Open a new SBI account easily with step-by-step guidance. Learn about documents, KYC, online application, and account benefits.

How to Open a New SBI Account:

If you’ve been thinking about opening a new SBI account, don’t worry—it’s easier than you think. With a few straightforward steps, you’ll be set to enjoy the services of one of India’s leading banks. Whether you prefer an offline visit to the bank or want to take the online route, I’ve got you covered. Let’s break down the SBI new account process in simple points!

1. Pick the Right Account Type for You

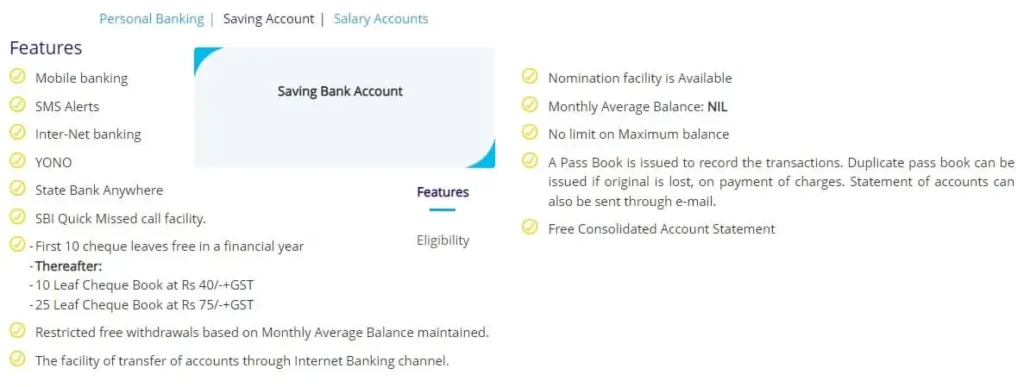

First things first, you’ll need to decide what kind of SBI account you want to open. The most common options include savings accounts, current accounts, and salary accounts. Think about how you plan to use the account, whether for saving money or managing day-to-day expenses.

If you want a simple savings account, SBI provides zero-balance account options. This means you don’t need to maintain a minimum balance, making it incredibly convenient!

2. Gather the Necessary Documents

Before heading to the bank or applying online, make sure you’ve got all the required documents. Here’s what you’ll need:

- Proof of identification (such as Aadhaar card, PAN card, etc.)

- Address proof (like utility bills, passport, etc.)

- Passport-sized photographs

- PAN card (or Form 60 if you don’t have one)

Having these documents ready will save you time and make the SBI new account process smoother.

3. Visit the Nearest SBI Branch or Use the Online Application

If you’re more of an in-person kind of person, visit the nearest SBI branch with your documents. Just walk up to the help desk and ask for the SBI new account opening form. You’ll have to provide basic details such as your name, address, and contact information. Hand over your documents, and the bank staff will verify them.

But if you prefer the comfort of your home, the online process is just as easy. Simply head over to the SBI official website. Here, you’ll find the option to open a new account under the “Personal Banking” section. Fill in the online form and upload scanned copies of your documents.

4. Complete KYC Verification

Whether you apply online or offline, you’ll need to complete the Know Your Customer (KYC) process. If you’re at the branch, this happens right away when you submit your documents. For online applications, a bank representative may visit you to verify your documents in person.

The KYC process ensures that all your details are correct, making your SBI new account secure and valid.

5. Set Up Your Debit Card and Internet Banking

Once your account is active, you’ll want to take full advantage of SBI’s services. The bank will provide you with a debit card, which you can use for ATM withdrawals and online purchases. If you’ve applied online, you can expect your debit card to be delivered to your address.

Next, don’t forget to activate your internet banking! You can register for online banking services through the official SBI website. With this, managing your account becomes super easy—you can check balances, transfer money, and pay bills from the comfort of your home.

6. Deposit Money into Your New Account

Your SBI new account is open, but it’s empty! It’s time to deposit some money. You can do this by visiting a branch or transferring funds online from another account. You can even deposit a cheque if that’s more convenient.

For those who opt for a zero-balance account, you don’t have to worry about this step right away. But eventually, you’ll want some money in there to start using the account.

7. Download the SBI YONO App

To make your life easier, SBI offers a mobile banking app called YONO (You Only Need One). This app is a one-stop shop for all your banking needs. You can check your balance, transfer money, and even apply for loans—all from your phone.

Downloading the app is a smart move, as it gives you 24/7 access to your new SBI account without ever needing to visit a branch.

8. Nominate a Beneficiary

Another important step when opening a new SBI account is to nominate someone. This ensures that, in case of an emergency, your account funds will go to a person you trust. You can easily add a nominee by filling out the nomination form when you open the account.

For online applications, you’ll find this option during the registration process. Just make sure you don’t skip it!

9. Enjoy Your New SBI Account Benefits

Once everything is set up, you can enjoy all the benefits of your new SBI account. From high-interest rates on savings to access to a vast network of ATMs, SBI has you covered. Plus, with internet banking and the YONO app, managing your money has never been easier.

So, whether you’re saving for a rainy day or managing monthly expenses, your new SBI account will make handling your finances a breeze.

Final Thoughts

Opening a new account with SBI might sound like a big task, but once you break it down, it’s a breeze. By following these simple steps, you’ll be set to manage your finances efficiently. Whether you choose to apply online or visit the branch, the process is quick, easy, and hassle-free.

Remember, the SBI new account process is designed to be convenient for you. So take your time, gather your documents, and open an account that suits your needs. Enjoy the perks of modern banking with SBI, and don’t forget to download the YONO app for extra convenience!