Learn about Telangana Encumbrance Certificate (EC), its importance, how to check it online, and what information it doesn’t cover. Stay informed!

Telangana Encumbrance Certificate (EC): Everything You Need to Know!

Buying property can be exciting, but let’s face it, it also comes with a mountain of paperwork. One document that stands out in the process is the Telangana Encumbrance Certificate (EC).

You might have heard about it, or maybe you’re here because someone told you it’s crucial for property deals. Either way, let’s break it down in a simple, easy-to-understand way.

- What Is the Telangana Encumbrance Certificate (EC)?

- Why Do You Need the Telangana Encumbrance Certificate?

- How to Check Your Telangana Encumbrance Certificate

- What Information Is Covered in the Telangana EC?

- What’s Not Included in the Telangana Encumbrance Certificate?

What Is the Telangana Encumbrance Certificate (EC)?

First things first, let’s clear up what an Encumbrance Certificate is. In simple terms, the Telangana EC is a legal document that provides the history of financial and legal transactions related to a specific property.

Think of it as the report card for your property—telling you if it has any debts or legal issues attached to it.

The Sub-Registrar’s Office issues the EC, which is similar to your property’s clean chit and verifies whether or not it has any encumbrances—a fancy term for debts like loans or mortgages.

This certificate covers details of the property’s transactions for a specific period, so it’s your go-to document to check whether the property you’re eyeing is free from any financial baggage.

Why Do You Need the Telangana Encumbrance Certificate?

You might be wondering, “Do I really need this Encumbrance Certificate EC thing?” at this point. The answer is a big YES! Here’s why.

- Verifying Ownership: The EC helps you confirm that the property actually belongs to the person selling it. No one wants to end up in a situation where someone else claims ownership!

- Clearing Bank Loans: If you’re planning to get a loan, banks will usually ask for the EC to make sure the property isn’t tied up in any unpaid loans or mortgages. It’s one of the key documents banks need before they release the funds.

- Avoid Legal Troubles: The last thing you want after buying a property is to find out there’s a legal issue attached to it. The Telangana Encumbrance Certificate gives you peace of mind by letting you know if the property has been involved in any sales, loans, or disputes.

- Selling Property: If you’re on the other side of the table and selling your property, the EC acts as proof that your property is free of any encumbrances. This builds trust with potential buyers and speeds up the sale.

How to Check Your Telangana Encumbrance Certificate

Gone are the days of standing in long queues at government offices just to get a document.

Checking your Telangana Encumbrance Certificate has become super easy, thanks to the online services provided by the Telangana government.

Here’s a step-by-step guide to checking your EC online:

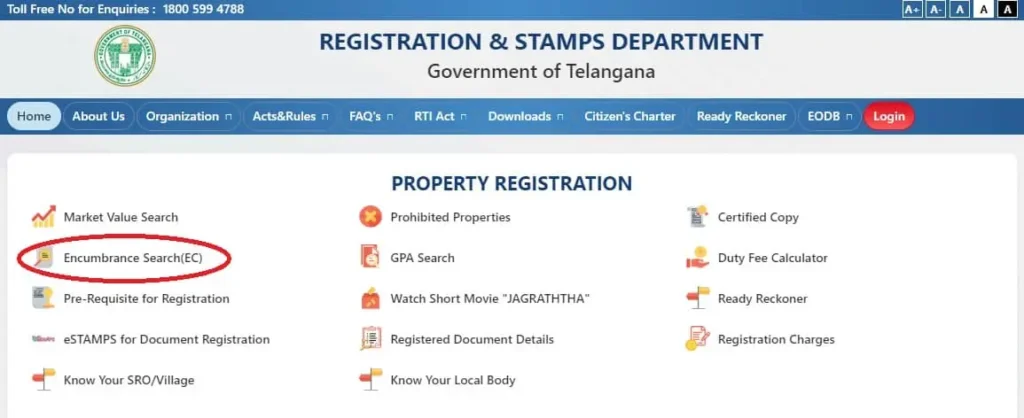

- Visit the Telangana Registration & Stamps Department Website: Head over to the official website, which offers an online EC service.

- Select “Encumbrance Search (EC)”: Once you’re on the website, look for the option to search for an EC. It’s usually pretty visible, so you won’t miss it.

- Enter the Required Details: You’ll need to provide some basic information like the property details (location, registration number, etc.), the period for which you want the EC, and your contact details. You can request the EC for a period of up to 30 years!

- Submit and Pay: Once you’ve filled out the form, you’ll be asked to make a small payment. Don’t worry, it’s not too heavy on the wallet. After payment, your Telangana Encumbrance Certificate will be ready for download.

And that’s it! You’ll have your EC in hand without even leaving your couch.

What Information Is Covered in the Telangana EC?

So, what do you actually get when you download an EC? The Telangana Encumbrance Certificate covers all transactions related to the property during the selected period. This includes:

- Sales

- Mortgages

- Partition deeds

- Gift deeds

In other words, the EC provides a history of who has owned the property and whether any loans were taken out against it.

It’s like the report card for your property’s financial health. If the EC shows a “Nil Encumbrance,” that means the property is clear of any liabilities—great news if you’re a buyer!

What’s Not Included in the Telangana Encumbrance Certificate?

Now, while the Telangana EC is super important, there are a few things it doesn’t cover. Knowing what’s missing will help you make a more informed decision.

- Unpaid Property Taxes: The EC won’t tell you if there are unpaid property taxes. You’ll need to check this separately by contacting the local municipal office or looking at property tax receipts.

- Pending Legal Disputes: While the EC can show you if there are financial liabilities like loans or mortgages, it doesn’t cover ongoing court cases or legal disputes that may be associated with the property. So, if there’s a family feud over ownership, the EC won’t reveal that information.

- Ownership Disputes: Similarly, if there are multiple ownership claims (like if the property was inherited and different family members are fighting over it), the EC won’t show this. You’d need to check that separately through legal means.

- Unauthorized Construction: The EC also won’t tell you if the property has any illegal or unauthorized construction. If you’re worried about zoning or building violations, you’ll need to check with the relevant authorities.

So, while the Telangana Encumbrance Certificate gives you a lot of valuable information, it’s not a catch-all document. Make sure to cover all your bases before making a big property decision.

Conclusion: Don’t Skip the EC!

Knowledge is power in the real estate industry. And having the Telangana Encumbrance Certificate in your hand gives you a lot of that power.

Whether you’re buying or selling property, the EC is a critical document that provides essential information about a property’s financial and legal history.

It might not cover everything (like unpaid taxes or legal disputes), but it’s a solid starting point. So, next time you’re looking at property in Telangana, make sure to check the EC and avoid unnecessary headaches down the line.