Union Bank of India Balance Check

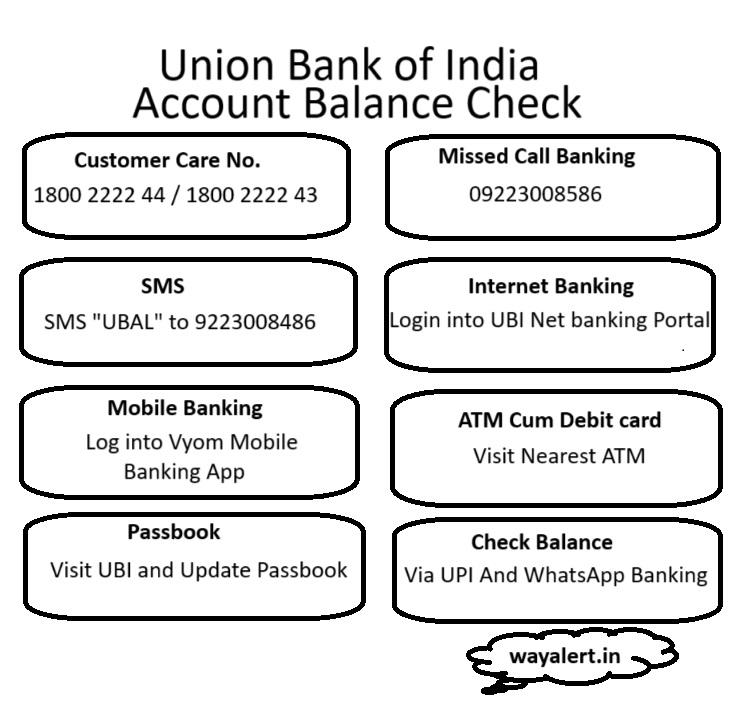

Banking doesn’t have to be a chore, and Union Bank of India makes it easier than ever to stay on top of your finances. With their convenient balance check services, you can quickly and effortlessly monitor your account balance. Whether you’re planning your monthly budget or just want to keep track of your spending, Union Bank of India has got you covered. Let’s dive into the various ways you can check your balance, all designed to save you time and effort.

Using Toll-Free Numbers : To Check Union Bank Account Balance

One of the simplest methods for a Union Bank of India balance check is by using their toll-free numbers. This service is perfect for those who prefer to avoid the hassle of visiting the bank or dealing with complicated online systems. All you need to do is dial the toll-free number from your registered mobile phone, and you’ll receive your balance information instantly. It’s that easy! The toll-free numbers are available 24/7, ensuring that you can check your balance anytime, anywhere.

All-India Toll Free number : 1800 2222 44 / 1800 2222 43

Dedicated Helpline for reporting fraud/disputed transactions / 1800 208 2244 / 1800 425 1515 / 1800 425 3555

Dedicated helpline for Premium account : 1800 425 2407

Union Bank of India Balance Check by Missed Call

Union Bank of India has made the balance check process incredibly simple with their missed call service. All you need to do is give a missed call to the designated toll-free number from your registered mobile phone.

Balance on Missed Call Service on 09223008586

Within moments, you’ll receive an SMS containing your account balance. There’s no need to wait in line at the bank or navigate through complex online systems. It’s banking made easy, right at your fingertips.

SMS Banking: Convenience at Your Fingertips

Another fantastic option for a Union Bank of India balance check is SMS banking. This service is incredibly user-friendly and convenient. Just send a simple text message with a specific keyword to the designated number, and you’ll receive a reply with your account balance. It’s perfect for those moments when you’re on the go and need quick access to your financial information. Plus, you don’t need an internet connection, making it a reliable option no matter where you are.

Balance Enquiry :

Primary account balance : UBAL

(e.g. UBAL sent to 09223008486)

Other account balance : UBALAccount number

(e.g. UBAL566802071234567 sent to 09223008486)

For Mini Statement :

Primary account statement : UMNS

(e.g. UMNS sent to 09223008486)

Other account statement : UMNSAccount number

(e.g. UMNS566802071234567 sent to 09223008486)

Union Bank of India Account Balance Check by Internet Banking

Checking your bank balance online has never been easier, thanks to Union Bank of India’s internet banking service. If you’re new to internet banking or need a quick refresher, this step-by-step guide will walk you through the process. Let’s get started on how you can effortlessly check your balance from the comfort of your home.

Step 1: Register for Internet Banking

Before you can use Union Bank of India’s internet banking, you need to register for the service. Visit the Union Bank of India website and click on the ‘Internet Banking’ section. Follow the simple registration process, which involves providing your account details and setting up a username and password. Once registered, you’ll have access to your online banking portal.

Step 2: Log In to Your Account

With your username and password ready, go to the Union Bank of India homepage and click on the ‘Login’ button under the internet banking section. Enter your credentials to access your account. The login process is secure, ensuring your financial information remains protected.

Step 3: Navigate to Account Summary

Once logged in, you’ll find yourself on the dashboard. Look for the ‘Account Summary’ or ‘Account Information’ section. This is where you’ll find a comprehensive overview of your accounts. Click on this section to proceed to the next step.

Step 4: View Your Balance

In the ‘Account Summary’ section, you’ll see a list of your accounts. Your current balance will be displayed alongside each account. This clear and detailed view allows you to easily monitor your finances. Whether you have a savings account, current account, or multiple accounts, everything is neatly organized for you.

Step 5: Explore Additional Features

While checking your balance is essential, Union Bank of India’s internet banking offers much more. Take a moment to explore other features such as viewing transaction history, transferring funds, and paying bills. These options are designed to make your banking experience more convenient and efficient.

Tips for a Smooth Experience

- Keep Your Credentials Safe: Always keep your username and password confidential to ensure the security of your account.

- Update Your Information: Regularly update your contact information and check for any notifications from the bank.

- Log Out Securely: Always log out of your internet banking session when you’re done, especially if using a shared or public computer.

Union Bank of India Account Balance Check by Mobile Banking App

Mobile banking has revolutionized the way we manage our finances, making it incredibly easy to keep track of our accounts. With Union Bank of India’s mobile banking app, you can check your balance anytime, anywhere. If you’re new to the app or need a refresher, follow this step-by-step guide to make the most of this convenient service.

Step 1: Download the Mobile Banking App

First things first, you need to download the Union Bank of India mobile banking app. Head to the Google Play Store or Apple App Store and search for the official Union Bank of India app. Download and install the app on your smartphone. This step is quick and straightforward, bringing banking convenience to your fingertips.

Step 2: Register and Set Up Your Account

Once the app is installed, open it and follow the on-screen instructions to register your account. You’ll need your account number, registered mobile number, and other personal details. Set up your login credentials, including a secure password. This process ensures that your banking information is protected.

Step 3: Log In to the App

With your account set up, log in using your newly created username and password. The app’s interface is user-friendly and designed for easy navigation. If you ever forget your password, the app provides simple steps to reset it.

Step 4: Navigate to Account Information

After logging in, you’ll find yourself on the dashboard. Look for the ‘Account Information’ or ‘Account Summary’ section. Tap on this section to proceed. This is where you’ll find detailed information about your accounts.

Step 5: Check Your Balance

In the ‘Account Information’ section, you’ll see a list of your accounts along with their respective balances. The information is presented clearly, allowing you to see your current balance at a glance. Whether you have a savings account, a current account, or both, you can easily monitor your finances.

Explore Additional Features

The Union Bank of India mobile banking app offers more than just balance checks. Take some time to explore other features such as fund transfers, bill payments, and transaction history. These features are designed to provide a comprehensive banking experience right from your phone.

Tips for a Smooth Experience

- Keep Your App Updated: Regularly update the app to enjoy the latest features and security enhancements.

- Use a Strong Password: Ensure your password is strong and unique to protect your account.

- Enable Notifications: Turn on notifications to receive real-time updates about your account activities.

Union Bank of India Balance Check via Passbook, ATM, and UPI

Keeping track of your bank balance is essential for managing your finances effectively. Union Bank of India offers multiple ways to check your account balance, catering to different preferences and needs. Whether you prefer traditional methods like the passbook or modern solutions like UPI, this guide will walk you through each process step by step.

Union Bank Checking Balance via Passbook

The passbook is a reliable and straightforward way to keep track of your account balance. Here’s how you can use it:

- Visit Your Branch: Go to your nearest Union Bank of India branch with your passbook.

- Update Your Passbook: Hand over your passbook to the bank teller and request an update. They will print the latest transactions and balance information.

- Review Your Balance: Once updated, your passbook will display your current account balance and recent transactions. It’s a simple, offline method perfect for those who prefer physical records.

Union Bank Checking Balance via ATM

Using an ATM is another quick and convenient way to check your Union Bank of India account balance. Follow these steps:

- Locate an ATM: Find a Union Bank of India ATM or any other ATM that accepts your card.

- Insert Your Card: Insert your debit card into the ATM machine and enter your PIN when prompted.

- Select Balance Inquiry: From the menu options, choose ‘Balance Inquiry’ or ‘Check Balance.’

- View Your Balance: The ATM will display your current account balance on the screen. You can also choose to print a receipt for your records.

Union Bank Checking Balance via UPI

Unified Payments Interface (UPI) is a modern and highly convenient method for checking your account balance. Here’s how to do it:

- Download a UPI App: If you don’t already have one, download a UPI-enabled app like BHIM, Google Pay, or PhonePe.

- Link Your Bank Account: Follow the app’s instructions to link your Union Bank of India account to the UPI app.

- Open the App: Launch the UPI app on your smartphone.

- Check Balance: Look for the ‘Check Balance’ option, typically found in the main menu or account section.

- Enter Your UPI PIN: Enter your UPI PIN to authenticate the request.

- View Your Balance: The app will display your current account balance on the screen.

Tips for a Smooth Experience

- Keep Your Passbook Updated: Regularly update your passbook to have the latest transaction details.

- Secure Your ATM PIN: Always keep your ATM PIN confidential and change it regularly for security.

- Ensure UPI Security: Use a strong UPI PIN and keep your app updated to protect your account.

Union Bank of India Balance Check via WhatsApp Banking

Union Bank of India continues to innovate, making banking more accessible and convenient. One of the latest features is WhatsApp Banking, which allows you to check your account balance right from your chat app. If you’re wondering how to use this feature, here’s a simple step-by-step guide to get you started.

Step 1: Register for WhatsApp Banking

First, you need to register your phone number for Union Bank of India’s WhatsApp Banking service. Ensure your mobile number is registered with the bank. Save the Union Bank of India’s official WhatsApp number in your contacts. You can find this number on the bank’s website or by visiting your nearest branch.

Whatsapp Number is 9666606060

Step 2: Send a Message

Open WhatsApp and start a new chat with Union Bank of India’s saved contact. Simply send a “Hi” or any greeting message to begin the conversation. The automated system will respond with a menu of available services.

Step 3: Select Balance Inquiry

From the menu options provided, select the option for ‘Balance Inquiry.’ You can do this by typing the corresponding number or keyword. The system will guide you through the process.

Step 4: Verify Your Identity

To ensure the security of your account, you will need to verify your identity. The system may ask for specific details like your last four digits of the account number or a one-time password (OTP) sent to your registered mobile number. Enter the required information to proceed.

Step 5: View Your Balance

Once your identity is verified, the system will provide your account balance in the chat. You can view it instantly without any hassle. It’s that simple!

Tips for a Smooth Experience

- Save the Official Number: Ensure you save the correct Union Bank of India WhatsApp number to avoid scams.

- Keep Your Information Handy: Have your account details ready for quick verification.

- Secure Your Device: Always use a secure phone and avoid sharing personal information over unsecured networks.

Frequently Asked Questions: Union Bank of India Balance Check

Managing your bank balance is a crucial part of financial planning. Union Bank of India offers several ways to check your account balance, but you might still have some questions. Here’s a compilation of frequently asked questions to help you navigate the balance check process effortlessly.

Q. How Can I Check My Union Bank of India Account Balance?

You have multiple options to check your balance. You can use the mobile banking app, internet banking, missed call service, SMS banking, ATM, passbook, UPI, or WhatsApp banking. Each method is designed to be user-friendly and convenient, catering to different preferences.

Is There a Charge for Checking My Balance?

No, Union Bank of India does not charge you for checking your account balance through any of its services. Whether you use the mobile app, internet banking, missed call, or any other method, it’s free of charge. Enjoy the convenience without worrying about extra costs.

What If I Forget My Internet Banking Password?

If you forget your internet banking password, don’t worry! Simply go to the Union Bank of India internet banking login page and click on the ‘Forgot Password’ link. Follow the instructions to reset your password securely. You’ll be back to checking your balance in no time.

Can I Check My Balance Without Internet Access?

Absolutely! If you don’t have internet access, you can still check your balance using the missed call service, SMS banking, or by visiting an ATM. These methods ensure you can always stay updated on your account balance, no matter where you are.

How Often Should I Check My Balance?

It’s a good habit to check your balance regularly. Whether daily, weekly, or monthly, choose a frequency that helps you stay on top of your finances. Regular checks help you monitor your spending, avoid overdrafts, and catch any unauthorized transactions early.

Is My Information Safe?

Yes, Union Bank of India prioritizes your security. All balance check methods are secure, ensuring your personal and financial information is protected. Always use official channels and keep your login credentials confidential to enhance your security.

How Do I Register for Mobile and Internet Banking?

To register for mobile banking, download the Union Bank of India app from the app store and follow the registration instructions. For internet banking, visit the Union Bank of India website and complete the registration process online. Both registrations require your account details and registered mobile number.

What Is the Missed Call Service Number?

To check your balance using the missed call service, dial the designated toll-free number from your registered mobile phone. You can find this number on the Union Bank of India website or by contacting customer service.

Can I Use WhatsApp Banking for Balance Check?

Yes, you can! Register your number with Union Bank of India’s WhatsApp banking service and save their official number. Send a message to start the service and follow the prompts to check your balance. It’s quick, easy, and incredibly convenient.

Conclusion

In conclusion, Union Bank of India offers a variety of methods to check your account balance, ensuring you can choose the one that suits you best. Whether you prefer digital solutions or traditional methods, there’s an option for everyone. By understanding these FAQs, you can confidently manage your finances and make the most of the banking services available to you. Happy banking with Union Bank of India!