Learn how to log in to SBI General Insurance and access policy details for health, car, bike, and more. Simple steps to manage your insurance!

How to Check Your SBI General Insurance Policies:

If you’re reading this, chances are you’ve got an SBI General Insurance policy—maybe for your health, car, bike, cyber protection, home, or even travel. And that’s a smart move! But let’s face it, keeping track of your insurance details or figuring out how to check them can sometimes feel like a chore. Don’t worry; I’m here to simplify it for you. This guide combines everything you need to know to check your SBI General Insurance details with zero confusion.

👉 If you’re looking to manage your life insurance as well, check out our guide on how to log in to the SBI Life Customer Portal.

So grab a cup of chai, sit back, and let’s get into it!

Why Should You Check Your SBI General Insurance Policies Regularly?

Before we dive into the “how,” let’s take a moment to understand the “why.” Why is it important to check your SBI General Insurance policy details?

- Stay Informed: Checking your policy helps you understand your coverage, renewal dates, and claim status.

- Avoid Surprises: Knowing what’s covered and what isn’t can save you from unexpected financial shocks.

- Renew on Time: Nobody wants to deal with expired insurance. Staying on top of your renewal dates keeps you stress-free.

- Claim Updates: Keep track of your claims—whether pending, approved, or rejected—without needing to call customer care.

How to Check SBI General Insurance Policies Without Logging In

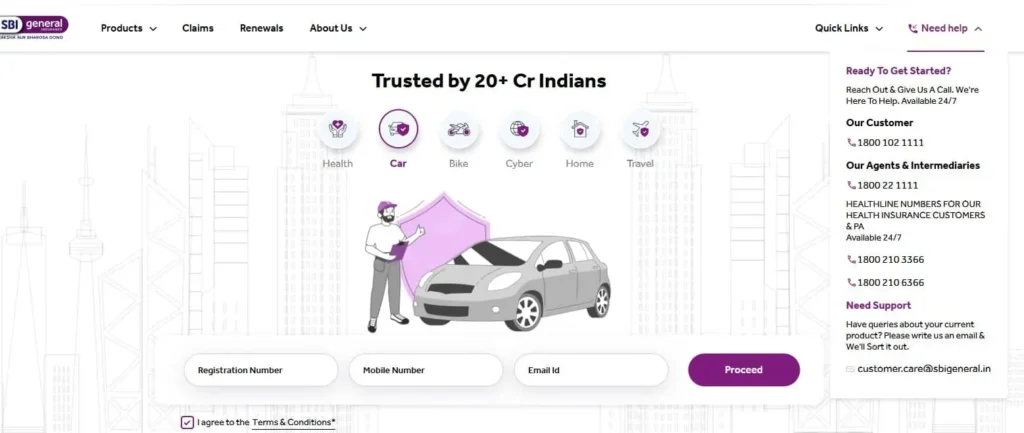

Unlike some insurance websites, the SBI General Insurance portal (sbigeneral.in) doesn’t have a login option. But that doesn’t mean you can’t check your policy details! Here’s how you can access the information easily.

- Visit the SBI General Insurance Website

Start by visiting the official website: sbigeneral.in. The website is user-friendly and designed to make navigation smooth. - Use the ‘Quick Links’ Section

Once you’re on the homepage, look for the ‘Quick Links’ section in the top-right corner. - Select ‘Claim Status’

From the dropdown menu under Quick Links, choose ‘Claim Status’. - Enter Your Policy Details

You’ll need to input your policy number or claim number along with a captcha code. - Check the Details

Once verified, you’ll be able to view your claim status or policy updates.

Alternative Ways to Manage Your SBI General Insurance Policies

If you’re looking for more ways to access your insurance details, don’t worry—SBI General Insurance has got your back!

1. Use the SBI General Insurance Mobile App

- Download the App: Search for “SBI General Insurance” in your app store.

- Register Your Policy: Use your policy number to set up your account.

- Explore Features: View policy details, claim history, and renew policies on the go.

2. Leverage the YONO App

If you’re an SBI customer, the YONO app can be your best friend.

You can also use it for SBI Online Banking Login and manage transactions efficiently.

- Install the App: Download YONO from your app store.

- Link Your Policy: Navigate to the insurance section and link your SBI GeneralInsurance policy.

- Access Details Anytime: View policies, pay premiums, and renew easily.

3. Offline Options

- Call Customer Care: Dial 1800 102 1111

- Visit a Branch: Find your nearest SBI GeneralInsurance office.

What You Can Check for Each Policy Type

Health Insurance

- Coverage for hospitalization and critical illnesses

- Claim status and renewal dates

Car and Bike Insurance

- Expiry dates, No Claim Bonus (NCB), add-ons like zero depreciation

Cyber Insurance

- Coverage for data breaches, phishing, and incident reporting

Home Insurance

- Coverage for natural disasters, theft, and premium breakdown

Travel Insurance

- Validity, claim process for lost luggage or trip cancellation

Tips for a Hassle-Free Experience

- Keep Your Policy Number Handy

- Set Renewal Reminders

- Bookmark the Website: https://www.sbigeneral.in/

- Download the App

- Don’t Hesitate to Call

👉 If you also manage life insurance, here’s a guide on how to handle SBI Life premium payments, policy updates, and claims.

Final Thoughts: Staying Insured and Informed

Managing your SBI GeneralInsurance policies doesn’t have to be complicated. Whether it’s health, car, bike, cyber, home, or travelinsurance, SBI General provides you with the tools to stay informed.

Take a few minutes today to explore the website, download the app, or link your policy to YONO.

And for SBI Life Insurance users, don’t forget to log in to the customer portal to manage your policies easily.