Manage your finances effortlessly from home with ICICI Net Banking Login. Access personal, corporate, and NRI banking services securely and conveniently.

ICICI Net Banking Login: How to Access Personal, Corporate, and NRI Banking

Are you tired of waiting in long queues at the bank? Do you want to manage your finances effortlessly from the comfort of your home? Look no further! ICICI Net Banking offers a seamless and user-friendly platform for all your banking needs. Whether you’re a personal account holder, a corporate client, or an NRI customer, ICICI Net Banking Login is your gateway to convenient and secure banking.

In this blog post, we’ll walk you through the various aspects of ICICI Net Banking, including the services offered, their uses and benefits, and a step-by-step guide to get you started.

Net Banking Services: What You Can Do with ICICI Net Banking

ICICI Net Banking is a versatile platform that offers a wide range of services to cater to your diverse banking needs. Let’s take a closer look at some of the key services available:

1. Account Management: With ICICI Net Banking, you can view your account balance, transaction history, and download account statements at any time.

2. Fund Transfers: Easily transfer funds between your own accounts or to other bank accounts using NEFT, RTGS, or IMPS services.

3. Bill Payments: Pay your utility bills, credit card bills, and even recharge your mobile phone with just a few clicks.

4. Investment Services: Manage your investments, buy and sell mutual funds, and check your demat account details effortlessly.

5. Loan Services: Apply for personal, home, or auto loans, and track your loan application status online.

6. Card Services: Request a new debit or credit card, set transaction limits, and view your card statements securely.

7. Tax Services: File your income tax returns, pay taxes, and view TDS details with ease.

8. Forex Services: Conveniently buy and sell foreign currency, and manage your forex card.

9. Insurance Services: Buy insurance policies, renew existing ones, and file claims online without any hassle.

10. Secure Messaging: Communicate securely with the bank for any queries or service requests through the net banking portal.

Uses and Benefits of ICICI Net Banking

ICICI Net Banking is not just about convenience; it offers numerous benefits that can enhance your banking experience. Here are some of the key uses and benefits:

1. 24/7 Access: You can access your account and perform transactions anytime, anywhere, without being restricted by bank hours.

2. Time-Saving: Skip the queues and avoid trips to the bank by managing your finances online.

3. Secure Transactions: ICICI Net Banking uses advanced security measures to ensure your transactions are safe and secure.

4. Real-Time Updates: Get instant notifications and updates on your account activities and transactions.

5. Easy Monitoring: Keep track of your spending, manage your budget, and monitor your investments with ease.

6. Cost-Effective: Save on transaction fees and charges that are often associated with traditional banking methods.

7. Convenience: Pay bills, transfer funds, and manage investments without leaving your home.

8. Personalized Services: Enjoy tailored banking services and offers based on your account and transaction history.

9. Environmental Friendly: Reduce paper usage by opting for e-statements and online transactions.

10. Comprehensive Support: Access a wide range of banking services and get support through the online help desk.

Guide to ICICI Net Banking Login

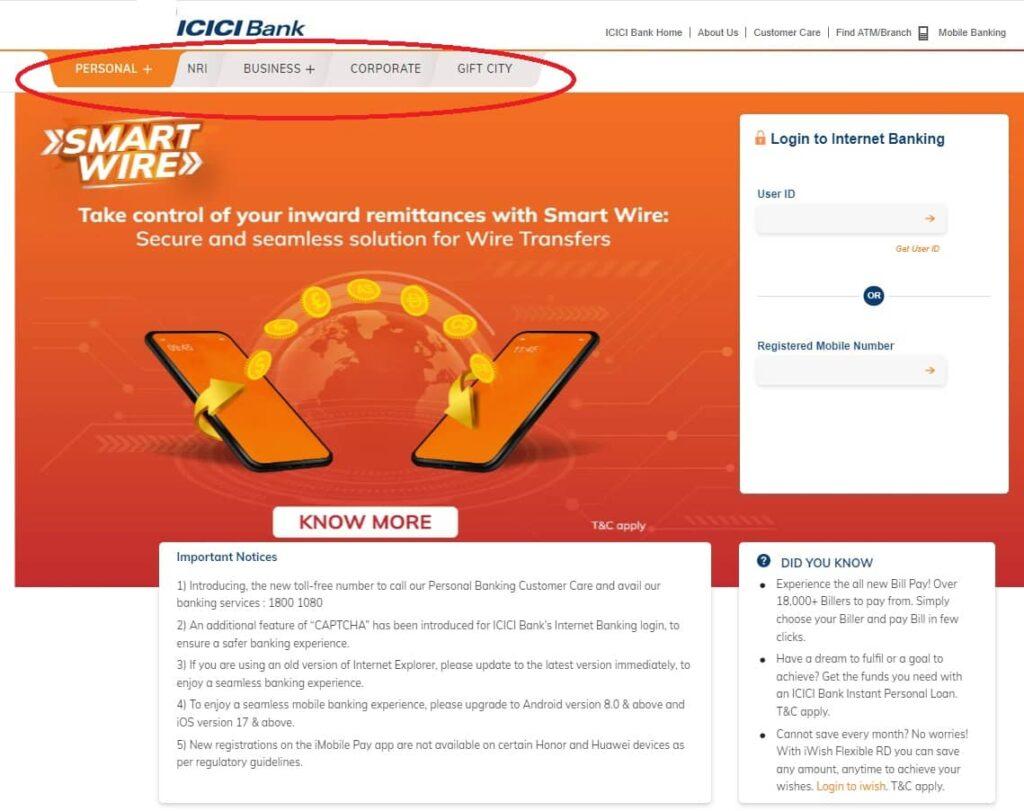

Ready to dive into the world of online banking with ICICI? Here’s a simple step-by-step guide to help you get started with ICICI Net Banking Login:

Register for Net Banking

If you’re a first-time user, you’ll need to register for ICICI Net Banking. Follow these steps:

- Visit the official ICICI Bank website.

- Click on the ‘Login’ button and select ‘Get User ID’.

- Enter your account number, registered mobile number, and email ID.

- Follow the prompts to verify your details and create your User ID and password.

How to Logging In

Once you’ve registered, you can log in to your ICICI Net Banking account:

Logging into ICICI Personal Banking

Personal banking with ICICI Net Banking is designed to give you complete control over your finances from the comfort of your home. Here’s how to log in:

1: Register for Net Banking

- Visit the official ICICI Bank website.

- Click on the ‘Login’ button at the top right corner.

- Select ‘Get User ID’ to start the registration process.

- Enter your account number, registered mobile number, and email ID.

- Follow the instructions to verify your details.

- Create your User ID and password.

2: Login Process

- Go to the ICICI Bank website and click on ‘Login’.

- Enter your User ID and password.

- Complete the two-factor authentication by entering the OTP sent to your registered mobile number.

- Click ‘Login’ to access your personal banking dashboard.

3: Navigating Your Dashboard

Once logged in, you can easily navigate through your dashboard to manage your accounts, transfer funds, pay bills, and more.

Account Summary: View your account balance and recent transactions.

Fund Transfer: Transfer money to other accounts within ICICI or to other banks.

Bill Payments: Pay utility bills and recharge your mobile.

Investments: Manage your investments in mutual funds and view your demat account.

Logging into ICICI Corporate Banking

ICICI Corporate Net Banking is tailored to meet the needs of businesses, providing a range of services that help manage corporate finances efficiently. Here’s how you can log in:

1: Register for Corporate Net Banking

- Visit the ICICI Bank website.

- Click on ‘Corporate Banking’ and select ‘Get Corporate User ID’.

- Enter your corporate account details, including the account number and registered email ID.

- Follow the prompts to verify your corporate information.

- Create your Corporate User ID and password.

2: Login Process

- Visit the ICICI Bank website and select ‘Corporate Banking Login’.

- Enter your Corporate User ID and password.

- Complete the two-factor authentication by entering the OTP sent to your registered mobile number.

- Click ‘Login’ to access your corporate banking dashboard.

3: Navigating Your Corporate Dashboard

Your corporate dashboard is designed to streamline business transactions and financial management.

Account Management: View account balances and transaction history.

Bulk Payments: Process bulk payments, including salary disbursements and vendor payments.

Trade Services: Manage trade finance services such as letters of credit and bank guarantees.

Cash Management: Optimize your company’s cash flow with advanced cash management services.

Logging into ICICI Bank NRI Banking

For Non-Resident Indians (NRIs), ICICI offers a comprehensive net banking platform that caters to your unique banking needs. Here’s how to log in:

1: Register for NRI Net Banking

- Go to the ICICI Bank website.

- Click on ‘NRI Banking’ and select ‘Get NRI User ID’.

- Enter your NRI account number, registered mobile number, and email ID.

- Follow the instructions to verify your NRI details.

- Create your NRI User ID and password.

2: Login Process

- Visit the ICICI Bank website and select ‘NRI Banking Login’.

- Enter your NRI User ID and password.

- Complete the two-factor authentication by entering the OTP sent to your registered mobile number.

- Click ‘Login’ to access your NRI banking dashboard.

3: Navigating Your NRI Dashboard

The NRI dashboard is tailored to manage your NRI accounts and financial activities effectively.

Account Management: View your NRI account balance and recent transactions.

Fund Transfer: Transfer funds to accounts in India or abroad using various transfer options.

Investment Services: Invest in mutual funds, manage your demat account, and more.

Forex Services: Buy and sell foreign currency and manage your forex card.

Making Transactions

Performing transactions on ICICI Net Banking is straightforward:

- Fund Transfer:

- Select ‘Fund Transfer’ from the menu.

- Choose the type of transfer (within ICICI, to other banks, etc.).

- Enter the recipient’s details and the amount.

- Verify the details and confirm the transaction.

- Bill Payment:

- Select ‘Bill Payment’ from the menu.

- Choose the biller from the list or add a new biller.

- Enter the bill amount and verify the details.

- Confirm the payment.

- Investment:

- Select ‘Investments’ from the menu.

- Choose the type of investment (mutual funds, demat account, etc.).

- Follow the prompts to complete the transaction.

- Loan Services:

- Select ‘Loans’ from the menu.

- Choose the type of loan and follow the prompts to apply or manage your loan.

- Card Services:

- Select ‘Cards’ from the menu.

- Request a new card, set transaction limits, or view statements.

Security Measures

ICICI Net Banking takes your security seriously. Here are some tips to keep your account safe:

- Strong Passwords: Use a strong, unique password and change it regularly.

- Two-Factor Authentication: Enable two-factor authentication for added security.

- Logout: Always log out of your account after completing your transactions.

- Secure Connection: Use a secure and private internet connection for banking activities.

- Alerts: Set up transaction alerts to monitor your account activities.

FAQ Related ICICI Net Banking Login:

Are you wondering how to log in to your ICICI Net Banking account? Whether you’re managing personal finances, corporate accounts, or NRI banking, we’ve got you covered. In this section, we’ll answer some frequently asked questions about ICICI Net Banking Login, making the process easy and straightforward. Let’s dive in!

How Do I Register for ICICI Net Banking?

First things first, if you’re new to ICICI Net Banking, you need to register. Here’s how:

- Visit the official ICICI Bank website.

- Click on the ‘Login’ button at the top right corner.

- Select ‘Get User ID’ to begin the registration process.

- Enter your account number, registered mobile number, and email ID.

- Follow the prompts to verify your details and create your User ID and password.

What if I forget my User ID or password?

Don’t worry! Click on ‘Forgot User ID’ or ‘Forgot Password’ on the login page and follow the instructions to reset them.

Can multiple users access corporate banking?

Yes, you can set up multiple users with different access levels for your corporate account. Contact your ICICI relationship manager for assistance.

How do I get assistance with NRI banking?

ICICI offers dedicated NRI customer support. You can reach them via phone, email, or live chat for any assistance.

What Services Can I Access with ICICI Net Banking?

ICICI Net Banking provides a comprehensive range of services. Here’s a quick look at what you can do:

Account Management: Check your account balance, view transaction history, and download statements.

Fund Transfers: Transfer money within ICICI or to other banks using NEFT, RTGS, or IMPS.

Bill Payments: Pay utility bills, credit card bills, and recharge your mobile.

Investments: Manage your mutual funds, buy and sell stocks, and view your demat account.

Loans: Apply for personal, home, or auto loans, and track your loan status.

Cards: Request new debit or credit cards, set transaction limits, and view statements.

Tax Services: File your income tax returns, pay taxes, and view TDS details.

Forex Services: Buy and sell foreign currency, and manage your forex card.

Insurance: Purchase insurance policies, renew them, and file claims online.

Is ICICI Net Banking safe?

Absolutely! ICICI Net Banking uses advanced security measures like two-factor authentication and encryption to protect your data.

What If I Face Issues While Logging In?

If you encounter any issues while logging in, don’t panic! Here are a few common problems and solutions:

Forgot User ID or Password: Use the ‘Forgot User ID’ or ‘Forgot Password’ links on the login page to reset your credentials.

OTP Not Received: Ensure your mobile number is registered with the bank and has network coverage. Request a new OTP if necessary.

Account Locked: After multiple failed login attempts, your account may be locked for security reasons. Contact ICICI customer support to unlock it.

How can I contact ICICI customer support?

You can reach ICICI customer support via phone, email, or live chat. Visit the ICICI website for contact details.

Conclusion

ICICI Net Banking is a powerful tool that brings the bank to your fingertips. With a wide range of services, robust security features, and an easy-to-use interface, managing your finances has never been simpler. Whether you’re handling personal accounts, corporate finances, or NRI banking needs, ICICI Net Banking Login ensures that you have complete control over your financial activities. So, why wait? Register today and experience the convenience and efficiency of online banking with ICICI. Happy banking!