KVB Net Banking Password Reset: How to Recover Login Access Easily

KVB Net Banking Password Reset is a simple and secure process provided by Karur Vysya Bank to help users regain access to their online accounts. Whether you’ve forgotten your password or want to change it for security reasons, KVB offers multiple ways to reset your login credentials — online, by phone, email, or by visiting a branch.

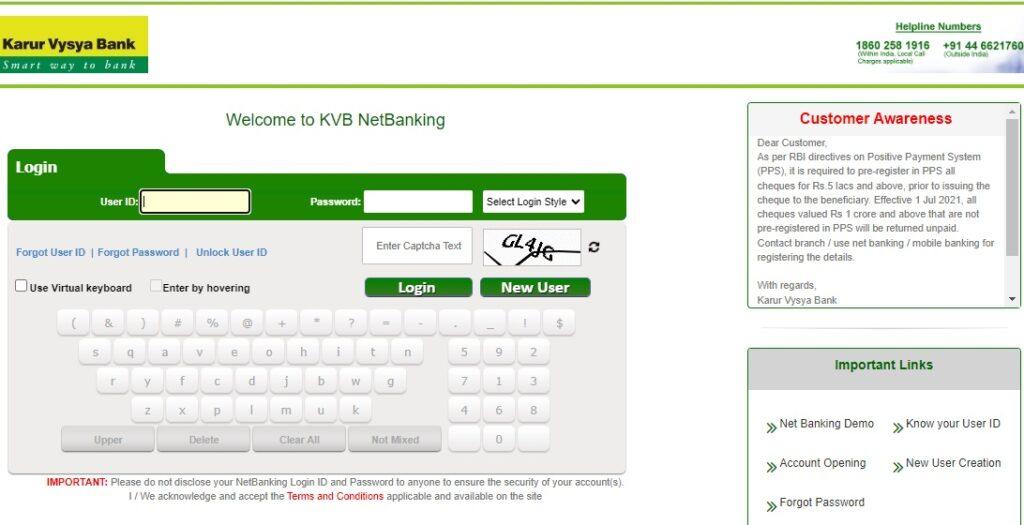

How to Reset KVB Net Banking Password Online

You can easily reset your KVB login password using your TPIN and the OTP sent to your registered mobile number.

✅ Steps to Reset Online:

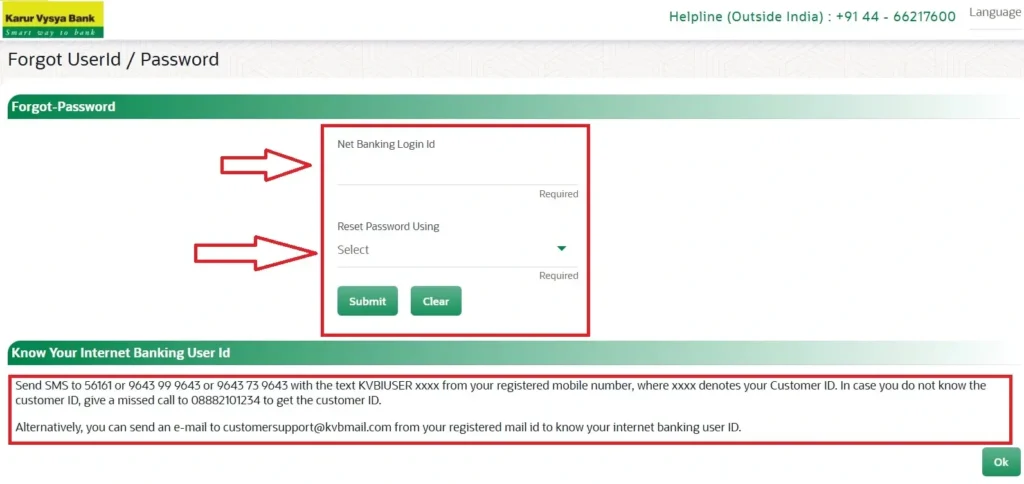

- Visit the official portal: https://inb.kvbin.com/?page=forget-password

- Enter your Customer ID and proceed

- Choose the Online Reset option

- Verify your identity using your registered mobile OTP and optionally your TPIN, if required

- Set and confirm your new password

- Login using your new credentials

🔒 Note: Ensure your registered mobile number is active to receive OTP.

Reset Password via Customer Care

If you cannot reset your password online, you can request assistance by phone:

- Dial KVB Customer Support at 1860 258 1916

- Request a password reset

- After identity verification, your new login password will be sent to your registered address within 5 working days

Read This : Karur Vysya Bank Net Banking: Login, Registration

Reset Password via Email

You can also initiate a password reset by sending an email:

- Email: activateiuser@kvbmail.com

- Mention your Customer ID, full name, and registered mobile number

- KVB will dispatch the new login details to your communication address within 5 working days

Reset by Visiting a Branch

If you’re unable to use the above methods, visit your nearest KVB branch:

- Ask for the password reset application and complete the required details

- Submit a valid ID proof

- The bank will process your request and send your new login credentials by post

Security Tips After Password Reset

- Create a strong password with a mix of letters, numbers, and symbols

- Avoid reusing old passwords

- Change your password regularly

- Never disclose your password, TPIN, or OTP to anyone—even bank staff

- Always log out after using net banking

FAQs – KVB Net Banking Password Reset

Q: How can I reset my KVB password without TPIN?

A: You can reset your password by answering security questions (if previously set) or by contacting customer support via email or by visiting a branch.

Q: How long does postal delivery take for a reset password?

A: It typically takes 5 working days from the date of verification.

Q: Is TPIN reset included in the same process?

A: No. Resetting your TPIN requires a separate process through the net banking portal or customer care.

Q: Is online password reset safe?

A: Yes, it’s secure as long as you use the official KVB website and never share OTPs or passwords with anyone.

How to Reset KVB Net Banking Password (Summary)

To reset your KVB Net Banking password:

- Visit inb.kvbin.com

- Enter your Customer ID

- Choose online reset and verify using TPIN + OTP

- Set a new password and log in

Alternative methods: phone support at 1860 258 1916, email to activateiuser@kvbmail.com, or visit the nearest KVB branch.

Conclusion

Recovering your KVB Net Banking password is fast, reliable, and supported through multiple secure methods tailored to your convenience. Whether you prefer doing it online or offline, KVB ensures your account remains safe while giving you flexibility in recovery methods. Keep your registered mobile and email up to date to avoid issues in the future.