Discover how to use the Pension Calculator in India for pre-2006, post-2006, and post-2016 retirees, including Dearness Relief calculations.

How to Calculate Your Pension:

Navigating the world of pensions can feel like trying to decode an ancient script. But don’t worry! With the Pension Calculator on pensionersportal.gov.in, you’ll be able to figure out your pension in no time. This handy guide will walk you through how to calculate your pension, whether you retired before 2006, between 2006 and 2015, or after 2016. We’ll also cover how to calculate your Dearness Relief (DR), so you can stay financially secure in your golden years.

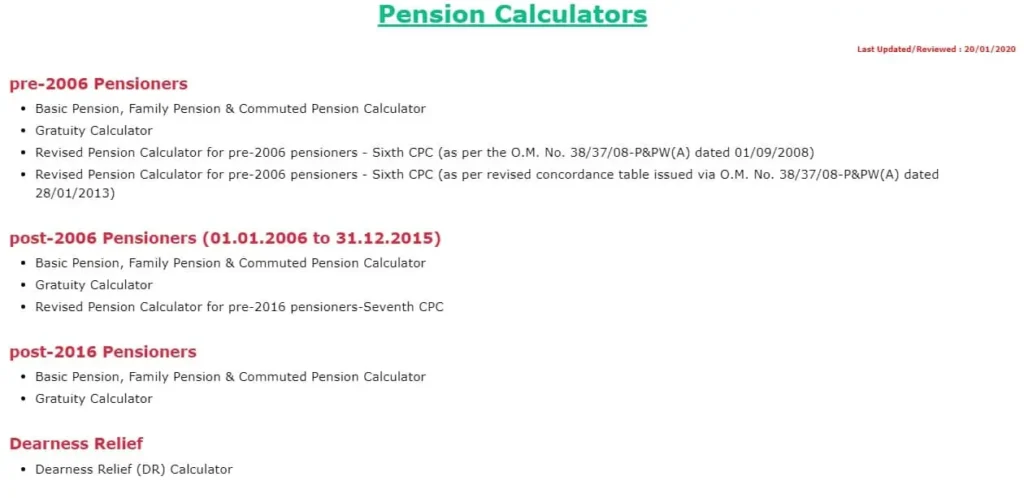

For Pre-2006 Pensioners: The Golden Era

If you retired before 2006, you’re in the group we fondly call the Golden Era pensioners. Calculating your pension is as easy as pie with the Pension Calculator. You’ll start with your Basic Pension, which is calculated based on your last drawn salary and years of service. The calculator will guide you through entering these details, making sure you’re not missing out on a single penny.

Next up, you have the Family Pension. This is a crucial benefit for your loved ones, ensuring they’re taken care of in your absence. The Pension Calculator simplifies this process by using your basic pension amount to determine how much your family will receive.

Finally, let’s not forget the Commuted Pension. If you chose to receive a lump sum at retirement, this amount will be deducted from your basic pension. The Revised Pension Calculator then comes into play, factoring in any changes or revisions to your pension over the years. And if you’re curious about your gratuity, the Gratuity Calculator will do the math for you. It’s like having a personal financial advisor, minus the hefty fees!

Pension Calculators

Post-2006 to Pre-2016 Pensioners: The Transition Team

For those of you who retired between 1st January 2006 and 31st December 2015, you’re part of what we call the Transition Team. You’ve seen the shift in pension schemes, and the Pension Calculator is designed to handle this transition with ease. Start by calculating your Basic Pension using the calculator. Just input your retirement date, last salary, and service years, and voilà—you’ve got your pension amount!

Your Family Pension is next, and just like with pre-2006 pensioners, the calculator will use your basic pension to determine this amount. This ensures that your family is financially secure, even after you’re gone.

If you opted for a Commuted Pension, the Pension Calculator will help you figure out how much of your pension was commuted and what’s left for your monthly pension. The Revised Pension Calculator is particularly useful for this group, as it factors in any government revisions that may have been implemented during this period. And of course, the Gratuity Calculator is at your service to help you figure out that lump sum payment you received when you retired.

Post-2016 Pensioners: The New Age

Retired after 2016? Welcome to the New Age pensioners club! Your pension calculation might seem straightforward, but it’s always good to double-check. The Pension Calculator is here to help. Start with your Basic Pension by entering your retirement details. The calculator will do the heavy lifting, ensuring you get an accurate pension amount.

Your Family Pension is calculated next, ensuring your loved ones are covered. If you commuted a portion of your pension, the Commuted Pension calculation will help you understand how much you’re entitled to monthly.

The Revised Pension Calculator is a must-use tool for you, as it accounts for the latest government updates and revisions to pension schemes. This ensures that your pension remains relevant and reflective of current standards. Lastly, the Gratuity Calculator will help you figure out the gratuity amount you received upon retirement, adding another layer of financial clarity.

Dearness Relief (DR) Calculator: Keeping Up with Inflation

Dearness Relief (DR) is like a superhero for your pension, protecting it from the villain of inflation. The DR Calculator on pensionersportal.gov.in is your go-to tool for figuring out how much extra you’ll get to keep up with rising prices.

Whether you retired before 2006, between 2006 and 2015, or after 2016, DR is an important part of your pension calculation. The Pension Calculator automatically factors in the latest DR rates, so you don’t have to worry about manually updating your figures. It’s a seamless way to ensure that your pension maintains its purchasing power over time.

Simply enter your basic pension, and the DR Calculator will do the rest. It’s like having a financial wizard in your pocket, ensuring you’re always one step ahead of inflation. This tool is particularly useful during times of economic uncertainty, as it helps you plan your finances with confidence.

How to Use the Pensioners’ Portal: Your One-Stop Shop

The Pension Calculator and its associated tools are all available on the pensionersportal.gov.in website. This portal is a treasure trove of resources designed to help you navigate your pension with ease.

To get started, head over to the calculators section on the website. You’ll find options for pre-2006 pensioners, post-2006 to pre-2016 pensioners, and post-2016 pensioners. Simply select the calculator that applies to you, enter your details, and let the tool do its magic.

If you’re calculating your Dearness Relief, just click on the DR Calculator link and input your basic pension amount. In seconds, you’ll have a clear understanding of how much extra you’ll receive to combat inflation.

And if you ever run into trouble, the website offers a comprehensive FAQ section and customer support. You can also check out the latest updates and circulars to stay informed about any changes that might affect your pension.

Frequently Asked Questions (FAQs) About the Pension Calculator

Q1: What is the Pension Calculator, and how can it help me?

A1: The Pension Calculator is a tool available on pensionersportal.gov.in that helps you calculate your pension based on your retirement date, last drawn salary, and years of service. Whether you retired before 2006, between 2006 and 2015, or after 2016, this tool provides an accurate estimate of your pension, including adjustments for Dearness Relief (DR).

Q2: How do I calculate my pension if I retired before 2006?

A2: If you retired before 2006, you can use the Pension Calculator to determine your Basic Pension, Family Pension, and Commuted Pension. Simply enter your last drawn salary, years of service, and other required details to get an accurate estimate. The tool also includes a Gratuity Calculator and Revised Pension Calculator to account for any updates or changes to your pension.

Q3: What details do I need to calculate my pension if I retired between 2006 and 2015?

A3: For those who retired between 1st January 2006 and 31st December 2015, you’ll need to input your retirement date, last salary, and years of service. The Pension Calculator will help you calculate your Basic Pension, Family Pension, and Commuted Pension, along with any gratuity received. It also includes a Revised Pension Calculator to factor in any government revisions.

Q4: How can I calculate my pension if I retired after 2016?

A4: Retirees from 2016 onward can use the Pension Calculator by entering their retirement details, such as the last drawn salary and years of service. The tool will provide an accurate estimate of your Basic Pension, Family Pension, and Commuted Pension, along with gratuity and any applicable revisions.

Q5: What is the Dearness Relief (DR) Calculator?

A5: The Dearness Relief (DR) Calculator helps you calculate the additional amount you’ll receive to counteract inflation. This tool adjusts your pension based on the latest DR rates, ensuring your pension maintains its purchasing power over time.

Q6: How often should I use the Pension Calculator?

A6: It’s a good idea to use the Pension Calculator whenever there are updates to pension rules or if you notice any changes in Dearness Relief rates. Regular checks can help you stay informed about your financial status and make necessary adjustments.

Q7: Can I use the Pension Calculators on my smartphone or tablet?

A7: Yes! The Pension Calculator is accessible on all devices, including smartphones, tablets, and desktops. The user-friendly interface makes it easy to calculate your pension from anywhere, at any time.

Q8: What should I do if I encounter issues while using the Pension Calculators?

A8: If you run into any problems, the pensionersportal.gov.in website offers a comprehensive FAQ section and customer support. You can also reach out via the contact information provided on the website for further assistance.

Q9: Is my personal information safe when using the Pension Calculator?

A9: Yes, the Pension Calculator is designed to be secure, ensuring that your personal information is protected while you calculate your pension.

Q10: Can the Pension Calculator help me understand changes to my pension due to government revisions?

A10: Absolutely! The Revised Pension Calculator included in the tool accounts for any changes or revisions to pension schemes, ensuring your calculations reflect the most current regulations.

Wrapping It Up: The Importance of Accurate Pension Calculations

Calculating your pension doesn’t have to be a headache. With the Pension Calculator on pensionersportal.gov.in, you’ve got all the tools you need to ensure your financial future is secure. Whether you’re a pre-2006 pensioner, a post-2006 retiree, or part of the New Age group, this tool simplifies the process, making it easy to understand exactly what you’re entitled to.

Don’t forget to use the DR Calculator to stay ahead of inflation and ensure your pension keeps pace with the cost of living. With these tools at your disposal, you can rest easy knowing that your retirement is financially secure.

So why wait? Log on to pensionersportal.gov.in today and start calculating your pension. It’s quick, easy, and—dare we say it—fun! Whether you’re planning your retirement or just curious about your financial future, the Pension Calculator is here to help.