for a quick balance check.

2. Internet Banking: Log in to your account on the ICICI Bank website.

3. WhatsApp Banking: Send a message on WhatsApp to get your balance.

4. ATM: Check your balance at any ICICI Bank ATM.

5. Customer Care: Call the customer care number for balance inquiries.

6. Passbook: Update your passbook at any branch or passbook update machine.

7. UPI Apps: Use UPI-enabled apps like BHIM, Google Pay, or PhonePe.

Q. How Do I Register for ICICI Mobile Banking?

Registering for ICICI Mobile Banking is simple and can be done in a few steps:

1. Download the App: Download the ICICI Bank mobile banking app from the App Store or Google Play Store.

2. Register Your Mobile Number: Open the app and enter your registered mobile number.

3. Verify Your Number: Enter the OTP sent to your mobile number.

4. Set Up a Login PIN: Create a secure login PIN to access your account.

Q. Can I Check My ICICI Bank Account Balance Without Internet?

Yes, you can check your balance without internet using SMS banking or by calling the customer care number. Here’s how:

1. SMS Banking: Send an SMS with the format ‘IBAL <last six digits of your account number>’ to 9215676766.

2. Customer Care: Call 1800-103-8181 and follow the prompts to check your balance.

Q. How Do I Check My Account Balance Using WhatsApp Banking?

Using ICICI WhatsApp Banking is easy and convenient. Follow these steps:

1. Save the WhatsApp Number: Save +91 86400 86400 to your contacts.

2. Send a Message: Open WhatsApp and send a “Hi” to the saved number.

3. Authenticate Your Account: Follow the prompts to authenticate your account.

4. Select ‘Account Balance’: Type “Account Balance” or select it from the options.

5. View Your Balance: Your balance will be displayed in the chat.

Q. Is It Safe to Check My ICICI Bank Account Balance Online?

Yes, ICICI Bank uses advanced security measures to ensure your information is safe. Here are some tips to enhance security:

1. Use Strong Passwords: Create strong, unique passwords for your accounts.

2. Enable Two-Factor Authentication: Use two-factor authentication for added security.

3. Avoid Public Wi-Fi: Use secure networks when accessing your account.

Q. How Often Should I Check My Account Balance?

It’s a good habit to check your account balance regularly to monitor your spending and ensure there are no unauthorized transactions. You might want to check:

1. After Large Transactions: Verify the balance after making significant transactions.

2. Before Payments: Check your balance before paying bills or making purchases.

3. Weekly: A weekly check helps you stay on top of your finances.

Q. What Should I Do If I Find an Unauthorized Transaction?

If you notice any unauthorized transactions, take the following steps immediately:

1. Contact Customer Care: Call ICICI Bank customer care to report the issue.

2. Block Your Card: Temporarily block your debit or credit card if necessary.

3. Change Passwords: Change your internet and mobile banking passwords.

Q. Can I Check My Balance at Any ATM?

Yes, you can check your ICICI Bank account balance at any ICICI Bank ATM. Here’s how:

1. Insert Your Debit Card: Insert your card into the ATM.

2. Enter Your PIN: Type your PIN to access your account.

3. Select ‘Balance Inquiry’: Choose the ‘Balance Inquiry’ option to view your balance.