Learn all about the Sukanya Samriddhi Yojana Scheme, its benefits, and step-by-step guide to opening an account for your daughter’s secure future.

What is Sukanya Samriddhi Yojana Account Scheme and How to Open One

If you’re a parent or guardian looking for a secure future for your girl child, the Sukanya Samriddhi Yojana Scheme (SSY) is a wonderful option. This government-backed savings scheme is specifically designed for girl children in India, offering excellent interest rates and tax benefits. In this blog, I’ll explain the scheme and guide you on how to open the account step by step.

Understanding the Sukanya Samriddhi Yojana Scheme

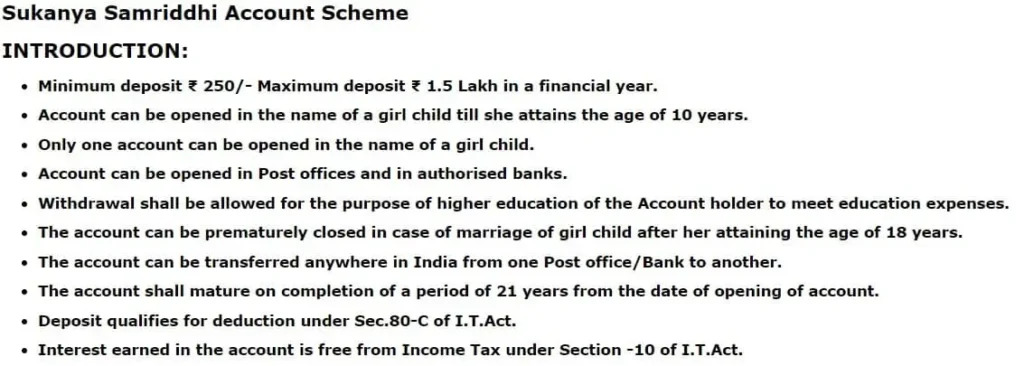

Sukanya Samriddhi Yojana is a savings scheme introduced by the Government of India as part of the “Beti Bachao Beti Padhao” campaign. The primary aim of this scheme is to encourage parents to save for their daughters’ education and future expenses, such as marriage. You can open an SSY account for your girl child and start saving systematically with the peace of mind that comes from a government-guaranteed scheme.

Key Benefits of the Sukanya Samriddhi Yojana Scheme:

- High-interest rate: The SSY offers a higher interest rate compared to regular savings accounts.

- Tax exemptions: You get tax benefits under Section 80C of the Income Tax Act, which is always a bonus.

- Flexibility: The minimum deposit is as low as ₹250, making it accessible for every family.

How to Open a Sukanya Samriddhi Yojana Account

Opening a Sukanya Samriddhi Yojana account is super simple, and you can do it at any post office or authorized bank. Follow these easy steps, and you’re all set:

1. Choose Your Bank or Post Office

You can open the Sukanya Samriddhi Yojana account at any authorized bank or post office. Look for one close to you for convenience. All major banks and post offices offer this service.

2. Fill Out the Application Form

Visit the bank or post office and request the SSY application form. The form is straightforward and requires basic details like the child’s name, age, and the parent or guardian’s details. Make sure to fill in the correct information.

3. Submit Required Documents

Once you’ve filled out the form, you’ll need to submit the necessary documents to open the account. These documents typically include:

- Birth certificate of the girl child.

- A valid proof of identity (like an Aadhaar card or PAN card) is required. .

- Proof of address (such as a utility bill or ration card).

Make sure you have these ready to avoid any last-minute hassles.

4. Make the Initial Deposit

The minimum deposit to open an SSY account is ₹250. However, you can deposit up to Every financial year, ₹1.5 lakh. After your first deposit, you can contribute any amount, as long as it’s within this range. The interest is compounded annually, so the earlier you start, the better!

Key Features of the Sukanya Samriddhi Yojana Account

Here are some cool features of the Sukanya Samriddhi Yojana account that will make you want to start one today:

- Eligibility: Only parents or legal guardians of a girl child can open the account. The child should be below 10 years of age.

- Tenure: The account matures after 21 years from the date of opening or when the girl turns 18 and marries, whichever is earlier.

- Partial Withdrawals: Once the girl turns 18, you can make partial withdrawals of up to 50% of the account balance for her higher education or marriage.

- Account Maintenance: You need to maintain the account with regular deposits for at least 15 years. After this period, no further deposits are required, but the account continues to earn interest.

Deposits and Interest Rates in Sukanya Samriddhi Yojana Scheme

The deposit and interest structure is the cherry on top! You can make deposits ranging from ₹250 to ₹1.5 lakh each financial year. The best part? The government revises the interest rate quarterly, and it’s always been on the higher side compared to other schemes. Currently, the interest rate is around 7.6%. Not bad, right?

Tax Benefits of Sukanya Samriddhi Yojana

You are eligible for tax deductions of up to ₹1.5 lakh in accordance with Section 80C of the Income Tax Act. This makes the Sukanya Samriddhi Yojana Scheme even more attractive.Both the interest earned and the maturity amount are fully exempt from taxes. In short, you save for your daughter’s future and get tax benefits—it’s a win-win!

How to Operate the Sukanya Samriddhi Yojana Account

Once the account is opened, it’s easy to manage. You can deposit money online or by visiting the bank or post office where the account was opened. You will also receive an SSY passbook that records all your deposits, interest earned, and balance. Keeping an eye on your account is just like checking your regular savings account.

Things to Remember:

- The account must be opened solely in the name of a girl child.

- One girl child can have only one account under the scheme.

- You cannot open an account after the girl turns 10.

Closing or Transferring the Sukanya Samriddhi Yojana Account

If you need to close the account early, it can be done in special circumstances such as the untimely death of the account holder or if there are extraordinary medical expenses. Otherwise, the account will remain active for 21 years or until your daughter’s marriage after she turns 18.

You can also transfer the SSY account from one post office or bank to another if you relocate. This ensures you can continue to save for your daughter, no matter where life takes you.

Why You Should Open a Sukanya Samriddhi Yojana Account

The Sukanya Samriddhi Yojana Scheme is an excellent way to secure your daughter’s financial future. It offers a safe and profitable investment option with plenty of flexibility. Plus, the tax benefits make it a fantastic deal. It’s easy to open and maintain, and with a few simple steps, you can ensure your little girl has a financially secure future.