Punjab National Bank Balance Check: Complete Guide

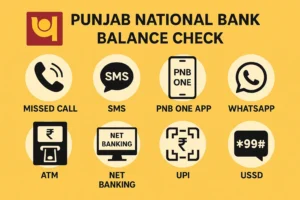

Managing your money is easier when you can quickly check your account balance anytime. Punjab National Bank (PNB), one of India’s largest public sector banks, provides multiple options to check your balance—whether you have internet access or not. From toll-free missed call numbers to WhatsApp Banking and the PNB ONE mobile app, customers can stay updated about their savings or current account instantly.

This article gives you a step-by-step guide on all methods of Punjab National Bank balance check, along with FAQs, safety tips, and official links.

PNB Balance Check Number (Missed Call Service)

One of the fastest ways to know your balance is by giving a missed call.

- Toll-free number: 1800 180 2223

- Tolled number: 0120-2303090

How it works:

- Dial the number from your registered mobile number.

- The call disconnects automatically.

- You receive an SMS with your account balance.

Key points:

- Service is free from PNB’s side. Normal carrier charges may apply for tolled calls.

- Only registered mobile numbers linked with your account will work.

- If you have multiple accounts, you can set a primary account with the branch.

If your number is not registered, visit your branch or use internet banking to update KYC details.

PNB Balance Check by SMS Banking

If you prefer text messages, PNB’s SMS service is simple:

- For balance enquiry: BAL <Account Number> → 5607040

- For mini statement (last 5 transactions): MINSTMT <Account Number> → 5607040

Notes:

- SMS charges apply as per your mobile operator.

- Works only with registered mobile numbers.

- Keep account number handy; formats must be typed correctly.

This method is helpful in areas with poor internet connectivity.

PNB ONE Mobile Banking App

PNB’s official mobile banking application, PNB ONE, combines balance enquiry, mini statements, and many digital services.

Steps:

- Download PNB ONE from Google Play or App Store.

- Log in using User ID + MPIN/Password.

- Go to Accounts → Account Summary to view balances.

- For transaction history, open mPassbook inside the app.

Advantages:

- Works 24×7 across multiple accounts.

- Allows funds transfer, bill payment, cheque book requests.

- Statement export available in PDF/Excel.

PNB mPassbook App

PNB also offers a standalone mPassbook app. It provides:

- Instant balance enquiry.

- Transaction history in passbook style.

- Offline storage (after initial sync).

Login requires Customer ID and registered mobile number. Ideal for those who want a digital passbook without full net banking.

PNB Net Banking Balance Check

PNB customers can use Internet Banking for detailed account information.

Steps:

- Visit the official site: ibanking.pnb.bank.in

- Login with User ID and Password.

- Navigate to Accounts → Account Summary.

Security tips:

- Always check the domain name (look for

ibanking.pnb.bank.in). - Avoid using public Wi-Fi.

- Always log out after use.

Net banking is best for downloading detailed statements or managing multiple accounts.

PNB Balance Check via WhatsApp Banking

PNB has launched WhatsApp Banking for quick queries.

Steps:

- Save the official WhatsApp number (+91-9264092640).

- Send “Hi” from your registered mobile number.

- Choose “Balance Enquiry” from the menu.

Features:

- Works like a chat service.

- Offers balance, mini statement, cheque status.

- Available 24×7.

ATM, UPI & USSD Balance Enquiry

1. ATM Balance Enquiry

Insert your PNB Debit Card at any ATM:

- Select Balance Enquiry.

- Enter your PIN to view balance.

⚠️ Note: Non-PNB ATMs may charge after free limits (usually 3–5 per month).

2. UPI Balance Check

Through apps like BHIM, PhonePe, Google Pay:

- Open the app → “Check Balance.”

- Enter your UPI PIN → Balance displayed.

3. USSD Banking (*99#)

Dial *99# from your registered mobile.

- Choose “Check Balance.”

- Works without internet.

- Requires UPI registration.

PNB Balance Check Without Internet

For feature-phone users or areas with low connectivity, PNB provides offline methods:

- Missed Call Number (1800 180 2223).

- SMS Banking (BAL to 5607040).

- USSD Code (*99#).

- ATM Balance Enquiry.

These methods ensure you can always know your account balance without mobile data.

Common Errors & Fixes

- Unregistered mobile number: Update KYC and register with branch.

- Wrong SMS format: Check spelling and spacing.

- Dual SIM issues: Ensure SIM with registered number is active.

- App login issues: Reset MPIN/password or reinstall app.

- Website access issues: Use correct link (

ibanking.pnb.bank.in).

Safety Tips for Checking Balance

- Only use official PNB apps and websites.

- Never share OTP, PIN, MPIN, or passwords.

- Enable two-factor authentication and device lock.

- Do not click on suspicious SMS/WhatsApp links.

Fees, Limits & When to Contact Support

- Missed call service: Free.

- SMS/USSD: Mobile operator charges may apply.

- ATM: Beyond free limits at other bank ATMs, small charges apply.

Contact PNB customer care if:

- Balance shown is incorrect.

- Services fail repeatedly.

- You need to register or update mobile number.

FAQs on Punjab National Bank Balance Check

PNB offers 1800 180 2223 (toll-free) and 0120-2303090 (tolled).

Use missed call, SMS to 5607040, USSD (*99#), or ATM.

Send SMS MINSTMT <Account Number> to 5607040, use PNB ONE → mPassbook, or visit an ATM.

Yes. Send “Hi” to +91-9264092640 from registered mobile.

Yes. It is free from PNB’s side. Operator charges may apply for tolled numbers.

ibanking.pnb.bank.in is the new domain.

Conclusion

Punjab National Bank makes it easy to keep track of your money. Whether you prefer missed call and SMS banking or modern tools like PNB ONE and WhatsApp Banking, you can access your account anytime. Always use official numbers, apps, and links to ensure security.

By using these methods, customers can manage finances smarter, avoid unnecessary branch visits, and stay updated on their account balance 24×7