Apply for a new PAN card online effortlessly! Follow this step-by-step guide to apply via NSDL & UTIITSL, check fees, track status, and download e-PAN instantly. Get your PAN card hassle-free in 2025!

New PAN Card Apply Online – Step-by-Step Guide (2025)

Applying for a new PAN card online is now easier than ever. Whether you are an individual, business entity, or an NRI, you can apply for a PAN card through NSDL or UTIITSL portals from the comfort of your home. In this guide, we will walk you through the step-by-step process, required documents, fees, and other important details.

What is a PAN Card?

A Permanent Account Number (PAN) is a government-issued 10-digit alphanumeric code that serves as a unique identifier for individuals and businesses conducting financial transactions in India. It is essential for financial transactions such as opening a bank account, filing taxes, and investing in securities.

Who Needs a PAN Card?

- Indian citizens above 18 years of age.

- Companies, partnerships, and businesses.

- NRIs and foreign nationals with financial dealings in India.

- Minors (can apply with a guardian).

Documents Required for New PAN Card

The following documents are required based on the applicant type:

For Individuals:

- Identity Proof (Aadhaar, Voter ID, Passport, Driving License)

- Address Proof (Aadhaar, Utility Bill, Rent Agreement)

- Date of Birth Proof (Birth Certificate, Matriculation Certificate)

For Companies/Firms:

- Certificate of Incorporation

- Partnership Deed (for partnership firms)

- Company PAN application form signed by an authorized person

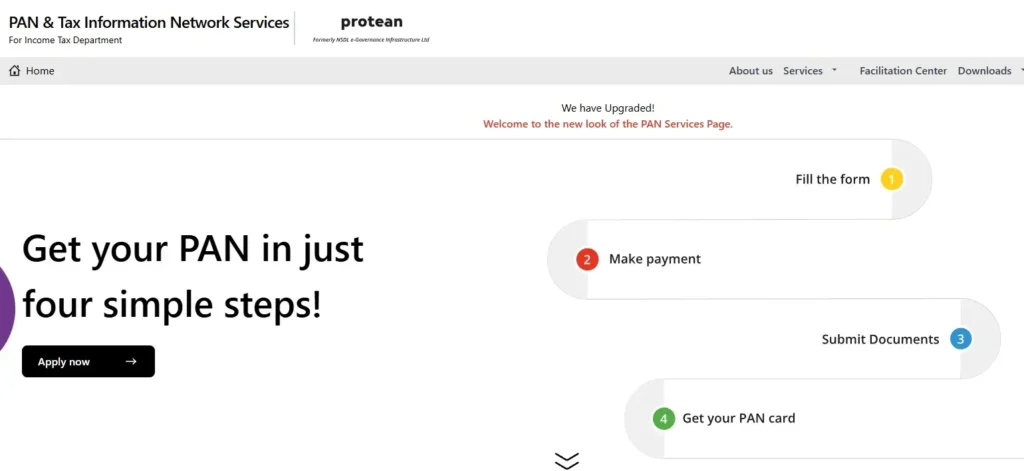

How to Apply for a PAN Card Online Step-by-Step? (2025 Guide)**

- Visit the official PAN card application portal: NSDL or UTIITSL.

- Choose the PAN Card application type (Form 49A for Indian citizens, Form 49AA for foreigners).

- Fill out the online application form with your personal details.

- Upload required documents (Aadhaar, address proof, etc.).

- Make the payment using Credit/Debit Card, Net Banking, or UPI.

- Submit the application and download the acknowledgment slip.

- Track your PAN card status using the acknowledgment number.

PAN Card Application Fees (2025)

| Category | Physical PAN Fee | e-PAN Fee |

|---|---|---|

| Indian Citizens | ₹101 | ₹66 |

| Foreign Citizens | ₹1,011 | ₹66 |

- Payment modes:

- Online: Credit/Debit Card, Net Banking, UPI.

- Offline: Demand Draft in favor of ‘Protean – Mumbai’.

How to Track Your PAN Card Application Status?

- Use your acknowledgment number to check PAN card status on our website.

- PAN card is usually issued within 10-15 business days.

What is Instant e-PAN and How to Apply?

Instant e-PAN is a digital PAN card issued online by the Income Tax Department using Aadhaar verification. It is processed instantly and can be downloaded online. To apply, visit the Income Tax e-Filing Portal and select the ‘Instant e-PAN’ option.

How to Download an e-PAN Card Online Instantly?

Once your PAN card is approved, you can download your e-PAN by following our Guide to Download e-PAN Card.

FAQs

1. What is the procedure to apply for a PAN card online?*

👉 To get a PAN card online, access our Full PAN Card Application Walkthrough, complete Form 49A, submit required documents, make the payment, and finish the application process. You can also track the status online using the acknowledgment number. You can check the progress of your application using the acknowledgment number on the official tracking portal.

2. What is the expected delivery time for a PAN card after application?*

👉 A PAN card is usually issued within 10-15 working days after application submission. You can track the status online.

3. Is it possible to apply for a PAN card without an Aadhaar card?*

👉 Yes, Aadhaar is not mandatory; you can use alternate identity documents like a passport, voter ID, or driving license to apply for a PAN card.

4. Is e-PAN valid as a normal PAN card?

👉 Yes, e-PAN is valid just like a physical PAN and can be used for all financial and tax-related transactions.

5. What are the charges for obtaining a new PAN card?*

- Indian citizens: ₹101 for a physical PAN, ₹66 for e-PAN

- Foreign citizens: ₹1,011 for a physical PAN, ₹66 for e-PAN

Final Words

Applying for a new PAN card online is simple and convenient. By following this guide, you can easily complete the process without any hassle. If you have any questions, let us know in the comments!

✅ Share this guide with friends and family who need a PAN card!