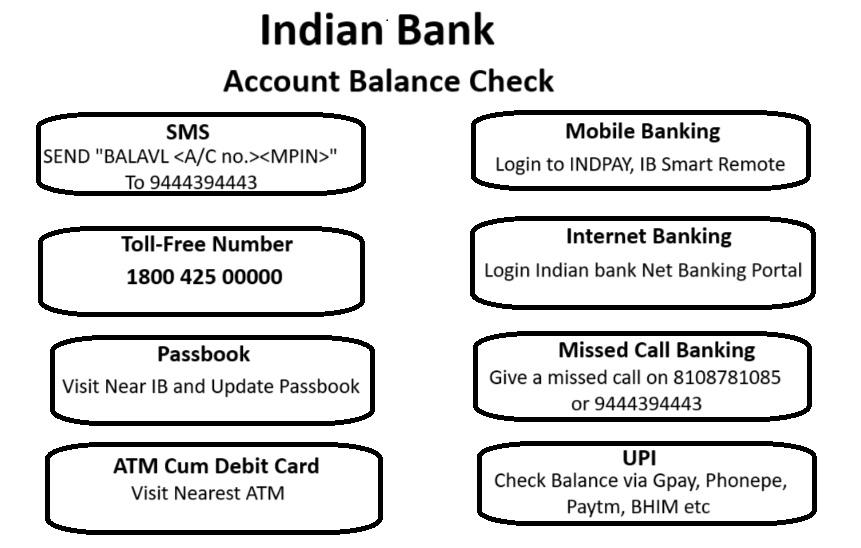

Keeping track of your finances is essential, and knowing your Indian bank account balance is a key part of that. Luckily, checking your balance has never been easier. With a few simple steps, you can stay on top of your money without any hassle. Let’s dive into the various methods you can use for an Indian bank account balance check.

Stay Updated with Your Indian Bank Account Balance!

Well, checking your Indian Bank account balance is now as easy as pie! Let’s dive into a simple step-by-step guide that will keep you informed about your finances without any hassle. Trust me, it’s super easy!

Toll Free Number : Dial in to Discover Your Balance

First things first, grab your phone – yes, that precious little buddy of yours! All you need to do is dial the Indian Bank balance enquiry number. It’s like making a quick call to an old friend, except this friend tells you exactly how much money you have! Just dial 1800-425-00000 from your registered mobile number, and voilà, you’ll receive an SMS in no time with your current balance.

Quick Balance Checks with Just a Missed Call!

Ever wondered if there’s a magic trick to check your Indian Bank account balance without logging into an app or visiting a branch? Guess what? There is, and it’s as simple as making a missed call. Yes, you read that right! Let’s break down how you can stay on top of your finances with just a ring.

Step 1: Set Up Your Number

Firstly, make sure your mobile number is linked to your Indian Bank account. If it’s not, a quick trip to your nearest branch or a call to customer service can fix that in no time. You need this to tap into the missed call service.

Step 2: Give a Ring to Know Your Thing!

Once your number is all set, just dial 09289592895 or 96776 33000 from your registered mobile phone. Don’t wait for an answer though! Hang up after a ring or two—yes, it’s that easy! This little action costs you nothing but a few seconds of your time.

Step 3: Check Your SMS for the Magic Numbers

After your quick call, Indian Bank works its magic. Within a few moments, you’ll receive an SMS. This isn’t just any SMS, though. It’s the golden ticket that reveals your account balance! All the details you need, right in your palm.

So, whether you’re sipping coffee at a café or taking a break at work, a simple missed call can keep you informed about your money. No internet needed, no long waits, just a quick ring away! Isn’t that just wonderful?

SMS Service : Never Miss a Beat with SMS Balance Checks!

Have you ever been in a rush and needed to check your bank balance quickly? Well, Indian Bank has got your back with its handy SMS service. Let’s walk through how you can get your account balance sent straight to your phone, without any app or internet fuss. It’s super easy and lightning fast!

Step 1: Register Your Mobile Number

First things first, your mobile number needs to be linked to your Indian Bank account. If you haven’t done this yet, don’t worry! A quick call to customer service or a visit to your local branch will get you sorted in no time. This is your first step to unlocking the magic of SMS balance checks.

Step 2: Send a Simple SMS

Once your number is all set up, just type “BALAVL” followed by your account number and the last four digits of your ATM PIN. Then, send this message to 9444394443. Remember, the format is key here, so make sure you’ve got it right to avoid any hiccups.

Step 3: Voila! Check Your Phone

In just a moment or two after sending your SMS, you’ll receive a reply. What’s in it? The exact details of your current account balance! It’s like having a mini bank teller right in your message inbox. How convenient is that?

So, whether you’re in line at the grocery store or taking a quick break at work, keeping tabs on your money is as easy as sending a text. The Indian Bank SMS service ensures you’re always informed and in control of your finances with just a few taps on your phone.

WhatsApp Bank Service : Way to Bank Balance Checks with WhatsApp!

Tech enthusiasts and convenience seekers! Isn’t it marvelous how our favorite apps can simplify life’s little tasks? If you’re an Indian Bank customer, you’re in for a treat. Checking your bank balance is as easy as chatting on WhatsApp. Let’s dive into how you can tap into this cool feature.

Step 1: Say Hi to Your New Banking Buddy

First off, make sure your mobile number is linked to your Indian Bank account. Got that sorted? Great! Now, save the official Indian Bank WhatsApp number, 9444394443 or 875 442 42 42, to your contacts. Open WhatsApp, refresh your contacts list, and send a simple “Hi” to start a conversation. It’s like texting a friend, but this friend helps you with your bank balance!

Step 2: Follow the Prompts

After your initial “Hi”, you’ll get a menu of options to choose from. Just type and send the number corresponding to the ‘Balance Check’ option. It’s like choosing your next Netflix show, but instead, you’re picking how to manage your finances!

Step 3: Receive Your Balance Instantly

Once you select the balance check option, the magic happens. Within seconds, you’ll receive a message detailing your current account balance. It’s fast, secure, and you didn’t even have to leave your favorite chat app. How cool is that?

So next time you’re mid-chat and suddenly remember you need to check your balance, just switch over to your Indian Bank chat. It’s quick, it’s easy, and it feels like your bank is just another one of your friends on WhatsApp.

Mobile Banking : Way to Balance Checks with Indian Bank Mobile Banking!

Ever thought your smartphone could also be your personal teller? Well, with Indian Bank’s mobile banking app, it’s just that! Let’s break down how you can check your bank balance anytime, anywhere, without breaking a sweat. It’s all at your fingertips!

Step 1: Get Set with the App!

First things first, you’ll need the Indian Bank mobile banking app installed on your phone. If it’s not already on your home screen, hop onto your app store, download it, and then just log in. Setting up is easy, and you only need to do it once. Make sure your phone number is linked to your bank account for seamless access.

Step 2: Log In and Navigate

Once you’re in, navigating the app is a breeze. Enter your login credentials (keep these handy and secure!), and you’ll land on the main dashboard. This is your command center for everything from balance checks to fund transfers. Looking for the Indian Bank account balance check? Just a tap away!

Step 3: Discover Your Balance Instantly

On the dashboard, find and tap on the ‘Account Balance’ option. It might feel like magic, but within seconds, your balance will be displayed right on your screen. It’s accurate, updated, and completely secure. Need more details? The ‘Mini Statement’ option is right there to give you the latest transactions at a glance.

So whether you’re in a cafe, on a train, or just lounging at home, keeping tabs on your finances has never been easier. No queues, no waiting, just quick information on the go.

Why Mobile Banking Rocks!

Mobile banking with Indian Bank isn’t just about checking your balance; it’s about managing your entire financial life effortlessly. It’s like carrying a bank branch in your pocket—minus the waiting time. Plus, the app’s user-friendly interface makes financial management something you might actually look forward to!

IndOASIS App!

Are you ready to explore the ultimate convenience of checking your Indian Bank account balance through the IndOASIS app? It’s like having a bank in your pocket, only more fun! Let’s walk through this super simple process together.

Step 1: Download and Dive In!

Kick things off by downloading the IndOASIS app from your favorite app store. Whether you’re team Android or iOS, this app has got you covered. Once downloaded, open it up and get ready for a smooth setup. Register using your mobile number linked to your Indian Bank account, and follow the prompts to set up your login credentials. Exciting, isn’t it?

Step 2: Log In and Look Around

After setting up, log in with your fresh credentials. Welcome to the IndOASIS dashboard—your new financial command center! Here, you can manage everything, but today we’re focused on how to check your bank balance. Feel the thrill of financial control at your fingertips!

Step 3: A Tap to Your Balance

Now, for the main event: checking your balance. Look for the ‘Accounts’ option on the dashboard. Tap it, and you’ll see your account(s) listed. Choose the one you want to check, tap on it, and there! Your balance will display quicker than you can say “Show me the money!” It’s simple, fast, and you didn’t even have to leave your couch.

Why You’ll Love the IndOASIS App

This app isn’t just about checking your balance; it’s about making your financial life a breeze. With IndOASIS, you can transfer funds, pay bills, and even apply for loans—all while wearing your pajamas at home! The user-friendly interface makes it easy for anyone to navigate, and the security features keep your money safe.

Net Banking : Check Your Balance Online Which Means Indian Bank Net Banking!

Are you ready to experience the magic of checking your Indian Bank account balance from the comfort of your home? Net banking is your ticket to this convenience, and I’m here to guide you through each step with a smile. Let’s make banking breezy!

Step 1: Set Up Your Net Banking

First off, if you haven’t yet registered for Indian Bank net banking, no worries! It’s a simple process. Visit the official Indian Bank website and find the ‘Net Banking’ section. Click on ‘Register’ and fill in the required details like your account number and registered mobile number. Follow the steps, set your password, and you’re all set!

Step 2: Log In and Explore

Now that you’re registered, log into your net banking account with your user ID and password. Welcome to your financial dashboard! Here, everything you need to manage your money is just a click away. Feeling the power yet?

Step 3: Instant Balance Check

For the all-important Indian Bank account balance check, look for the option labeled ‘Accounts’ or ‘Balances’ on the main menu. Click on it, and select your account. Your balance will pop up faster than you can say “Show me the money!” It’s that easy, and you didn’t even have to move an inch, well, maybe just your fingers.

Why Net Banking Makes Life Easier

Net banking is like having a personal bank branch on your laptop or smartphone. Apart from checking your balance, you can transfer funds, pay bills, and manage multiple accounts without standing in a single queue. It’s secure, swift, and lets you handle banking on your terms.

UPI: Your Quick Ticket to Balance Checks!

Ever wish you could check your Indian Bank account balance with just a few taps? Enter UPI, your modern-day magic wand. Let’s zap through how you can use this nifty tool for quick balance inquiries, all from your smartphone!

Step 1: Get Set with Your UPI App

First things first, make sure you have a UPI-enabled app installed on your phone. This could be any popular app like BHIM, Google Pay, or PhonePe. Once installed, link it to your Indian Bank account by verifying your mobile number and setting up a UPI PIN. Simple and secure!

Step 2: Check Your Balance Instantly

To start the magic, open your UPI app and head to the home screen. Look for the ‘Bank Account’ section, then select your linked Indian Bank account. See that ‘Check Balance’ button? Give it a tap, enter your UPI PIN, and boom! Your account balance will display quicker than you can snap your fingers.

Why UPI Makes Your Life Easier

Not only is using UPI super fast, but it’s also incredibly convenient. Whether you’re at a store, in a cab, or chilling at home, a quick balance check is always just a few taps away. Plus, UPI doesn’t just limit you to balance inquiries; you can also pay bills, send money, and more—all in one app.

Bank Passbook : Checking Your Balance with a Passbook!

Sometimes, going back to basics like using your passbook for an Indian Bank account balance check can be surprisingly satisfying. Let’s stroll down memory lane and get your balance the classic way!

Step 1: Dust Off That Passbook

First up, locate your passbook. Yes, that little book buried somewhere in your drawer. It’s more than just a booklet; it’s your financial diary! Once you’ve found it, give yourself a pat on the back. You’re on your way to unlocking your banking history!

Step 2: Visit Your Friendly Bank Teller

Now for a little outing. Head over to your nearest Indian Bank branch. Take your passbook with you, of course. At the bank, look for the passbook update machine or approach a teller. They can print all your recent transactions and balance info directly into your passbook. It’s like watching your financial story print right before your eyes!

Why This Method is Still Cool

There’s something genuinely gratifying about flipping through a passbook. Each page shows a part of your financial journey. Sure, it’s a bit more time-consuming than digital methods, but it’s secure, and you get a physical record of all transactions.

Plus, visiting the bank can be a mini adventure. You might even bump into a neighbor or make a new friend in line!

ATM Centre : A Swift Way to Check Your Indian Bank Balance!

Ready for a quick trip to the nearest ATM? Checking your Indian Bank account balance at an ATM is like a mini treasure hunt, only instead of a map, you have your ATM card. Let’s embark on this quest together!

Step 1: Start Your Engine (or your feet)!

First up, locate your nearest Indian Bank ATM or any ATM that’s part of the network. Grab your ATM card, and let’s get moving! It’s a perfect excuse to get a little fresh air.

Step 2: Swipe, Select, Smile!

Once you’re at the ATM, insert your card and enter your PIN. Be like a secret agent entering a code! Then, look for the ‘Balance Enquiry’ option on the screen. Select it, and in a flash, the machine will display your account balance. Quick and easy, right?

Why the ATM Route Rocks!

Using an ATM for an Indian Bank account balance check is not only convenient but also super quick. It’s perfect for those days when you’re out and about, need to withdraw some cash, and check your balance all in one go.

Conclusion

Stay on top of your finances with ease using various methods for an Indian Bank account balance check. From missed calls and SMS to WhatsApp, mobile banking, and more, checking your balance is quick and hassle-free. Dive into these convenient options and ensure you’re always informed about your financial status.