Income Tax Calculator: Calculate Your Taxes Easily Online

Calculating income tax can be a complex and time-consuming process, especially with frequent updates in tax regulations. The Income Tax Calculator simplifies this task, providing individuals with an accurate and quick way to estimate their tax liability. Whether you’re a salaried employee, a business owner, or a freelancer, this tool helps you plan your taxes efficiently.

What is an Income Tax Calculator? [Definition]

An Income Tax Calculator is an online tool designed to help taxpayers estimate their tax liability for a specific financial year. It takes into account factors like income, deductions, exemptions, and the tax regime (old or new) to compute the amount of tax payable.

Short Definition: An Income Tax Calculator is an online tool that estimates your tax liability based on your income, deductions, and selected tax regime.

It is especially useful for:

- Understanding how much tax you owe.

- Comparing tax liability under the old and new tax regimes.

- Planning investments to maximize deductions.

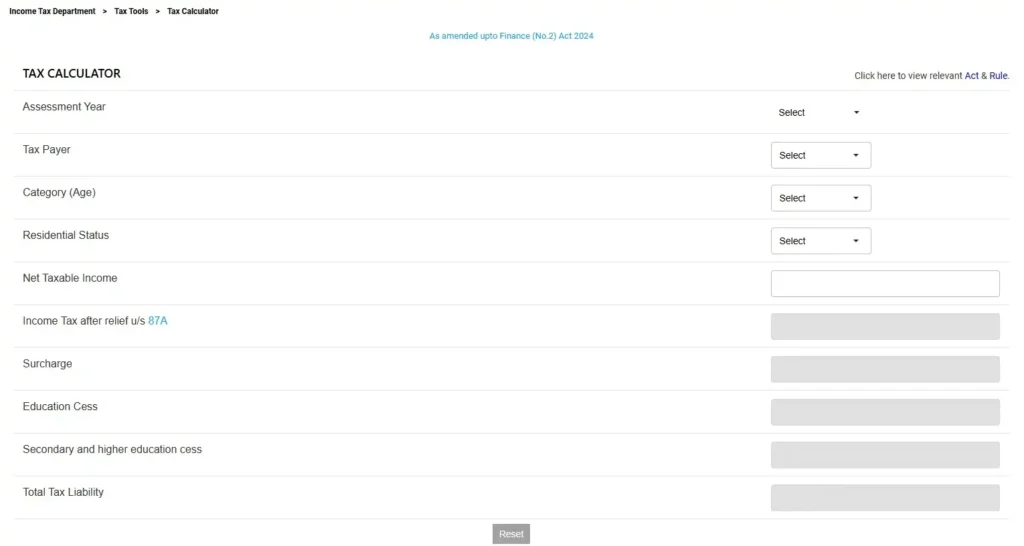

How to Use the Income Tax Calculator?

Using the Income Tax Calculator is simple and user-friendly. Follow these steps:

- Select the Financial Year: Choose the financial year for which you want to calculate tax (e.g., FY 2024-25).

- Enter Your Income Details: Input your annual income from all sources, such as salary, business income, or interest.

- Add Deductions and Exemptions: Include eligible deductions like Section 80C investments, HRA exemptions, or medical insurance under Section 80D.

- Choose the Tax Regime: Select either the old regime or the new regime as per the latest FY 2024-25 rules.

- Calculate: Click on the “Calculate” button to get an estimate of your tax liability.

Try the Income Tax Calculator now and simplify your tax planning!

Top Benefits of Using the Income Tax Calculator

- Time-Saving: Automates calculations, saving you from manual computations.

- Accurate Estimates: Eliminates errors, ensuring precise results.

- Comparison of Tax Regimes: Helps you choose between the old and new tax regimes.

- Investment Planning: Guides you in planning tax-saving investments effectively.

Old vs. New Tax Regime: Comparison Table

Here is a quick comparison of tax rates under the old and new regimes for FY 2024-25:

| Income Slab (₹) | Old Regime Tax Rate (%) | New Regime Tax Rate (%) |

|---|---|---|

| Up to ₹2,50,000 | Nil | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% | 10% |

| Above ₹10,00,000 | 30% | 20% |

- Old Regime: Includes deductions such as Section 80C, 80D, and HRA.

- New Regime: Offers lower tax rates but eliminates most exemptions and deductions.

FAQs

Q1: Can I use the calculator for previous financial years?

Yes, you can select past financial years (e.g., FY 2023-24) to compute taxes based on historical tax rates and rules.

Q2: Does the calculator account for updates in tax laws?

Yes, reliable calculators are updated annually to reflect changes in tax regulations, such as the Union Budget announcements.

Q3: What details do I need to use the Income Tax Calculator?

You need to input your total income, eligible deductions (e.g., Section 80C, HRA, 80D), and select the appropriate tax regime.

Q4: What are the current income tax slabs for FY 2024-25?

Refer to the table in the “Old vs. New Tax Regime” section for detailed tax rates.

Conclusion: Simplify Your Tax Calculations Today

The Income Tax Calculator is an essential tool for every taxpayer in India. It not only simplifies tax calculations but also empowers you to make informed financial decisions. By understanding your tax liability and planning investments, you can save money and avoid last-minute tax filing stress.