Learn how to easily fill out the RTGS Form Union Bank of India for quick, secure money transfers.

RTGS Form Union Bank of India: Everything You Need to Know in Easy Steps

If you’ve ever needed to transfer a large sum of money urgently, you’ve probably heard about RTGS. Real-Time Gross Settlement (RTGS) is the go-to option for transferring funds quickly and securely. But, have you ever wondered how to get started with RTGS at Union Bank of India? Don’t worry! The RTGS form Union Bank of India offers is straightforward, and I’m here to walk you through it.

What Exactly is RTGS?

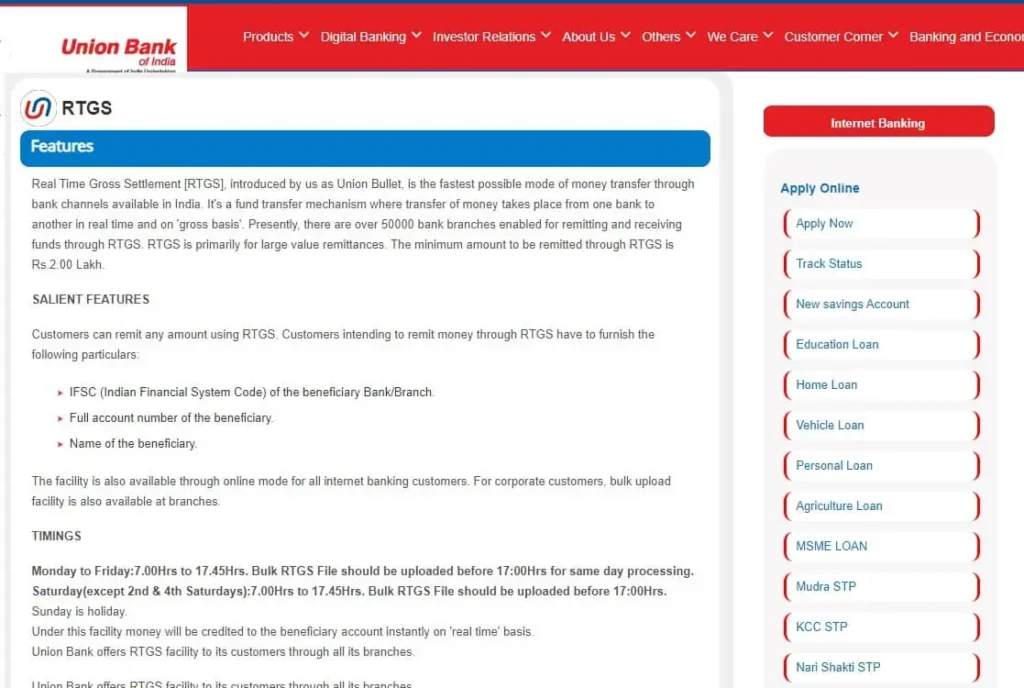

Before diving into the form, let’s quickly brush up on what RTGS is. RTGS is a system that allows you to transfer funds from one bank account to another in real time. It’s designed for high-value transactions, usually starting from ₹2 lakhs. If you’re looking for speed and reliability, RTGS is your friend. Unlike NEFT, which processes in batches, RTGS ensures your money reaches its destination immediately.

Why Choose RTGS Over Other Payment Methods?

You might be wondering, why should I choose RTGS over other methods? The answer is simple: speed and security. The RTGS form Union Bank of India provides ensures that your money moves directly from your account to the recipient’s account without any delay. It’s perfect for those moments when you need to make a significant payment quickly, like buying property or making a large business transaction.

Where to Get the RTGS Form for Union Bank of India

First things first, you’ll need the RTGS form from Union Bank of India. You can find it on their official website or at any Union Bank branch. If you prefer digital convenience, downloading the form from the website is super easy. Just visit the Union Bank of India’s official site, navigate to the forms section, and you’ll find the RTGS form ready for download. If you’re more of an in-person kind of person, just pop into your nearest branch, and they’ll hand you a form with a smile.

Filling Out the RTGS Form: A Step-by-Step Guide

Now, let’s get into the nitty-gritty of filling out the RTGS form Union Bank of India offers. It’s simpler than you might think. The form is divided into a few straightforward sections:

- Your Details: The form will first ask for your personal information. You’ll need to fill in your name, account number, and branch details. Make sure these details are accurate, as they are crucial for processing the transfer.

- Beneficiary Details: Next, you’ll need to provide the details of the person or entity receiving the funds. This includes their name, account number, and the bank’s IFSC code. Double-check these details to avoid any hiccups in the transfer.

- Transaction Details: Here, you’ll input the amount you want to transfer. Remember, the minimum amount for RTGS is ₹2 lakhs. You’ll also need to specify the purpose of the transfer. This could be anything from business payments to personal remittances.

- Declaration and Signature: Finally, you’ll sign the form, declaring that the information provided is correct. This is crucial as it serves as your agreement to the transfer terms.

Where to Submit the RTGS Form?

Once you’ve filled out the RTGS form Union Bank of India provides, the next step is submission. You can submit the form at your local Union Bank of India branch. Some branches may even allow you to submit the form online, making the process even more convenient. After submission, the bank will process your request, and the funds will be transferred in real time.

Tips for a Smooth RTGS Transaction

While the process is relatively simple, a few tips can ensure everything goes smoothly:

- Double-Check the Details: Ensure all information on the RTGS form is accurate. A small error in the account number or IFSC code can delay the transfer.

- Keep a Copy: Always keep a copy of the filled-out RTGS form for your records. It’s handy in case you need to track the transaction later.

- Know the Timings: RTGS transactions are process during specific hours. Make sure you’re aware of these timings to avoid any delays.

Benefits of Using RTGS with Union Bank of India

The Union Bank of India is known for its reliable and efficient banking services, and their RTGS facility is no exception. Here’s why using the RTGS form Union Bank of India offers is a smart choice:

- Immediate Transfers: Your money reaches the recipient instantly, making it ideal for urgent transactions.

- High Security: RTGS is one of the most secure ways to transfer funds. The bank ensures that all transactions are process with the highest level of security.

- Large Transfers: If you need to transfer a large amount of money, RTGS is the best option. With a minimum limit of ₹2 lakhs, it’s perfect for big-ticket payments.

Common Mistakes to Avoid When Filling Out the RTGS Form

Even though the RTGS form for Union Bank of India is straightforward, mistakes can happen. Here are a few common ones to watch out for:

1. Incorrect Account Number or IFSC Code

This is the most common error. Double-check these numbers to ensure they’re correct. A small mistake can lead to delays.

2. Missing Signature

Without your signature, the bank won’t process the form. It sounds simple, but it’s an easy detail to overlook.

3. Incomplete Beneficiary Details

Make sure all required fields for the beneficiary are filled in. Missing details can result in the form being rejected.

How to Rectify Mistakes

If you realize you’ve made a mistake after submitting the RTGS form, don’t panic. Contact Union Bank’s customer service immediately. If the transaction hasn’t been processed yet, they may be able to halt it and allow you to correct the information. However, if the funds have already been transferred, the process of recovery could be more complicated, involving the beneficiary’s bank. Always double-check before submission to avoid this hassle.

Common FAQs About the RTGS Form Union Bank of India

You might have some lingering questions about using the RTGS form Union Bank of India provides. Let’s tackle a few common ones:

- Is there a maximum limit for RTGS?

There’s no upper limit for RTGS transactions, making it ideal for large payments. - What are the charges?

Union Bank of India typically charges a nominal fee for RTGS transactions. It’s worth checking with your branch for exact details. - Can I do RTGS online?

Yes, many branches of Union Bank of India allow you to process RTGS transactions online. This is incredibly convenient if you can’t visit the branch. - What happens if I make a mistake on the form?

If you realize there’s an error after submission, contact your bank immediately. They may able to correct the mistake before the transaction is processed. - RTGS full form?

- RTGS stands for Real-Time Gross Settlement.

Final Thoughts on the RTGS Form Union Bank of India

Using the RTGS form Union Bank of India offers is a reliable way to transfer large sums of money securely. Whether you’re making a business payment or sending money to family, RTGS ensures your funds reach the recipient without delay. Just remember to fill out the form carefully, double-check the details, and submit it within the bank’s RTGS hours. With these tips, you’re all set for a smooth and stress-free RTGS transaction!

So, the next time you need to make a quick, high-value payment, you know exactly what to do. Grab that RTGS form, fill it out with confidence, and let Union Bank of India handle the rest!