Easily navigate Tamil Nadu Dealer Search on tnvat.tn.gov.in. Learn how to find dealers using TIN/PAN/Firm Name & simplify VAT payments today!

Tamil Nadu Dealer Search Made Simple: Guide on VAT Payments

If you’ve ever tried navigating the maze of tax-related tasks, you know it can feel overwhelming. But don’t worry! When it comes to Tamil Nadu dealer search and VAT payments, things aren’t as complicated as they might seem.

This blog is here to walk you through the process in an easy, friendly way. Whether you’re a first-timer or someone brushing up on your tax knowledge, we’ve got you covered. Let’s dive right in!

Tamil Nadu Dealer Search: What Is It and Why Do You Need It?

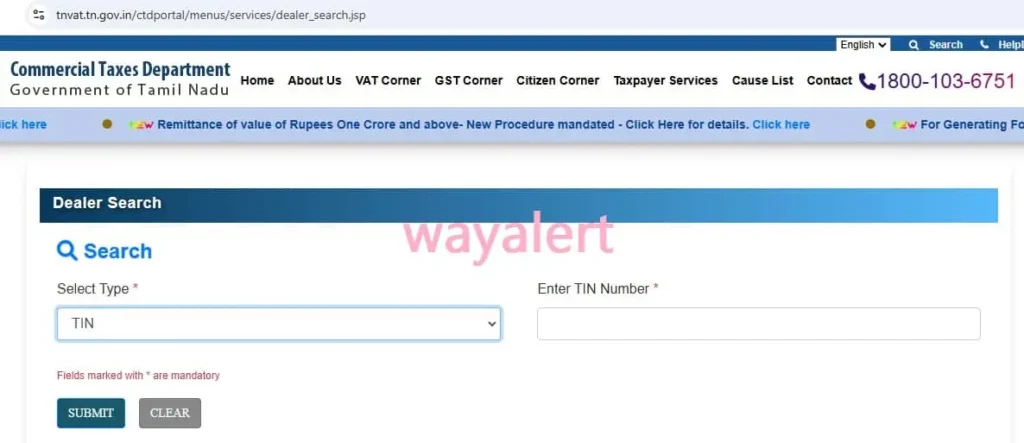

Let’s start with the basics. The Tamil Nadu dealer search tool is a handy online feature available on the tnvat.tn.gov.in website. It allows you to look up registered dealers in Tamil Nadu by their TIN (Taxpayer Identification Number), PAN, or firm name.

Why does this matter? Well, let’s say you’re a business owner working with vendors or suppliers. Knowing their VAT registration status ensures transparency and avoids any compliance hiccups. Plus, it’s super easy to verify their details online! Trust me, this tool can save you a lot of headaches down the line.

Here’s how you can access it:

- Head to tnvat.tn.gov.in.

- Click on the Tamil Nadu dealer search section.

- Enter details like TIN, PAN, or firm name.

- Hit “Search” and voila, the results are right there!

Pro tip: Double-check the TIN or PAN before entering it to avoid errors.

Step-by-Step Guide to Using the Tamil Nadu Dealer Search Tool

Okay, now that you know what the Tamil Nadu dealer search tool is all about, let’s break down the steps further. Don’t worry if you’re not tech-savvy; it’s simpler than ordering food online!

Step 1: Visit the Website

The first thing you need to do is head over to the tnvat.tn.gov.in website. It’s user-friendly and doesn’t require you to sign up or create an account just to search for dealers.

Step 2: Choose Your Search Criteria

You can search using three key details:

- TIN (Taxpayer Identification Number): This is a unique number assigned to every registered dealer.

- PAN (Permanent Account Number): If you don’t have the TIN, the dealer’s PAN can work as an alternative.

- Firm Name: Not sure about the numbers? Use the firm’s name to locate their details.

Step 3: Input the Details

Once you’ve decided which search method to use, enter the relevant information. Be precise here! Even a small typo can throw off the search results.

Step 4: Click Search and Review Results

Click the search button, and in a few seconds, the details of the registered dealer will pop up. The information includes the dealer’s name, address, and registration status.

If the dealer isn’t listed, it’s a red flag, and you should double-check with them before proceeding.

How to Make VAT Payments on the Tamil Nadu Portal

Now that you’ve mastered the Tamil Nadu dealer search, let’s tackle another important topic—VAT payments. Paying VAT (Value Added Tax) is a responsibility you can’t ignore if you’re running a business. Thankfully, the process is pretty straightforward, especially with the Tamil Nadu VAT portal.

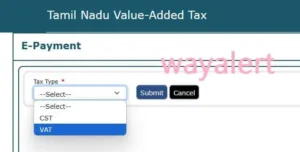

Here’s a quick guide:

- Log in to Your Account: If you’re a registered dealer, log in using your credentials on the tnvat.tn.gov.in website. New users will need to register first.

- Navigate to the Payment Section: Once logged in, look for the VAT payment option in the dashboard. It’s usually labeled as “e-Payment.”

- Enter Payment Details: Provide details like your TIN, the payment period, and the amount due. Double-check everything to avoid errors.

- Choose Payment Mode: You can pay via net banking, debit card, or other supported payment options. Pick what’s convenient for you.

- Confirm and Pay: Review all the entered details and hit “Pay.” You’ll get a confirmation receipt once the transaction is successful. Save this for your records.

Why the Tamil Nadu VAT Portal Is a Game-Changer

“Why should I use this portal?” you ask. let me give you a few reasons. The Tamil Nadu VAT portal isn’t just about dealer searches and VAT payments—it’s a one-stop shop for all things tax-related. Whether it’s filing returns, accessing tax forms, or checking updates, the website simplifies your life.

Here’s what makes it stand out:

- Convenience: You can complete tasks from the comfort of your home or office, saving time and effort.

- Transparency: The dealer search tool ensures you’re dealing with verified businesses.

- Real-Time Updates: Get instant updates on your VAT transactions and account status.

Common Issues and How to Solve Them

Using the Tamil Nadu VAT portal is mostly smooth sailing, but let’s face it—technology isn’t always perfect. Here are a few typical glitches and their fixes:

- Error in Dealer Search Results:

- Make sure you’ve entered the correct TIN, PAN, or firm name.

- If the problem still exists, clear the cache in your browser and try again.

- Payment Gateway Issues:

- Ensure your internet connection is stable.

- Contact your bank if the payment fails repeatedly.

- Login Problems:

- Forgot your password? Use the “Forgot Password” option to reset it.

- Still stuck? The portal’s helpdesk is just a call or email away.

Wrapping It Up: Mastering Tamil Nadu Dealer Search and VAT Payments

By now, you’ve got a clear picture of how to use the Tamil Nadu dealer search tool and make VAT payments seamlessly. The tnvat.tn.gov.in portal is your ultimate ally in managing tax-related tasks efficiently. Whether you’re verifying dealers or paying taxes, it’s all just a few clicks away.

So, next time you’re faced with tax-related stress, remember this guide and tackle it like a pro. With a little practice, you’ll be navigating the system effortlessly. Got any tips or tricks for using the Tamil Nadu VAT portal? We’d love to hear your thoughts, so please leave them in the comments!

Happy searching and paying!