Karur Vysya Bank Net Banking Overview

Karur Vysya Bank Net Banking is a secure and convenient digital service that allows customers to manage their banking needs online. From checking balances and transferring funds to downloading account statements, KVB Internet Banking offers 24×7 access to your account — anytime, anywhere.

How to Register for KVB Karur Vysya Bank Net Banking

Karur Vysya Bank now allows self-registration directly through its official portal, making onboarding faster and more accessible for users.

To use Karur Vysya Bank’s internet banking, you must first register your account online or at a branch.

Steps to Register:

- Open your browser and go to the official KVB Net Banking website: https://inb.kvbin.com/

- Click on ‘New User Registration’.

- Enter your Customer ID, Account Number, and mobile number registered with the bank.

- Create a Login Password and Transaction Password.

- Submit the details and verify with the OTP sent to your mobile.

- After successful registration and verification, you will receive confirmation to log in with your credentials.

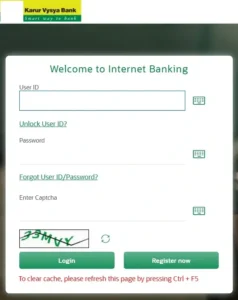

KVB Karur Vysya Bank Net Banking Net Banking Login Guide

Already registered? Here’s how you can log in:

Steps to Karur Vysya Bank Net Banking Log In:

The login process has been updated to include enhanced verification for security.

- Go to https://inb.kvbin.com/

- Enter your User ID and click ‘Continue’.

- Enter your password and the captcha code.

- Click ‘Login’ to access your dashboard.

Read this : KVB Net Banking Password Reset – Forgot Password? Fix It Now

Forgot Password?

You can reset your password in multiple ways:

- Online via OTP or by answering security questions.

- Through email support by contacting kvbnetbanking@kvbmail.com.

- By reaching customer care at 1860 258 1916.

Top Features of KVB Internet Banking

With KVB Net Banking, you can access a variety of services including:

- 🏦 Open Fixed/Recurring Deposit Accounts: Start or manage your fixed and recurring deposits without visiting a branch.

- 📈 Manage Demat Accounts: View and operate your demat holdings.

- 🛡️ Purchase Insurance: Apply for insurance policies directly via the portal.

- 💸 Fund Transfers: NEFT, IMPS, RTGS to any bank.

- 📄 Account Statements: View/download e-statements anytime.

- 📅 Cheque Book Services: Apply for a new cheque book, check request history, and monitor delivery status online.

- 🔁 Recurring Payments: Set standing instructions.

- 📱 Bill Payments: Recharge mobile, pay electricity, water, gas, and more.

Security Tips for KVB Net Banking Users

KVB uses enhanced double-factor authentication including TPIN + OTP or RSA token to safeguard transactions.

- Use a unique, strong password and update it periodically to enhance account security.

- Do not share your TPIN or login credentials.

- Avoid using public Wi-Fi to log in.

- Enable two-factor authentication (OTP) for added protection.

Frequently Asked Questions (FAQs) – Karur Vysya Bank Net Banking

Q: How to reset KVB Net Banking password?

A: Visit the login page > Click on “Forgot Password” > Verify with OTP > Set a new password.

Q: How to register for Karur Vysya Bank internet banking?

A: Go to the KVB net banking portal > Click on “New User” > Fill in required details > Verify with OTP > Complete registration.

Q: Can I check my KVB mini statement online?

A: Yes. Log in and go to “Account Summary” > Select account > Click on “Mini Statement”.

Q: What is TPIN in KVB Net Banking?

A: TPIN is a confidential Transaction Password used to securely approve fund transfers and sensitive banking operations within your net banking account.

Conclusion

For any queries or login issues, you can contact Karur Vysya Bank customer support at 1860 258 1916 or email kvbnetbanking@kvbmail.com.

Karur Vysya Bank Net Banking is a convenient way to manage your finances anytime, anywhere. Its combination of strong security features, intuitive services, and 24/7 accessibility ensures a smooth digital banking experience for every customer. If you haven’t registered yet, follow the steps above and enjoy hassle-free digital banking.